WHY TYRE PRICES HAVE RISEN.

Page 12

If you've noticed an error in this article please click here to report it so we can fix it.

A Reply from the Tyre Manufacturer Members of the S.M.M. and T. to the query': Are Tyre Price Increases Justifiable ? "

INCLUDED in our issue dated August 11th was a contributed article which threw doubt on the justification for the recent large increases in the prices of tyres, and in our editorial comment upon the subject we invited the makers to explain, for the benefit both of themselves and the user, exactly why it had been found necessary to adopt this procedure. As a result of this, we have received the following communication from the Society of Motor Manufacturers and Traders, Ltd.:— My attention has been drawn to an article on the recent rise in the price of solid tyres and to the editorial comment hereon contained in your issue of the 11th inst. . On behalf of the tyre manufacturer members of the Society of Motor Manufacturers and Traders, I feel that it is only fair and just to your readers to say that the article is somewhat misleading. Possibly the writer of the article is not in possession of the true facts of the situation, and I append hereto a memorandum which has been prepared by this Society, giving figures which win more than account for the recent rises in the prices of solid and pneumatic tyres. I assume it is hardly necessary to add that all the figures contained in the memorandum have been properly verified.

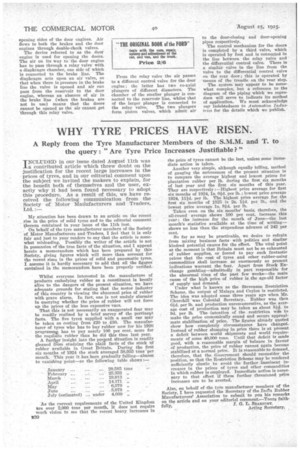

Whilst everyone interested in the manufacture of products embodying rubber as a constituent is keenly alive to the dangers of the present situation, we have adequate grounds for stating that the motor industry of this country is viewing the abnormal price of rubber with grave alarm. In fact, one is not unduly alarmist in querying whether the price of rubber will not force up the prices of the less expensive 'cars. That this is not necessarily an exaggerated fear may be readily realized by a brief survey of the pertinent facts. The five tyres supplied with a small car may be taken as costing from i20 to 130. The manufacturer of tyres who has to buy rubber now for his 1926 program% has to pay nearly 100 per cent, more for the requisite rubber than he did this time last year. A further insight into the present situation is readily gleaned from studying the plain facts of the stock of rubber available in Great Britain. During the first six months of 1924 the stock averaged 58,955 tons per month. This year it has been gradually falling—almost to vanishing point—as the following table shows 'As the current requirements of the United Kingdom are over 2,000 tons per month, it does not require much vision to see that the recent heavy increases in B30

the price of tyres cannot be the last, unless some immediate action is taken.

Another very simple, although equally telling, method of gauging the seriousness of the present situation is to compare the average highest and lowest prices for plantation rubber per lb. during the first six months of last year and the first six months of this year. They are respectively :—Highest price average for first six months of 1924, is. Old. per lb. ; lowest price average 1924, 111d. per lb. The highest price average for the first six months of 1925 is 2s. lid. per ihe and the lowest price average Is. 8id. per lb.

Taken even on the six months' basis, therefore, the all-round average shows 100 per cent. increase this year; the increase for the month of June—the last month's statistics available at the time of writing'— shows no less than the stupendous advance of 242 per cent.

So far as may be practicable, we desire to refrain from mixing business facts • with politics and similar kindred potential causes for the effect. The vital point at the moment is that Britain must not be so exhausted of rubber supplies, or forced to pay such fantastic prices that the cost of tyres and other rubber-using commodities shall increase as enormously as present indications warrant the fear. Apart from Stock Exchange gambling—admittedly in part responsible for the abnormal rises of the pant few weeks—the main cause of the high price of rubber is the age-old factor of supply and demand. Under what is known as the Stevenson Restriction Scheme, the output of Malaya and Ceylon is restricted. The idea. was adopted some three years ago when Mr. Churchill' was Colonial Secretary. Rubber was then Old. per lb. and production unrernunerative as the average cost of production may be taken as about sic). to 9d. per lb. The intention of the restriction wan to make the price economically sound and secure approximate stabilization of price. The figures already quoted show how completely circumstances have changed. Instead of rubber slumping in price there is at present a deficit between world shipments and world requirements of some 40,000 tons. Until that deficit is made good, with a reasonable margin of balance in favour of production, the price of rubber cannot again become stabilized at a normal price. It is reasonable to demand, therefore, that the Government should reconsider the position, so that the Restriction Scheme may be rendered sufficiently elastic to avoid the further imminent increases in the prices of tyres and other commodities in which rubber is employed. Immediate action is necessary to that effect if these further threatened price increases are to be averted.

Also, on behalf of the tyre manufacturer members of the Society, I have requested the Secretary of the Indla Rubber Manufacturers' Association to submit to you his remarks on the article and on your editorial comment—Yours faith

fully, T. G. L. SEARIGHT,

Acting Secretary. ,