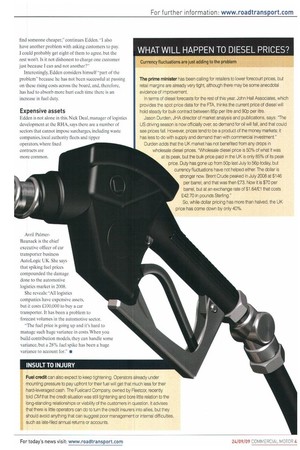

The recent hike in fuel duty has, understandably, caused outrage

Page 46

Page 47

If you've noticed an error in this article please click here to report it so we can fix it.

among hauliers up and down the country, but will fuel. escalators not absorb the impact? CM analyses the argument.

Words ; Louise Cote The axe has fallen once again, taking another quick chunk out of the neck of British industry. The road transport sector is, unsurprisingly, dismayed and outraged at the extra 2p fuel duty, which has been exacted by the Treasury. One thing to take from this, though, is that since we are still in the grip of a recession, despite the recent predictions of recovery, road transport is not alone in its complaint everyone is suffering.

Motoring groups have been throwing their weight against the increase, highlighting the difficulties of the average consumer. The average price of diesel is around 107p per litre at the forecourt: currently I4p of this is VAT, but that will rise another 2.3p when VAT returns to its former level of 17.5% in January. So far, the three rises this year have increased industry costs by around £810m, says the Freight Transport Association (FTA). The latest rise accounts for £277m of that.

Unprecedented tax grab

Road Haulage Association (RHA) director of policy Jack Semple says: -On 1 September, the Treasury added another 2p per litre. or £1.000 a year. to the cost of running UK trucks which was the third rise in nine months, totalling 12%, and an unprecedented tax grab on the operation of the British supply chain.

"The duty on diesel is a key cost element, accounting for 20% of the total operating cost of a 44-tonne lorry. To put it another way, duty is now a 25% tax on the operation of the road transport element of the supply chain of British industry."

The most obvious problem for road transport operators that are having to face continued fuel duty increases, then, is the pressure to keep absorbing costs they cannot pass on, particularly during a recession.

Fuel clauses

Managing director of Banbury-based TWE Haulage Trevor Edden says: "We have no chance of getting that money back. We have got some larger customers with fuel clauses in the contract, and they work both ways if the price falls outside the margin, we reimburse them. We now discuss surcharges up front with large clients before starting work, and there is a comfort in that.

"However, most of our other customers won't wear it. They are all suffering. You can see it in the volumes of freight they put through. And some will go straight to another transport supplier if I try to pass on this cost.

"Unless the entire industry stands up as one and insists on fuel surcharges, they will always be able to find someone cheaper," continues Edden. "I also have another problem with asking customers to pay. I could probably get eight of them to agree, but the rest won't. Is it not dishonest to charge one customer just because I can and not another?"

Interestingly, Edden considers himself "part of the problem" because he has not been successful at passing on these rising costs across the board, and, therefore, has had to absorb more hurt each time there is an increase in fuel duty.

Expensive assets

Edden is not alone in this. Nick Deal, manager of logistics development at the RHA, says there are a number of sectors that cannot impose surcharges, including waste companies, local authority fleets and tipper operators, where fixed contracts are more common.

Avril PalmerBaunack is the chief executive officer of car transporter business AutoLogic UK. She says that spiking fuel prices compounded the damage done to the automotive logistics market in 2008.

She reveals: All logistics companies have expensive assets, but it costs /100,000 to buy a car transporter. It has been a problem to forecast volumes in the automotive sector.

-The fuel price is going up and it's hard to manage such huge variance in costs. When you build contribution models, they can handle some variance, but a 28% fuel spike has been a huge variance to account for." •