Hire purchase has a cash-flow idvantage

Page 61

Page 62

If you've noticed an error in this article please click here to report it so we can fix it.

kdministration and cash-flow problems have been experienced since the introuction of Value-added Tax just over a year ago. Just what its effect has been ; now becoming apparent.

y J. C. Olsen, Fleet Finance Executive, United Dominions Trust (Commercial) Ltd.

PS A YEAR now since the VAT system was introduced ito the United Kingdom and the fact that this anniversary as passed without notice points to the ability of British rdustry to absorb what was a major shift in taxation policy.

What is unknown is the total cost in setting up VAT stems. In the case of a finance house, there was ed to investigate in depth, policy decisions to be ade, the settling of the new procedures, drafting and inting of totally new documentation, training of staff id education of customers.

But certain segments of the domestic community no ore understand VAT than they do decimalization or :trication, despite a considerable amount of publicity and vertising.

However, let us now examine the effect of VAT on hide purchases. On commercial vehicles it is rela ely simple and obvious, an increase of 10 per cent the pre-VAT price — but, of course, it did not follow tt the invoice price was increased by that amount ,ing to the frequent inclusion of zero-rated or nontable items such as licence fees, and until recently ;1.

The practical aspect is that due to the effect of lation and VAT during the last 12 months or so : vehicle which cost, say, £3,000 has now risen to 000 although the normal operator will recover 1111th e VAT) within three months. The overall effect is to Ise deterioration in the cash-flow situation, and )bably increased borrowings at today's high money ts.

rhe basic effect of VAT on passenger cars was rather 7erent — the withdrawal of purchase tax and istitution by a "car" tax plus VAT, resulted a marginally lower "recommended retail price" — the fact that the VAT element of the cost of the was "blocked" created all kinds of possibilities the minds of certain operators when it was ireciated that individual items fitted at a later time n delivery did not have their VAT blocked.

he subsequent supply of such items as radios, wing mirrors, spot lights is indeed possible, but imagination can run riot with the thought of heated rear windows, and power steering units being fitted later. In fact, few if any of these thoughts took place as the cost of supplementary fitting as to factory fitted costs outweighed any possible VAT recovery advantage. It is, of course, true that the reduction in total invoice price by granting of "fleet owner" discounts does result in a genuine saving of the irrecoverable VAT:

Methods of finance

For the self-financing operator who is zero or standard rated and uses either his own internal sources or bank overdraft there has been little change in his procedures apart from the worsening in his cash flow; he pays his supplier the VAT inclusive price of the vehicle and for commercial vehicles recoups his tax paid at the next settlement date.

It is in theory possible to arrange for the invoices to be received -just before the settlement date to minimize this problem, but as the vehicle supplier has already paid over his VAT to the manufacturer he is unlikely to be totally co-operative in this respect. Bank overdraft charges do not attract VAT.

Originally it had been thought that, in the case of hire purchase, VAT was to be charged on the interest and caused very serious misgivings fromboth an administration problem and in terms of profitability as the VAT on the charges would have to be paid Net: at the next settlement date, but only recovered .uring the life of the agreement. However, it was iossible to avoid this situation by a redrafting of the ppropriate section of the document. Consequently TAT is not charged on anything more than the goods .s detailed in the invoice from the supplier to the inance house..

The hire purchase agreement forms the tax invoice rom the finance house to the operator, and as-it is Lsually dated the same date as the vehicle supplier's nvoice the VATis recouped at the same time as if it Lad been a "cash purchase".

In the main, finance houses are agreeable to accept he VAT inclusive price of a commercial vehicle as heir basis for financing, and although traditionally hey have called for 20-25 per cent down payment on he total invoice price this is not essential as cornnercial vehicles are not subject to the current Hire 3urchase Control Order (cars are subject to this order Lnd it is necessary to pay one-third of the invoice )rice as the down payment). Normally the VAT content s included in the repayments and spread over he entire repayment period, although it could, if lesired, be repaid in a lump sum after recovery.

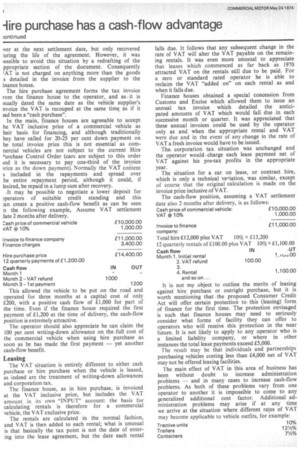

-It may be possible to negotiate a lower deposit for verators of suitable credit standing and this an create a positive cash-flow benefit as can be seen n the following example, Assume VAT settlement late 2 months after delivery.

This allowed the vehicle to be put on the road and operated for three months at a capital cost of only £200, with a positive cash flow of £1,000 for part of the time. Even if the finance house required the first payment of £1,200 at the time of delivery, the cash-flow position is extremely attractive.

The operator should also appreciate he can claim the 100 per cent writing-down allowance on the -full cost of the commercial vehicle when using hire purchase as soon as he has made the first payment — yet another cash-flow benefit.

Leasing

The VAT situation is entirely different to either cash purchase or hire purchase when the vehicle is leased, as indeed are the treatment of writing-down allowances and corporation tax.

The finance house, as in hire purchase, is invoiced at the VAT inclusive price, but includes the VAT amount in its own "INPUT' account: the basis for calculating rentals is therefore for a commercial vehicle, the VAT exclusive price.

The rentals are calculated in the normal fashion, and VAT is then added to each rental; what is unusual is that basically the tax point is not the date of entering into the lease agreement, but the date each rental falls due. It follows that any subsequent change in the rate of VAT will alter the VAT payable on the. remaining rentals. It was even more unusual to appreciate that leases which commenced as far back as 1970 attracted VAT on the rentals still due to be paid. For a zero or standard rated operator he is able to reclaim the VAT "added on" on each rental as and when it falls due.

Finance houses obtained a special concession from Customs and Excise which allowed them to issue an annual tax invoice which detailed the anticipated amounts of VAT which would fall due in each successive month or quarter. It was appreciated that these annual invoices could be used by the operator only as and when the appropriate rental and VAT were due and in the event of any change in the rate of VAT a fresh invoice would have to be issued.

Thecorporation tax situation was unchanged and the operator would charge each lease payment net of VAT against his pre-tax profits in the appropriate year.

The situation for a car on lease, or contract hire, which is only a technical variation, was similar, except of course that the original calculation is made on the invoice price inclusive of VAT.

The cash-flow position, assuming a VAT settlement date also 2 months after delivery, is as follows: It is not my object to outline the merits of leasing against hire purchase or outright purchase, but it is worth mentioning that the proposed Consumer Credit Act will offer certain protection tothis (leasing) form of finance for the first time. The protection envisaged is such that finance houses may need to seriously consider what forms of facility they can offer to operators who will receive this protection in the near future. It is not likely to apply to any operator who is a limited liability company, or where in other instances the total lease payments exceed £5,000. The result may be that individuals and partnerships purchasing vehicles costing less than £4,000 net of VAT may not be offered leasing facilities.

The main effect of VAT in this area of business has been without doubt to increase administration problems — and in many cases to increase cash-flow problems. As both of these problems vary from one operator to another it is impossible to come to any generalized additional cost factor. Additional administration problems may arise if at any time we arrive at the situation where different rates of VAT may become applicable to vehicle outfits, for example:

Tractive units 10% Trailers 121/2%

Containers 71/2%