Licensing Problems Elucidated

Page 36

Page 37

If you've noticed an error in this article please click here to report it so we can fix it.

BELOW we print a further selection of the most interesting and generally instructive inquiries and answers on topics connected with the Road and Rail Traffic Act. All queries on this subject receive the personal attention of the Editor.

A Point on Vehicle Ownership and Licensing.

(44) QUESTION : I started in business as a haulier in September, 193'2, using a 30-cwt. vehicle. Last April a friend purchased another of the same capacity, and after Working it for a week had to give up through illness. I took the vehicle over, worked it for him and paid the instalments on the hire purchase, on the understanding that it should become my property. It is, however, still working in his name. How should I apply for the licence and will this vehicle come into the 2-ton class as I often carry that weight?

ANSWER: In making an application for a licence, the only thing that matters is the unladen weight of the vehicle, not the actual load that is carried. The only " claimed " tonnage for which you can apply is that in respect of the 30-cwt. model, which was operated during the basic year (April 1, 1932-March 31, 1933). For this, as a public carrier not carrying your own goods, you will be able to obtain a Class A licence. Any other tonnage will have to be applied for as "discretionary."

As the second vehicle was not operated at any time during the basic year, it does not matter whether it now belongs to you or your friend, but the real owner must make the application, so that if you wish to do so the vehicle must be transferred to your ownership.

The application for " discretionary " tonnage may, however, be subject to objection by other interests.

A Matter of Licence Class.

(45) QUESTION: We are flour millers, but sometimes have sent to our warehouse consignments of oil cake which we load on our own lorries for delivery, being paid for this work by the oil cake company. May our vehicles do this under a Class C licence? Also, on occasions, some of our own customers require some of this cake from our warehouse, and if we are going there with our own goods and have room we carry it on our own wagons, but the company still pays us for its transport. We have nothing to do with it except warehousing.

ANswEn : As the oil cake which you are carrying is only warehoused by you and never becomes your own property, you are carrying it for hire or reward, and not in the course of your ordinary business as flour millers. Therefore, this work cannot legally be performed by a vehicle operating under a Class C licence.

If you could arrange to buy the cake and resell it, then its transport would fall within a Class C licence, as it would be carried within the course of your own business.

1126

Should a Class B or C Licence be Applied For ?

(46) QUESTION: What is the procedure for licensing a lorry used mainly for the haulage of our own goods, hut occasionally for that of similar goods on behalf of other persons? The general haulage work is very slight, perhaps not more than a dozen loads per year. The lorry is used for a radius of 20 miles.

ANSWER: Replying to your inquiry of January 1. As you haul your own goods and, occasionally, those of other people, you will require a Class B licence as a limited carrier. Such a licence may be subject to certain restrictions, such as the class of goods carried, area of operation, etc., and it might be more advantageous for you to give up your general haulage work (as this only covers a dozen or so loads per year) as you would then be able to obtain a Class C licence as a private carrier. We note, however, that your lorry is used within a radius of only 20 miles, so that the question of restriction might not be in important in your case.

If you apply for a Class B licence and your vehicle was in operation .at any time during the basic year (April 1, 1932-March 31, 1933) you should apply for " claimed " tonnage, application forms for which will be available shortly.

Licensing Vehicles in a Mixed Business.

(47) QUESTION: I am a furniture remover, also a coal dealer. My removal vans are used exclusively on furniture work, but I have one lorry which is used mostly in my coal business, but, occasionally, has a lift van placed on it for the removal of furniture. What licences shall 1 require?

AxswErt : Your removal vans will be required to be included in a. Class A licence, but if you use the lorry, even on very few occasions, for carrying a lift van of furniture, it will require a Class B licence. If it were not for the carrying of this lift van, it would be regarded as being used for private work and could be included in a Class C licence.

When Private Cars and Public Service Vehicles May be Included in a Carrier's Licence.

