Loadsa money

Page 50

Page 51

Page 52

Page 53

If you've noticed an error in this article please click here to report it so we can fix it.

CONSTRUCTION

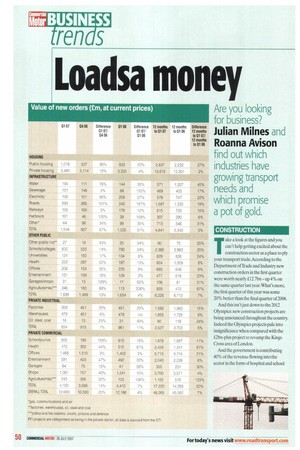

Take a look at the figures and you can't help getting excited about the construction sector as a place to ply your transport trade.According to the Department of Trade and Industry new construction orders in the first quarter were worth nearly £12.7bn up 4% on the same quarter last year. What's more, the first quarter of this year was some 20% better than the final quarter of 2006.

And this isn't just down to the 2012 Olympics: new construction projects are being announced throughout the country. Indeed the Olympics projects pale into insignificance when compared with the f2bn-plus project to revamp the Kings Cross area of London.

And the government is contributing 40% of the revenue flowing into the sector in the form of hospital and school projects.The recent flooding in Yorkshire will also trigger further spending by the Environment Agency for improved drainage and water treatment facilities.

Clearly this presents opportunities for smart transport operators with an eye on the market, but before there's a mad rush for new tippers, grabs, cranes and brick carriers, remember that all that glisters may not be gold in the construction sector. Emma Penny, editor of leading industry magazine Contract Journal, wams:"Construction is a high-turnover/lowprofit margin business. It's very similar to the road transport sector in that respect."This should be enough of a warning for operators to tread carefully when entering this sector.

For innovative operators there may be some The UK manufacturing sector has been on the rise since the beginning of the year, but the 0.4% increase in manufacturing output for May 2007 compared with April is hardly reason to get excited. Indeed, the rise in interest rates should be of greater concern to everyone in the sector.

Manufacturing output now accounts for just 14.7% of the UK economy but it remains one of the biggest consumers of road transport activity, behind construction.While output is now at its highest level since just before the terrorist attacks on 11 September 2001, it remains a mature market, with little obvious opportunity for growth. Indeed the adage, 'get big, get niche or get out' fits this sector very well.The big boys have welded themselves to the production lines of the big UK manufacturers, while the smart operators have spotted the niches and exploited them.

The outlook for the manufacturing sector is difficult to predict so operators should tread earefully."Activity is strong now," says Paul Dales, UK economist at Capital Economics, "but I don't think it will be able to sustain these gains.As the impact of the interest rate hikes begins to work its way through to the sector,we will see growth slowing." opportunity for just-in-time operation to construction sites.There's a big push in construction to drive down costs, and that means a more efficient supply chain. Construction firms are looking to their suppliers for more efficiency gains delivering the goods is no longer enough as the big projects look for manufacturing-style delivery schedules.

A recent letter in Contract Journal from the sales director at Wolseley UK sums up this philosophy: "Smart logistics, for example, will make or break the Olympics construction projects.Thanks to the size and reach of our logistics network, we're ready, waiting and eager to partner on a commercial scale and tighten the supply chain for the benefit of all contractor, client and user." When the construction sector is strong then it follows the quarrying and mining sector should be equally buoyant as the demand for aggregates and other building materials booms.The UK construction sector has an annual demand of nearly 300 million tonnes of aggregates, the vast majority of which is drawn from domestic quarries.This generates a strong demand for tipper operators in those areas where the stone is being quarried.

However, aggregates haulage has a notoriously low margin and many economists see it as a 'sunset industry' with little prospect for accelerated growth, despite the strong demand. Quarrying is a political and environmental hot potato as local communities lobby against new quarries opening and seek to get existing ones shut down.

This pariah status will be all too familiar to road transport operators, but sympathy doesn't make the prospects for profitability any better.

Further consolidation of the quarrying and mining sector will inevitably lead to further pressures to reduce cost and, as with construction,road transport will feel its fair share of heat.

While this sector may not be particularly attractive to road transport investors -the quarries are scattered far and wide and are often quite a long way from the construction sites it is worth retaining a watching brief as future structural shifts in the business could change this.

For instance,continued increases in aggregates tax and restrictions on quarrying could cause a shift to imports, thereby increasing reliance on a more planned logistics model. Not good news if you are currently committed to running tippers. hut food for strategic thought if you are reviewing your operations. There have been marked differences in the sales performance of companies in the oil distribution industry over the past 10 years. According to research by Plimsoll, the overall growth of the sector during the period was 763%.

But the difference in sales growth between businesses within the industry is large, with only 1% managing the same level of sales as last year, even though the market grew by 20.5% last year to £148.85bn.This suggests that the top 1% of the sector has sucked up all the growth.

BP International led the sales league at £31.4bn, despite its sales growth falling by 7.5%. Shell was second with f13.3bn, ahead of Es.so with £11.7bn.

