Doing your own costing

Page 52

Page 53

Page 54

If you've noticed an error in this article please click here to report it so we can fix it.

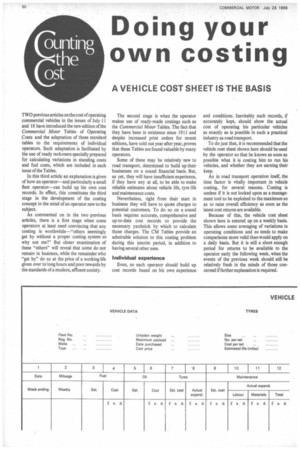

A VEHICLE COST SHEET IS THE BASIS

TWO previous articles on the cost of operating commercial vehicles in the issues of July 11 and 18 have introduced the new edition of the Commercial Motor Tables of Operating Costs and the adaptation of these standard tables to the requirements of individual operators. Such adaptation is facilitated by the use of ready reckoners specially prepared for calculating variations in standing costs and fuel costs, which are included in each issue of the Tables.

In this third article an explanation is given of how an operator—and particularly a small fleet operator—can build up his own cost records. In effect, this constitutes the third stage in the development of the costing concept in the mind of an operator new to the subject.

As commented on in the two previous articles, there is a first stage when some operators at least need convincing that any costing is worthwhile—"others seemingly get by without a proper costing system so why not me?" But closer examination of these "others" will reveal that some do not remain in business, while the remainder who "get by" do so at the price of a working life given over to long hours and poor rewards by the standards of a modern, affluent society.

The second stage is when the operator makes use of ready-made costings such as the Commercial Motor Tables. The fact that they have been in existence since 1911 and despite increased print orders for recent editions, have sold out year after year, proves that these Tables are found valuable by many operators.

Some of these may be relatively new to road transport, determined to build up their businesses on a sound financial basis. But, as yet, they will have insufficient experience, if they have any at all, to be able to make reliable estimates about vehicle life, tyre life and maintenance costs.

Nevertheless, right from their start in business they will have to quote charges to potential customers. To do so on a sound basis requires accurate, comprehensive and up-to-date cost records to provide the necessary yardstick by which to calculate those charges. The CM Tables provide an admirable solution to this costing problem during this interim period, in addition to having several other uses.

Individual experience Even, so each operator should build up cost records based on his own experience and conditions. Inevitably such records, if accurately kept, should show the actual cost of operating his particular vehicles as exactly as is possible in such a practical industry as road transport.

To do just that, it is recommended that the vehicle cost sheet shown here should be used by the operator so that he knows as soon as possible what it is costing him to run his vehicles, and whether they are earning their keep.

As in road transport operation itself, the time factor is vitally important in vehicle costing, for several reasons. Costing is useless if it is not looked upon as a management tool to be exploited to the maximum so as to raise overall efficiency as soon as the latest cost returns are available.

Because of this, the vehicle cost sheet shown here is entered up on a weekly basis. This allows some averaging of variations in operating conditions and so tends to make comparisons more valid than would apply on a daily basis. But it is still a short enough period for returns to be available to the operator early the following week, when the events of the previous week should still be relatively fresh in the minds of those concerned if further explanation is required. Another reason for a weekly return is to help the small fleet operator. Possibly with no clerical assistance, all the paperwork necessary for a monthly costing exercise might well seem overwelming to him, apart from the results being somewhat dated by the time they were available for action.

However, before the weekly entries are made it is first necessary to make the entries alongside the items shown in the heading.

Those entries to be made under the subheading "Vehicle data" can readily be obtained from the registration book, manufacturer's specification or purchase invoice. The same applies to the entries concerning tyres, the last item, "Estimated life (Miles)-, being increased in accuracy as records are built up based on the operator's own experience.

On this latter point it is a basic principle of this recommended vehicle cost sheet that, throughout its use, figures obtained from records of actual operation will be used whenever available. Where they are not, estimates are used, but provision is made to initiate and keep whatever additional records are necessary to replace any estimates in due course.

Standing and running As explained briefly in the two previous articles, the two basic elements of transport operation—time and mileage—are reflected in the division of the total operating costs of a vehicle into two groups. These are standing costs and running costs, and each group contains five items.

Standing costs are incurred whether the vehicle is operated or not and are expressed as a time unit cost, i.e. a cost per annum, per week etc. The five items are licences, wages, rent and rates, insurance and interest.

Running costs, in contrast, are incurred only when the vehicle is operated and are currently expressed as a cost (usually in pence to two decimal places) per mile. The five items here are fuel, lubricants, tyres, maintenance and depreciation.

Operating costs are costs which can be specifically allocated to individual vehicles. In addition, however, there are items of cost which cannot be so allocated and these are termed establishment or overhead costs. These costs can be said to be incurred in running the transport business as a whole, as distinct from individual vehicles.