(48) QUESTION: Can a private car licensed on a horsepower basis be used for commercial purposes under a Class C licence? Also, may a public service vehicle be used for a mail contract carrying mail bags as well as passengers?

ANSWER: If a car taxed on the horse-power basis be used for commercial purposes it will not require to be included in a carrier's licence unless it be materially altered for such purpose or adapted for the carriage of goods, e.g., by the fitting of shelves, etc.

A public service vehicle can be used for a mail contract as well as for transport of passengers. in so tar as its use is authorized by the road service licence, but if it be used outside the conditions of such licence, its employment for the carriage of goods would then come within the scope of the 1933 Act, as in the case of an extra journey being undertaken purely for the transport of the mails or other parcels.

It is possible that the same vehicle could be subject both to the licensing system as a public service vehicle under the Act of 1930 and to that under the Act of 1933. The convertible-body vehicle is a case in point.

Fleet Increases and Procedure in the Event of Vehicle Breakdown.

(49) QUESTION: My business is that of general haulage, consisting largely of the transport of milk from farms to dairies. Should I apply for a Class A licence? The total unladen weight of my vehicles, which have been employed for seven years, is 12 tons. If I should require to add another lorry to my fleet, what would be the position? Also, can I keep a spare lorry to be used in case of breakdown?

ANSWER: In reply to your queries. So long as you do not carry your own goods, you should apply for a Class A licence, and you can put in for " claimed " tonnage to the full extent of your fleet. If, however, you wish to make an addition you will have to include this under " discretionary " tonnage.

A spare lorry to be used in the case of a breakdown would have to be .included in your ordinary tonnage. Although a vehicle used solely for towing a disabled vehicle or for removing the goods from such a vehicle to convey them to a place of safety is outside the scope of the licensing provisions.

Additions to a Class C Fleet.

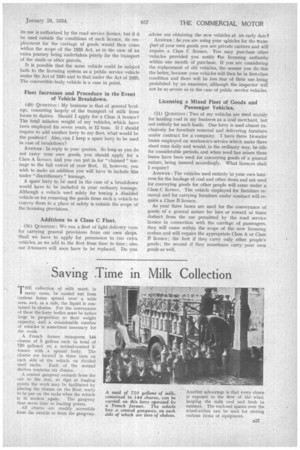

(50) QUESTION: We run a fleet of light delivery vans for carrying general provisions from our own shops. Shall we have to apply for permission to run extra vehicles, as we add to the fleet from time to time ; also our 3-thrillers will soon have to be replaced. Do you

advise our obtaining the new vehicles at an early date?

ANSWER: As you are using your v‘hicles for the transPort of your Own goods you are private carriers and will require a Class C licence. You may purchase other vehicles provided you notify the licensing authority within one month of purchase. If you are considering the replacement of old vehicles, the sooner you do this the better, because your vehicles will then be in first-class condition and there will be less fear of their use being prohibited by an examiner, although the inspector will not be so severe as in the case of public service vehicles.

Licensing a Mixed Fleet of Goods and Passenger Vehicles.

(51) QUESTION: Two of my vehicles are used mainly for hauling coal in my business as a coal merchant, but not entirely for such loads. One lorry is used almost exclusively for furniture removal and delivering furniture under contract for a company. I have three 14-seater buses employed on workmen's service which make three short runs daily and would, in the ordinary way, be idle for considerable periods, and when need has arisen these buses have been used for conveying goods of a general nature, being insured accordingly. What licences shall I require?

ANSWER: The vehicles used entirely in your own business for the haulage of coal and other items and not used for conveying goods for other people will come under a Class C licence. The vehicle employed for furniture removal and for carrying furniture under contract will require a Class 13 licence.

As your three buses are used for the conveyance of goods of a general nature for hire or reward at times distinct from the use permitted by the road service licence in connection with the carrikge of passengers, they will come within the scope of the new licensing system and will require the appropriate Class A or Class Ti licence ; the first if they carry only other people's goods ; the second if they sometimes carry your own goods as well.