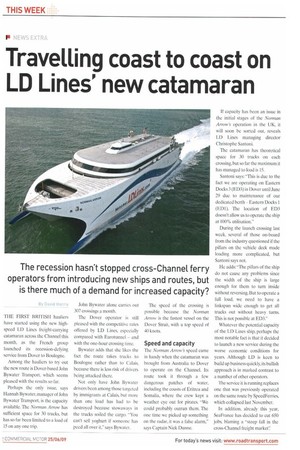

Travelling coast to coast on LD Lines' new catamaran

Page 12

Page 13

If you've noticed an error in this article please click here to report it so we can fix it.

The recession hasn't stopped cross-Channel ferry operators from introducing new ships and routes, but is there much of a demand for increased capacity?

THE FIRST BRITISH hauliers have started using the new highspeed LD Lines freight-carrying catamaran across the Channel this month, as the French group launched its recession-defying service from Dover to Boulogne.

Among the hauliers to try out the new route is Dover-based John Bywater Transport, which seems pleased with the results so far.

Perhaps the only issue, says Hannah Bywater, manager of John Bywater Transport, is the capacity available. The Norman Arrow has sufficient space for 30 trucks, but has so far been limited to a load of 15 on any one trip, John Bywater alone carries out 307 crossings a month.

The Dover operator is still pleased with the competitive rates offered by LD Lines, especially compared with Eurotunnel and with the one-hour crossing time.

Bywater adds that she likes the fact the route takes trucks to Boulogne rather than to Calais, because there is less risk of drivers being attacked there.

Not only have John Bywater drivers been among those targeted by immigrants at Calais, but more than one load has had to be destroyed because stowaways in the trucks soiled the cargo. "You can't sell yoghurt if someone has peed all over it," says Bywater. The speed of the crossing is possible because the Norman Arrow is the fastest vessel on the Dover Strait, with a top speed of 40 knots.

Speed and capacity

The Norman Arrow's speed came in handy when the catamaran was brought from Australia to Dover to operate on the Channel. Its route took it through a few dangerous patches of water, including the coasts of Eritrea and Somalia, where the crew kept a weather eye out for pirates. "We could probably outrun them. The one time we picked up something on the radar, it was a false alarm," says Captain Nick Dunne. If capacity has been an issue in the initial stages of the Norman Arrow's operation in the UK, it will soon be sorted out, reveals LD Lines managing director Christophe Santoni.

The catamaran has theoretical space for 30 trucks on each crossing, but so far the maximum it has managed to load is 15.

Santoni says: -This is due to the fact we are operating on Eastern Docks 3 (ED3) in Dover until June 29 due to maintenance of our dedicated berth Eastern Docks 1 (ED1). The location of ED3 doesn't allow us to operate the ship at 100% utilisation."

During the launch crossing last week, several of those on-board from the industry questioned if the pillars on the vehicle deck made loading more complicated, but Santoni says not.

He adds: "The pillars of the ship do not cause any problems since the width of the ship is large enough for them to turn inside without reversing. But to operate a full load, we need to have a linkspan wide enough to get all trucks out without heavy turns. This is not possible at ED3."

Whatever the potential capacity of the LD Lines ship, perhaps the most notable fact is that it decided to launch a new service during the worse economic conditions for years. Although LD is keen to build up business quickly. its bullish approach is in marked contrast to a number of other operators.

The service it is running replaces one that was previously operated on the same route by SpeedFerries, which collapsed last November.

In addition, already this year. SeaFrance has decided to cut 650 jobs, blaming a "steep fall in the cross-Channel freight market': In January, it said the Channel freight market was down 23% compared to 2008 — the equivalent of 800,000 trucks a year.

In stark contrast, LD Lines launched its first service on the Dover Strait back in February, before adding the Norman Arrow this June. It even launched a bid to buy SeaFrance, although by the end of

March. LD was saying this offer had been withdrawn due to the attitudes of trades unions.

Brittany Ferries, another firm which has been relatively upbeat about the cross-Channel market, then put in a bid.

Later bookings

A spokesman for Brittany says that this bid is still on the table, although the outcome is still

unclear. He adds that Brittany's optimism about the cross-Channel route is partly due to its main operations being on the western routes, which are more dependent on passenger traffic than freight.

"It's true this has insulated us a bit from many of the problems experienced by those operating on the eastern corridor, but we have found there is a tendency for people to book later and later." Whether or not LD Lines can make a long-term success of the Dover-Boulogne route remains to be seen, but it has made a confident start, and the deep pockets of the parent company, the Louis Dreyfus Armateurs group, should go a long way to seeing it through to the real shoots of economic recovery, •