COSTING The Dollar Method

Page 24

Page 25

If you've noticed an error in this article please click here to report it so we can fix it.

I HAVE been examining an American method of record'. ing vehicle operating costs. It is in the form of a book

issued by an American manufacturer, the Autocar Company, and contains first a page of instructions and then 12 double pages of analysis sheets designed to facilitate the recording of costs. Each double page prov.ides for the recording of costs of operation for a month and one book is sufficient to enable the costs of one vehicle to be kept for a year.

The first important point is that, according to this authority, it is the custom in America to keep a much closer cheek on operating costs than is deemed necessary in this country. This book calls for a daily entry instead of a weekly one which I consider sufficient. On each double page there are 31 lines and on each of these is recorded the cost of operating a vehicle for one day.

The author agrees entirely with me about the need for estimated as well as actual cost figures. He says, in effect, that in his view it is essential that estimated costs be compiled of all vehicles before they are put into operation. I hese costs should be estimated either by the manufacturer of the vehicle or the owner and must be based on the most accurate operating experience. Without this information, he points out, the advisability of placing the vehicle in service cannot be decided, nor can haulage rates be determined.

He goes much further than I do in this connection. I call for estimates only in respect of tyres and maintenance: he asks, as his note suggests, for a complete estimate of the operating costs of the vehicle, including every item.

In making these estimates he is of opinion that it is not sufficient to estimate the total cost "per mile." The cost of each item making up the total must be estimated separately. When actual operating costs consistently show "more than estimate" it indicates that the vehicle employed is not being operated economically and corrective measures should be applied in respect of those cost items which are excessive.

The cost record sheet which is reproduced with this article shows that the preliminary columns ask not merely for the number of miles run and the number of journeys, but also for the units carried and for "unit-miles." The latter, in a sense, corresponds to our old and frequently discussed friend " ton-miles."

• He tells us that by "units"-he means tons, packages, gallons, or whatever measure is best suited for the commodity handled. The item "unit-miles ". is the product of the number of units multiplied by the total miles travelled to deliver them. If, for example, gallons be the unit of measurement, multiply the number of gallons per day by the nuinber of miles travelled to deliver this gallonage. The result will be the gallon-miles, and that, in the author's opinion, is the only "common denominator" between the various units in a fleet.

I do not, however, agree, with this opinion. The information as to cost per unit-mile is not sufficient by itself to justify a comparison for performance as between one vehicle and another. Let me quote three possible examples.

Take the case of a vehicle having a capacity of 100 units, and as a first example assume that this 100 units delivered as a full load is conveyed over a distance of 90 miles. Assuming that the vehicle returns empty, it must travel 180 miles to deliver this 100 units, so that the number of unitmiles is 18,000.

For the second example, assume that the vehicle takes this load of 100 units a distance of 10 miles, still returning empty, but that, nevertheless, it covers 180 miles per day so that it will have to make nine journeys. It will be appreciated that over a short journey of 10 miles the bulk of the journey will be in congested areas and the cost of operation increased accordingly. The cost per unit-mile will be greater and it will be unfair to compare this with the first example because the conditions are different.

As a matter of fact it will be almost impossible to complete nine journeys per day, taking into consideration the time lost at terminals. It is more likely that the vehicle will only be able to cover six journeys. The time factor will also enter into the calculation of cost per unit-mile, which will he still further increased, making comparison between the first example and this third one even more difficult. It is only practicable to compare the cost per unit-mile if the conditions of operation for each journey be precisely the same. Turning now to depreciation, the next column on the sheet. I observe a certain inconsistency. This item is entered as a fixed charge, .notwithstanding the fact that the author begins his paragraph on that item by suggesting that the vehicle be depreciated on a mileage basis of 200,000. He goes on to suggest, however, that if this mileage of 200,000 does not accrue within 50 months, depreciation should be calculated on the basis of two per cent, per month on the cost of the.vehicle.Presumably he anticipates a majority of cases in which the basic mileage will not be covered.

Punctilious Provision for Depreciation

In assessing . the total amount on which depreciation should be calculated he states that the cost of tyres and panting should be deducted from the first cost of the vehicle, the amount so dedUcted being immediately charged to operating expenses in the column provided for tyres and painting.

This goes a step further than is usual in this country where, whilst it is customary. to deduct the cost of tyres. I have never previously heard it suggested that the cost of painting be deducted. I admit that, logically, there is just as much. justification for the one deduction as for the other but as a matter of practical every-day commercial application regard it as unnecessary. I will justify that on one basis alone; that it is impossible to calculate depreciation to so fine a degree of accuracy as to make a comparatively small amount involved in painting the vehicle of any importance.

No mention is made of the residual

value, that is, the amount obtained for the vehicle when it is replaced. Possibly in America there is no market for second-hand vehicles which have run 200,000 miles or 50 months; perhaps they are just scrapped.

As regards " Interest," the next item

in the list Of Cost headings, he states that interest is calculated on the total investment (less tyres and painting) and should be 3 per cent, until the vehicle is fully depreciated. On account of depreciation this 3 per cent. is equal to 6 per cent, per annum

depreciated value. This is a point which has often been discussed in this country.

The idea behind the suggestion is that, presumably, the

operator banks each year a sum equal to the depreciation involved, the amount being put aside towards the purchase of a new vehicle. The interest on the amount thus banked is supposed to be set against the total interest of 6 per cent. which, accordingly, diminshes, until at the end of the term the amounts are equal and there is no interest to be debited or credited.

