Crossing the big divide

Page 28

Page 29

If you've noticed an error in this article please click here to report it so we can fix it.

The fall-out from the catastrophic accident at Calais last February is still being felt by international operators. Brian Weatheriey

and Dominic Perry report.

When a linkspan at the Port of Calais failed in February, something of a minor miracle occurred. Its collapse (caused by a broken cable) was slow enough for drivers and terminal workers on the bridge to get clear, though by all accounts it was a closerun thing.

The bottom deck linking Berth 7 broke as two trucks were coming off — one truck almost went into the water and its driver broke his ankle as he jumped clear.

Losing a berth was bad enough, especially as a linkspan on one of the others was already closed for maintenance. However, the subsequent Health & Safety investigation proved even more debilitating, as the authorities demanded precautionary work on all remaining linkspans and those passed fit for work were restricted to one truck at a time, further delaying loading and unloading. Heavy snow in March held up the repair work, and just for good measure French transport unions at the port held a 24-hour strike. Meanwhile, back in Britain, the log-jam of hundreds of HG Vs waiting to cross over to France prompted the re-introduction of Operation Stack on the M20, to the fury of local residents and commuters.

All-in-all, operators and drivers trying to enter France via Calais have had a pretty bloody time of it, but there is some light on the horizon. By the end of the year the terminal should have six berths back in action compared with the current three.

Megaferry capacity Kevin Root. Seafrance's head of UK operations, says a major effort is being made by the French port authorities to step up throughput. A third 'big-ship' berth will open on 19 May, raising the number of available berths to four, three of them capable of handling the latest 'rnegaferries' like Seafrance's Rodin and Berlioz which can carry 120 trucks apiece.

Sadly that's not the end of the story because more maintenance work in June and July will cut the number of berths back to three."There's a lot that's still to happen," Root warns. The Calais Charnbre de Commerce et d'Industrie (CCTC) insists things can only get better: "The investment programme in new port facilities that started a year ago continues and this will result in the opening of a new ferry berth, number 9, at the end of 2005.

"In addition, the opening of a RO-RO berth in August 2004 and another RO-RO linkspan at the beginning of 2006 will result in the Port of Calais having three new berths in the space of 18-20 months." In the long-term throughput should match that of Dover. "Everything possible is being done to meet the expectations of our customers," says the CCIC. "The situation we have experienced should soon be nothing more than a bad memory."

P&O Ferries and Seafrance had talked of suing the CCIC over the crisis but they're still doing 'damage assessment' to quantify the full impact of delays on their business. Whether they will do battle in the notoriously slow French civil courts remains to be seen.

Faced with the disruptions at Calais, UK and Continental-based international hauliers have been forced to reappraise their vehicle routeing. Adrian Richardson, Seafrance's freight sales and marketing manager for the UK and Ireland, says:"Previously they've always been able to get a fast crossing via Calais. Now some migration [to other routes] has been noticeable.

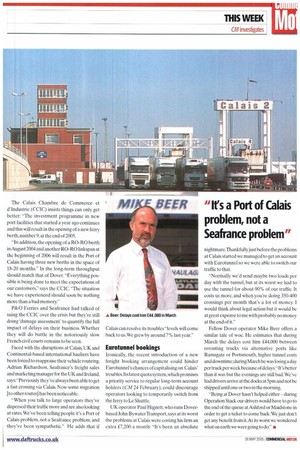

"When you talk to large operators they've dispersed their traffic more and are also looking at rates. We've been telling people it's a Port of Calais problem, not a Seafrance problem, and they've been sympathetic." He adds that if Calais can resolve its troubles "levels will come back to us.We grew by around 7% last year."

Eurotunnel bookings Ironically, the recent introduction of a new freight booking arrangement could hinder Eurotunnel's chances of capitalising on Calais' troubles.Its latest quota system, which promises a priority service to regular long-term account holders (CM 24 February), could discourage operators looking to temporarily switch from the ferry to Le Shuttle.

UK operator Paul Hignett. who runs Doverbased John Bywater Transport, says at its worst the problems at Calais were costing his firm an extra £7,200 a month: "It's been an absolute nightmare.Thankfully just before the problems at Calais started we managed to get an account with Eurotunnel so we were able to switch our traffic to that.

"Normally we'd send maybe two loads per day with the tunnel, but at its worst we had to use the tunnel for about 90% of our traffic. It costs us more, and when you're doing 350-400 crossings per month that's a lot of money. I would think about legal action but it would be at great expense tome with probably no money at the end of it."

Fellow Dover operator Mike Beer offers a similar tale of woe. He estimates that during March the delays cost him £44,000 between rerouting trucks via alternative ports like Ramsgate or Portsmouth, higher tunnel costs and downtime ;during March he was losing a day per truck per week because of delays:"It's better than it was but the evenings are still bad. We've had drivers arrive at the docks at 5pin and not be shipped until one or two in the morning.

"Being at Dover hasn't helped either — during Operation Stack our drivers would have to go to the end of the queue at Ashford or Maidstone in order to get a ticket to come back. We just don't get any benefit from it.At its worst we wondered what on earth we were going to do." •