Problems of the

Page 54

Page 55

If you've noticed an error in this article please click here to report it so we can fix it.

HAULIER and CARRIER

rr HE next point that I propose to deal with in this series of articles on the effects. which the Road and Rail Traffic Act is likely to have on the operations of haulage contractors is the increased need for provision for "contingencies." This is not an operating expense in the true sense of the word.

It is an item which I have always included under the heading of establishment costs. It becomes more, important now, because, having in mind that it will hereafter be compulsory to use only mechanically sound vehicles, there will arise the necessity of keeping spare vehicles available or making arrangements to hire a spare machine while regular lorries are undergoing repairs or maintenance operations.

As a matter of fact, this item of contingencies, or, taking the matter in its broader aspect, establishment costs, is one, the ventilation of which, in these articles, is, perhaps, overdue. It is even less understood than some of the items of operating costs and is even more frequently ignored. It so happens that I have before me an example of rate-cutting which, I believe, is largely due to the fact that the haulier in question has taken no account of the need for provision for contingencies.

The case relates to furniture removal, and the information has been sent to me in the hope that I will write about it in this series of articles, so that my correspondent can show the statement to his rate-cutting competitor with a view to its perusal bringing about an amendment in prices. The complaint was that this competitor was charging`only 6s. 6d. per hour for the use of a 5-ton furniture van and two men, increasing his charge to 8s. per hour when three men were employed.

My correspondent insists that 7s. 6d. and 9s. 6d. per hour should be minimum rates for this work and tells me that his friends actually charge us. 6d. and 12s. per hour for a similar vehicle with three men in attendance.

It is easy to show that there is no real margin of B44 THIS WEEK'S PROBLEM

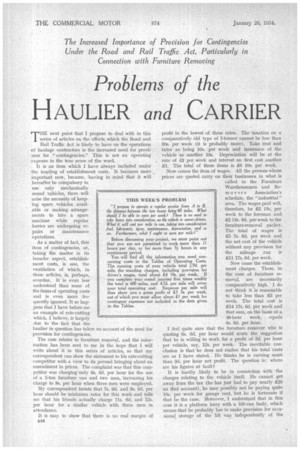

"1 propose to operate a regular service from A to B. the distance between the two towns being 60 miles. What should I be able to earn per week? There is no need to take hours into consideration, as the vehicle is owner-driven. What it will cost per mile to run, taking into consideration fuel, lubriCants, tyres, maintenance, depreciation, and so on. Furthermore, what 1 ought to earn per mile?"

Before discussing your project, we must point out . that you are not permitted to work more than I I hours per day, or for more than 51 hours in any continuous period.

You will find all the information you need concerning cost; in the Tables of Operating Costs. The running costs of your vehicle total 2.9d. per mile, the standing charges, including provision for driver's wages, total about £4 10s. per week. If you complete your round journey five times weekly the total is 600 miles, and 4.7d. per mile will cover your total operating cost. Sixpence per mile will thus show you a gross profit of £3 5s. per week,

profit in the lowest of these rates. The taxation on a comparatively old type of 5-tonner cannot he less than 30s. per week (it is probably more). Take rent and

rates as being 10s. per week and insurance of the•

vehicle as another 10s. Depreciation will be at the rate of £3 per Week and interest on first cost another £1. The total of these items is £6 10s. per week. Now comes the item of wages. All the persons whose prices are quoted carry on their businesses in what is called in the Furniture Warehousemen and Removers Association's schedule, the " industrial " area. The wages paid will, therefore, be £2 15s, per week to the foreman and £2 12s. 6d. per week to the , furniture-removal packer. The total of wages is £5 7s. 6d. per week and the net cost of the vehicle without any provision for the mileage run is £11 17s. 6d. per week.

Now come the establishment charges. These, in the case of furniture re

• moval, are necessarily comparatively high. I do not think it is reasonable to take less than £3 per week. The total cost is £14 17s. 6d. per week and that sum, on the basis of a 48-hour week, equals Os. 3d. per hour.

I feel quite sure that the furniture remover who is quoting 6s. 6d. per hour would scorn the suggestion that he is willing to work for a profit of 3d, per hour per vehicle, say, 12s. per week. The inevitable conclusion is that he does not realize that his total costs are as I have stated. He thinks he is earning more than 3d. per hour net profit. The question is : where are his figures at fault?

It is hardly likely to be in connection with the charges relating to the vehicle itself. He cannot get away from the tax (he has just had to pay nearly £20 on that account), he may possibly not be paying quite 10s. per week for garage rent, but he is fortunate if that be the case. Moreover, I understand that in this case it is a platform lorry with a lift-van body, which means that he probably has to make provision for occasional storage of the lift van independently of the vehicle itself. The insurance is another item which is "fixed " in its amount.

It is quite likely, I must admit, that he is not making proper provision for depreciation. That is not, however, to say that he is right, for now, more than ever, is it necessary to provide for the purchase of new vehicles so as to eliminate risks of delay and extra cost on account of maintenance. The furniture van of the type in question would cost at least £1,000, so that £3 per week is equivalent to an allowance of only seven years' life. Interest on first cost, the final item, whilst not an expenditure, is something which shottld never be overlooked,

It is almost certain that he was not making proper provision for establishment costs, including, as I have pointed out, provision for contingencies. Here are comprised a number of expenses and, in the ordinary way, it is sometimes difficult to know quite where to begin in enumerating them. In this case, however, there is one which I think jumps to the eye almost at once. Insurance of the load is vital in a furniture' removing business and that costs Os. or is. per week.

A furniture-removing business needs some management. It must have a chief, someone in control whose time will be fully occupied in directing the energies of his workpeople and in interviewing customers, making out estimates and the like. He cannot be doing that work and driving the vehicle or helping with a removal at the same time. He may divide his energies, but he has to be paid for the time and energy that he expends on this essential work. His wages are an establishment cost. If he pays himself £3 per week as manager and if he has, say, three vehicles, £1 per week must be debited against each.

Then there are such expenses as telephones, postage, stationery, possibly the wages of a clerk, and so on. It is impossible to indicate exactly what these expenses amount to, but sometimes they are considerable.

It is what I termed the contingency expense that is so considerable in this class of work. In the above calculations I have taken a week of 48 hours. How many furniture removers are there who are in the fortunate position of keeping all their vehicles fully employed for 48 hours per week, 50 weeks per year? For every hour less provision must be made.

It is largely to provide for that condition that the establishment costs in connection with furniture removing are comparatively high. If the idle time averages eight hours per week, provision for that amount is equivalent to £.2 per week.

I think that £3 per week is clearly not an excessive figure to allow for establishment costs. S.T.R.