Some 25% of businesses suffered a drop in sales, with well over 75% of these taking some action to cut their overheads, often by reducing their asset base.

In general the smaller companies are outperforming their larger counterparts, with the average gross profit margin of a smaller company standing at 22%, compared with larger businesses which manage 7.6%.

The tanker-hire sector has grown by 47.3% over the past 10 years, but last year average sales fell by 9.1%.

• According to Plimsoll, the top five companies, based on their commercial strength and their financial position hi the sector, are Chevron, Conocophillips Holdings, Esse UK, The domestic removals business grew by 62.1% during the past 10 years; the industrial and business removals market grew by 74.5% in the same period, but only by 2.8% last year. According to Plimsoll, the sector is currently worth £650m.

The average company in the industry will have sales that are increasing by 3.8%, but almost a third of businesses suffered a fall in sales.

The larger firms are outdoing the smaller ones with average growth of 10.3% and 5.9% respectively. But the smaller operators seem to be more successful at getting a return from their assets — they are also outperforming their larger counterparts when it comes to gross margin, with 46.2% compared with 31.2% . . for larger firms.

In the latest figures, 19% of companies reported a pre-tax loss. This sector is dominated by in-house operations and heavy hitters such as DHL-Excel, so breaking into it is a tough task. Diversification is the key. Being able to offer something extra will raise your profile with prospective customers.

Roger Rapson, secretary of the Road Haulage Association's transport warehousing and distribution group, says: "The advent of pallet networks has opened up the possibilities within this sector of the industry.Adding value to your service is the key, with warehousing continuing to be a popular added-value area."

However, following recent changes to business rates, empty industrial and warehouse properties benefit from 100% rate relief for only six months.

Another thriving area is picking and packing; there is also arising demand for high-security distribution. More firms, such as Sony and John Lewis, which produce or sell high-value goods, want AIMS accreditation to confirm that their operators have proper security systems in place. Increased UK legislation and public awareness of the impact of waste on the environment have meant the industry has seen dramatic developments in recent years. Businesses and public-sector organisations alike are aiming to reduce their waste output and increase their green credentials through recycling and better management.

However, specialist industries require specialist knowledge and a foray into the waste sector is not for the faint-hearted.You'll need the correct vehicles and equipment the o heavy initial investment is .. needed, while there are legislation and safety issues to adhere to as well, with tipper stability in landfill sites coming in for a lot of attention.

The price of recycled materials fluctuates constantly, so you should be prepared for variations in your profit margin, while storing waste demands bigger premises with increased business rates.

The emphasis now is on added-value services such as special waste services: integrated waste management, treatment technologies, waste water, packaged waste and clinical waste.

AGRICULTURE/FISHING

Amajor problem when operating in the agriculture industry is its inherent inefficiency due to the lack of backloads after goods have been delivered to their processing points.This is largely unavoidable so operators should accept increased overheads as par for the course.

Legislation also plays a major role, particularly if you are transporting livestock. Pressure from animal welfare groups combined with the reduced number of abattoirs means vehicles have to travel further and operators need to have the correct equipment when moving livestock.

However, there are more commodities than before to move further due to the centralisation of processing.

Biofuels are also taking off, and though the majority will be produced abroad the UK is gearing up for these crops, which will need transportation. Operators could also make deals with processing companies.

There is less favourable news in the fishing industry, where continuing quota reductions are strangling the market, as foreign competition hastens its decline. The bulk haulage sector has grown by 49.3% in the last 10 years, according to Plimsoll.This means that a company with a turnover of £1m 10 years ago will now have a turnover of £1.5m if it achieves the industry's average growth. Bulk haulage generates far higher gross profit margins than many other sectors, with an average of 14% of sales. However, the market shrank by 4.5% to £2.47bn last year.

Despite this, two thirds of companies in this sector enjoyed increased sales.That leaves a third suffering falling sales, but two thirds of them took some action to cut their overheads.

In general, the larger companies are growing at a rate of 3.3%, while the smaller players are growing at an average of 9.1%. However, the larger firms are better at 'sweating' their asset base, with capital investment proportionately lower against sales.

INTERNATIONAL

Aquick look at the international haulage market shows UK operators' share has settled to about 25%. Freight Transport Association (FTA) figures released in June show the long-standing decline in the UK's share of international business has made a modest recovery. International road haulage activity rose by an average 3.5% per year between 2004 and 2006, after a catastrophic four years during which UK operators' market share of UK-based international haulage fell from 39% to 26%.

One reason for the relative improvement, the FTA suggests, is that the sterlingjeuro exchange rate has remained relatively stable since 2004. Improving economic performance in the key UK export markets of Germany, Italy and France has also helped.

The survey says: "The rebalancing of economic growth rates across western Europe has led to import and export volumes out of the UK growing at similar rates.This has helped UK-based international hauliers stabilise their market share despite rapid growth in the presence of lowcost hauliers from the 2004 accession states."

Peter Cullum, head of international affairs at the Road Haulage Association, says only about 10% (110)()) of UK hauliers have international licences:-UK hauliers are at the high end of the market on international runs. We offer niche services and we do not compete on price alone."