Obvious examples of establishment costs in a transport business—however small— are those incurred in carrying out traffic control and in management itself. Unlike the specified 10 items of operating costs, the number and size of items of establishment costs can vary widely. Also they tend to occur at less regular intervals than operating costs—which is all the more reason why a careful record of all establishment costs should be kept.

Accordingly, provision is made on the right side of the sub-headings of the vehicle cost sheet to enter the estimated cost per mile for tyres and maintenance, using the standard figures shown in the Commercial Motor Tables until such time as the operator has sufficient data of his own from which to make these estimates. Likewise with the entry of total establishment costs, but the standing costs will be the actual amounts paid.

The equivalent weekly standing costs are obtained by dividing the annual amounts by 52. This is because this vehicle cost sheet constitutes a record of all work done on the vehicle concerned, week by week, irrespective of whether the vehicle is operating or not. Indeed some of the heaviest repair bills may well need entering on the sheet when it is not.

Not contradictory

This division is in contrast to—but not contradictory to—the division by 45 working weeks in compiling the CM Tables, when one of the objectives is to provide a yardstick for calculating charges. For that purpose it is necessary to ensure that sufficient revenue is earned in the 45 working weeks to cover all the expenditure incurred in the 52 weeks.

Incidentally, the vehicle cost sheet itself can be drawn up to cover any period. A minimum of 13 weeks is suggested to avoid repetitive entry of the headings. But any period longer than 12 months could result in some of the entries in the sub-headings being outdated.

A first glance at the main section of this sheet with its 23 columns may well give the newcomer the impression that compiling it would be a complex exercise. This is not so, always provided entry is done week by week.

After inserting the appropriate weekending date in the first column the data for entry into columns 2, 3, 4, 5 and 6 will in most cases by readily obtainable from the daily (or weekly) log sheet and the depot fuel issue record. These entries will be actual amounts as distinct from estimates.

Columns 7 and 8--"Tyres"—are concerned with both estimated costs and actual costs. Obviously, the precise wear that has occurred to a set of tyres in any one week is not known, at least for practical purposes. So an estimated amount as to the tyre costs for the week is obtained by multiplying the estimated tyre cost per mile (already entered in the sub-heading) by the vehicle mileage for that particular week. At the same time, however, a running record of the actual tyre costs must be kept so as to verify at appropriate intervals the previous estimates, or make the necessary adjustments where required.

The same procedure applies to maintenance costs in columns 9, 10, 11 and 12, with the additional provision to allow the recording of actual labour and materials costs separately..

Assuming depreciation is calculated on a mileage basis, the amount to be shown in column 13 is again obtained by multiplying the estimated cost per mile shown in the heading by the weeldy mileage.

Entries concerned with wages in columns 14, 15 and 16 are on the basis of actual amounts paid. Additional columns could be added to those shown (i.e. driver's wages and contributions to National Insurance and employer's liability insurance) if, for example, a mate was carried or contributions were regularly made to other funds. These could include the recently increased S.E.T. or the particular training levy paid. It is intended that these vehicle cost sheets should be applicable to both professional and ownaccount operation.

The equivalent amount for weekly standing costs as shown in the heading is next entered in column 17.

Total operating costs for the week are then entered in column 18, the amount being obtained by the addition of the amounts 'already entered in columns 4, 6, 7, 9, 13, 14, 15, 16 and 17. Division of this total by the mileage for the week provides the operating cost per mile for that week for entry in the next column.

Weekly establishment costs are entered in column 20. The addition of this amount to the total operating costs already entered in column 18 provides the total amount of expenditure for the week to be entered in column 21.

From records of traffic carried the total amount of revenue earned by the vehicle during the week is then entered in column 22. Comparison of total expenditure and revenue finally provides the amount to be recorded in the all-important column 23—Profit (or loss) per week.

Here again, although the own-account operator—whether for the carriage of passenge rs or goods—may not be directly concerned with actual profit he will still need some yardstick by which to measure his overall efficiency. In addition to comparison of his own operating costs per mile with other figures such as those shown in the CM Tables, (i.e. the engineering side of his business) he will also need to know the efficiency of his traffic office (i.e. loads carried in relation to mileage run).

To provide just such a valid comparison between expenditure and revenue some ownaccount operators find it worth the clerical work involved to make charges for the transport services they provide for other departments of their organization, even though no money actually passes between them. Where this applies, the appropriate entries will be made in column 23 of the Vehicle Cost Sheet.

Finally, the overriding principle involved in such an exercise by this own-account operator is applicable to all transport costing. It is simply this: to keep costing records accurately and up to date is praiseworthy but it is not enough; they must then be put to good use by the operator in providing a pointer to ways in which he can improve his efficiency and, with it, his profitability.