He is not strictly correct in doubling the 3 per cent. (or.

more correctly, halving the 6 per cent.), for he overlooks the fact that a year's interest is lost during the first year, and that deficiency is never overtaken. At one time I used the same idea myself, but in my method I made allowance for the loss of that year's interest. In the 1935 issue of The Commercial Motor Tables of Operating Costs" there was published

Standing charge per week :

Licences .

Wages ..

Rent and rates Insurance, I unrest

Total ..

Runnium costs per mile: FuL Lubricant Tyres ..

Maintenance (d)..

Maintenance (e)..

Depreciation ..

Total „

a formula for the calculation of this interest: in which P was the initial outlay, i the rate of interest, and x the number of years during which the vehicle was normally expected to be in service.

The author of this American method takes approximately four years, which is x; 6 per cent., which is i; and P is taken to be 100 The formula thus becomes

200 x 4 which is P multiplied by 30, that is 100 x 30 equals 3,000, over 800. This gives a figure of 31 per cent, as the actual interest to be charged. That means that in order to receive a real return of 6 per cent, spread over four years, the vehicle must be debited with the net amount of 32 per cent. and not 3 per cent., as suggested above.

I ceased to apply that rule, or the one suggested by the author of this book, because I found that a negligible number of operators actually invested the sums supposed to be set aside for depreciation. The rule, therefore, did not apply.

As the suggestion that .3 per cent, on the initial amount should be taken agrees precisely with my own in the current issue of "The. Commercial Motor Tables of Operating Costs" it seems that we might let that pass. Nothing need be said about the items "Housing" and "Insurance," sand in his reference to " Taxes" he makes it clear that the assessment of this item is likely to be a complicated and difficult operation in America.

The item, "Driver's Wage,' calls for no ,comment, and 1 turn immediately to the heading "Gasolene.". The users are recommended to multiply the loaded gross weight in tons by the loaded miles travelled. To this must be added the light vehicle weight (unladen weight) in tons, multiplied by the miles travellectlight. The total of these two amounts will be the total ton-miles worked. Divide this amount. by 80 and the result should approximate the quantities of gasolene required to perform this work.

This indicates that the publishers of this book assume that the vehicle would consume petrol at the rate of 80 ton-miles to the gallon. Actually, that theory would apply if only one size of truck Were manufactured because, as " The Commercial Motor " test results have shown, the ton-mileage to

be expected from large vehicles is much more than can be anticipated from the operation of a small vehicle. For example, these' tests show that whereas from a 10-cwt. van a tonmileage of 50 was achieved, with a 5-tonner more than 100. ton-miles per gallon resulted.

As a matter of interest I worked out this consumption. taking English figures and assuming the vehicle covered 1,000 miles fully loaded, having a gross weight of 8 tons, and 1,000 miles light, weighing 3 tons. The

total ton-mileage is 11,000. If I divide that by 80 I get 137, which is equivalent to an average of 144 m.p.g. and a cost (on the basis of Is. lid. per gallon) of I.6d. per mile, as compared with "The Commercial Motor" estimate, which is rather more than 11 m.p.g. and 1.92d. per mile.

For his estimate of the cost of oil the author takes 75 miles to the quart; this includes all oil changes and refills. On the basis of 2s. Id. per quart that is 0.33d., compared with "The Commercial Motor" estimate of 0.16d.

There are four items contributing to a total assessment of maintenance, from which painting is excluded. They are "Garage Labour," "Garage Supplies and Tools," "Chassis Repair Parts" and "Body Repairs." For garage labour, including provision for overheads (referred to by the author as Clerical Hire) the estimate put forward is 2 cents per mile. For chass.s repair parts, which includes the cost of replacement of chassis parts only, a farther 2 cents per mile is chatged, which is approximately a total of 2d. per mile.

Allowance for Tools and Supplies

For garage supplies and tools, which include such items as soap, waste, hoists, jacks and hand tools, an allowance of $24 per vehicle per year is made on the basis of a 24,000-mile year. That works out at approximately onetwentieth of a penny per mile. .The author fights shy. of making any estimate of body repairs which, he states, are usually done in an outside body shop and should include both labour and material.

With regard to tyres and tyre repairs, he recommends precisely the same procedure as is .generally' adopted here. Th.: original tyre equipment, he points out, should be immediately entered against this item and all replacements and repairs as they occur. In making an estimate he suggests that the operator should ..adopt the recommendation of the tyre manufacturer.

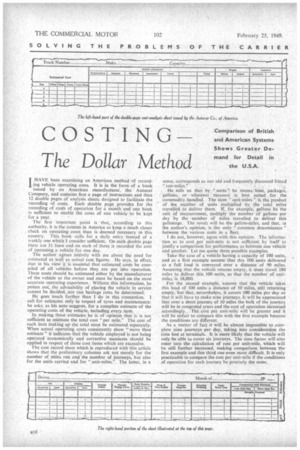

In Table 1 .1 have endeavoured to set out, for purposes of comparison, an estimate of the cost of operation of a 5-tonner (according to "The Commercial Motor Tables of Operating Costs ") side by side with a similar estimate based on the recommendations made in this book. As a basis for calcination I have assumed that the vehicle is covering 24,000

miles per annum. S.T. R.