NEW COST TABLES 50 NOT OUT

Page 71

If you've noticed an error in this article please click here to report it so we can fix it.

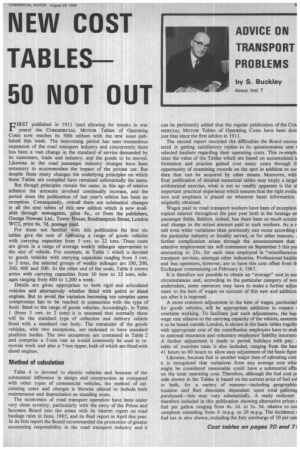

EvIRST published in 1911 (and allowing for breaks in war years) the COMMERCIAL MOTOR Tables of Operating Costs now reaches its 50th edition with the new issue published this week. The intervening period has seen tremendous expansion of the road transport industry and concurrently there has been a vast change in the standard of service demanded by its customers, trade and industry, and the goods to be moved. Likewise in the road passenger industry changes have been necessary to accommodate the impact of the private car. But despite these many changes the underlying principles on which these Tables are compiled have remained substantially the same.

But though principles remain the same, in this age of relative inflation the amounts involved continually increase, and the period since the publication of last year's edition has been no exception. Consequently, overall there are substantial changes in all the nine • tables of this new edition which is now available through newsagents, price 6s., or from the publishers, George Newnes Ltd., Tower. House, Southampton Street, London WC2, price 6s. 7d. postage paid.

For those not familiar with this publication the first six tables give the cost of operating a range of goods vehicles with carrying capacities from 5 cwt. to 22 tons. These costs are given in a range of average weekly mileages appropriate to the size of vehicle. For example, in Table 1 which is devoted to goods vehicles with carrying capacities ranging from 5 cwt. to 2 tons, the selected groups of weekly mileages are 100, 200, 300, 400 and 500. At the other end of the scale, Table 6 covers artics with carrying capacities from 10 tons to 22 tons, mileages ranging from 400 to 1,200 a week.

Details are given appropriate to both rigid and articulated vehicles and alternatively whether fitted with petrol or diesel engines. But to avoid the variation becoming too complex some compromise has to be reached in connection with the type of body fitted to the range of goods vehicles. Accordingly, in Table 1 (from 5 cwt. to 2 tons) it is assumed that normally these will be the standard type of collection and delivery vehicle fitted with a standard van body. The remainder of the goods vehicles, with two exceptions, are reckoned to have standard platform bodies. The two exceptions are contained in Table 2 and comprise a 5-ton van as would commonly be used in removals work and also a 7-ton tipper, both of which are fitted with diesel engines_

Method of calculation

Table 4 is devoted to electric vehicles and because of the substantial difference in design and construction as compared with other types of commercial vehicles, the method of calculating costs and charges is likewise altered to include both maintenance and depreciation as standing costs.

The economics of road transport operation have been under very close scrutiny, particularly with the entry of the Prices and Incomes Board into the arena with its interim report on road haulage rates in June, 1965, and its final report in April this year. In its first report the Board recommended the promotion of greater accounting responsibility in the road transport industry and it can be pertinently added that the regular publication of the Co MERCIAL MOTOR Tables of Operating Costs have been dole just that since the first edition in 1911.

The second report recorded the difficulties the Board encoui tered in getting satisfactory replies to its questionnaires sent I selected hauliers regarding their operating costs. This re-empffi sizes the value of the Tables which are based on accumulated it formation and practice gained over many years through tt opportunity of examining records on the spot in addition to sue data that can be acquired by other means.. Moreover, whil final publication of detailed numerical tables may imply a large] arithmetical exercise, what is not so readily apparent is the a] important practical experience which ensures that the right evahe tion and emphasis is placed on whatever basic information originally obtained.

Wages paid to road transport workers have been of exception. topical interest throughout the past year both in the haulage an passenger fields. Seldom, indeed, has there been so much scrutin and change in the actual amount paid to such workers. As a n stilt even wider variations than previously can occur according t the particular industry or locality served, or for other reasons. further complication arises through the announcement that selective employment tax will commence on September 5 this yei amounting to 25s. for each man employed in "miscellaneous transport services, amongst other industries. Professional hauliez and bus operators, however, are to have this cost offset from th Exchequer commencing on February 6, 1967.

It is therefore not possible to obtain an "average" cost in sue circumstances and, according to the particular category of wor undertaken, some operators may have to make a further adjus ment to the item of wages on account of this new and addition; tax after it is imposed.

A more common adjustment to the item of wages, particular] for goods vehicles, will be appropriate additions in respect < overtime working. To facilitate just such adjustments, the bas wage rate relative to the carrying capacity of the vehicle, assumin it to be based outside London, is shown in the basic tables togetlx with appropriate cost of the contribution employers have to mak to national insurance and voluntary employers' liability insuranci A further adjustment is made to permit holidays with pay. table of overtime rates is also included, ranging from the basi 41 hours to 60 hours to allow easy adjustment of the basic figun Likewise, because fuel is another major item of operating cost it is recognized that variations from any average cost whic might be considered reasonable could have a substantial effec on the total operating cost. Therefore, although the fuel cost pc mile shown in the Tables is based on the current price of fuel sol in bulk, for a variety of reasons—including geographic; location and fleet discounts dependent upon total gallona purchased—this may vary substantially. A ready reckoner therefore included in this publication showing alternative prices ( fuel per gallon ranging from 4s. 3d. to 5s. 3d. relative to cot sumption extending from 6 m.p.g. to 29 m.p.g. The incidence ( fuel tax is also shown, including the July surcharge of 10 per cen