Recording Overheads

Page 111

Page 112

If you've noticed an error in this article please click here to report it so we can fix it.

A Simple Method of Keeping Track of Costs that Are Not Incurred Directly in Running Vehicles

THERE are two aspects of establishment costs which have been put to me lately. One inquirer asks if

I would tell him how to go about keeping records of the expenditure under that heading, and coupled with this request is another on how to differentiate between establishment costs and operating costs so as to make sure that there is no overlapping, and that the records of the vehicleoperating costs arc accurate and self-contained.

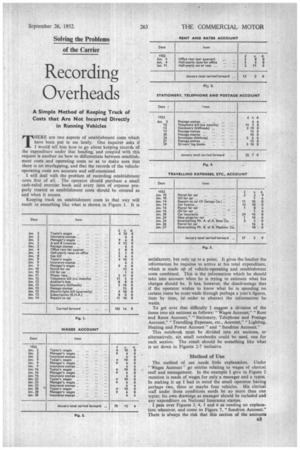

I will deal with the problem of recording establishment costs first of all. The operator should purchase a small cash-rnIed exercise book and every item of expense properly treated as establishment costs should be entered as and when it occurs.

Keeping track on establishment costs in that way will result in something like what is shown in Figure 1. It is

satisfactory, but only up to a point. It gives the haulier the information he requires to arrive at his total expenditure, which is made up of vehicle-operating and establishment costs combined. This is the information which he should take into account when he is trying to estimate what his charges should be. It has, however, the disadvantage that if the operator wishes to know what he is spending on certain items he must wade through perhaps a year's figures, item by item, in order to abstract the information he wants.

To get over that difficulty I suggest a division of the items into six sections as follows: "Wages Account," " Rent and Rates Account," "Stationery, Telephone and Postage Account," "Travelling Expenses, etc., Account," "Lighting, Heating and Power Account" and "Sundries Account."

This notebook must be divided into six sections, or alternatively, six small notebooks could be used, one for each section. The result should be something like what is set down in Figures 2-7 inclusive.

Method of Use

The method of use needs little explanation. Under "Wages Account" go entries relating to wages of clerical staff and management. In the example I give in Figure 2 mention is made of wages for only a manager and a typist. In making it up I had in mind the small operator having perhaps two, three or maybe four vehicles. His clerical staff under those conditions needs be no more than one typist; his own drawings as manager should be included and any expenditure on National Insurance stamps.

I pass over Figures 3, 4, 5 and 6 as needing no explanation whatever, and come to Figure 7, "Sundries Account." There is always the risk that this section of the accounts will grow and grow out of all proportion; and if that is to be avoided it is necessary for the operator to be clear in

his mind as to what should be included. This section should be used only for items which occur infrequently. It will be noted that under this heading are A and B licences, auditor's fees, an annual commitment, and other items like, " advertising for a driver," which should not often be necessary.

There is an alternative to this method of dealing with the subject and that ieeto confine the records to one book and to rule it in columns, each column referring to one of the divisions of establishment costs. Figure 8 shows how that method would apply. So that the whole thing can be easily understood, 1 have used the same figures in Figure 8 as I have done in Figures 2-7.

Before leaving this part of my subject, I should like to .deal with a difficulty which has been mentioned to me from time to time by haulie,rs when discussing establishment costs. They say they are not quite sure how to distinguish between establishment costs and operating costs.

This is the way to solve that problem. There are 10 principal headings relating to operating costs. They are: licences, wages, garage rent and rates, insurance, interest on capital outlay—those are the five standing charges; fuel, lubricants, tyres, maintenance, depreciation—the running costs. Any item of expense which cannot fairly be entered under one of these 10 headings is not an operating cost: it must therefore be an establishment cost.

Take as an example the purchase of the note book. What is this item? Establishment costs or operating costs'? The test: can the expenditure on the book be debited under any of the 10 headings scheduled above as operating costs? Obviously not: then the item. is an establishment cost and should be included and the expenses scheduled under Figure 4, " Stationery, Telephone and Postage Account."

Or take another item: a chit put in by one of the drivers relating to a trunk telephone call he made on behalf of the firm. It is clearly not an operating cost, as it cannot be entered under one of the 10 items; it must, therefore, be an establishment cost.

On the other hand, assume that a driver had e puncture while on a Journey and had to call at a local garage to have It repaired. Where does that go? Under the heading of

Date Item 1952.

Jan. 2 Typist's wages ... ..

2 Insurance stamps.. ..

2 Manager's wages .., 2

A and a fiCences ..

2 Postage stamps .. ..

4 Office rent for quarter ,.

4 8 Gas bill .,. .. ., 9 Typist's wages ... ,..

9 Insurance stamps .. ..

9 Manager's wages .. ..

10 Petrol for car „ „ 10 Oil for car .. „ ' 11 Half yearly water rate ,.

12 12. Auditor's fees „ ..

13 Stationery (billhoadt) ...

13 Postage sumps .. ..

13 Electric light bill

13 Subscription, R.H.A. ,.

14 Repairs to car .. ..,

" Tyres " of course and it therefore becomes an operating cost item.

Now to deal with the question 'of the distribution of establishment costs over the' vehicles in a fleet. Custom suggests that the allocation should be so arranged that each vehicle is debited in proportion to its payload capacity. Thus in a fleet comprising vehicles of 7 tons and 14 tons capacity, the establishment costs debit should be twice as much in the instances of the larger vehicles than with the smaller.

In a concern of which I have mime personal' knowledge, the fleet comprises three vehicles, two of which are 7-tonners and the other, a I4-tormer. The establishment costs total £580 per annum. The first thing to do is to calculate the full payload tonnage of the fleet. In this case it is obviously 28' tons. If. I divide £580 by 28 1 get £20 Is. 6d per payload ton per annum. It is more convenient to reckon the establishment costs on a weekly basis, in which case the amount is approximately 8s. per week per ton of payload. Filch of the 7-tormers must carry seven times 8s., which means charging £2 16s. per week for establishment costs, and the large vehicle 14 times 8s., or a total of £5 12s. per week.

Different System it is just that difference that caused one of my readers to write to mc and ask if 1 thought that to be fair. In putting forward his plea he made the point that so far as his clerical and other staffs were concerned there was in effect no more establishment expenditure in dealing with the 14-tonnet than with the 7-tonner, and according to his views £580 should be evenly divided among the three vehicles so that each had approximately £193 per annum of establishment costs.

The answer to that is that the basis of the allocation of establishment costs has nothing whatever to do with the way in which the work of clerical staffs is actually disposed among the vehicles of the fleet. The allocation is not meant to take that factor into consideration at all. The allocation of establishment costs should be carried out in such a way that each ton of traffic handled has to bear the same amount.

e If that principle be fully understood and applied, it follows that a 14-ton vehicle must be debited with twice the amount of establishment costs allotted to a 7-tonner, or 14 times as much as those debited against a 1-tonner. Admittedly that ruling, strictly speaking, applier only if the 14-tonger usually carries 14 tons and the 7-tonner 7 tons. I should imagine, however, that even if that be not true in respect of every load, the part-load proportions are the same and therefore there is every justification for making the allocation as I have indicated.—S.T.R.