Cut to the chase

Page 18

Page 19

If you've noticed an error in this article please click here to report it so we can fix it.

What are the legal remedies available for hauliers wishing to pursue unpaid debts?

Words: Michael Whitaker Late payment continues to be a problem for all UK hauliers and, if neglected, can result in serious cashflow problems, falling profits and ultimately affect the liquidity of a business.

It can also have a drastic impact on an operator's financial standing, which can result in the curtailment, or even the revocation, of its 0-licence.

So it follows that in today's climate, an efficient and disciplined internal credit control procedure is a vital part of any business.

However, what legal remedies are available to recover the debt if a customer doesn't pay following your final reminder? It is essential to act as quickly as possible if a customer doesn't pay, as any delay could allow other creditors the opportunity to recover before you or potentially even before the customer is formally declared insolvent.

In this situation, there are two ways forward for a creditor. Either a claim form can be issued at court or a statutory demand can be served, followed by the issue of a bankruptcy or winding-up petition.

Before court proceedings can be commenced, a formal letter before action must be sent. A sevenor 14-day deadline for payment or response is usually imposed.

It should state clearly that if the debtor still doesn't pay, court proceedings will be commenced, which will include a claim for court fees, costs and interest.

Commercial debt If it is a commercial debt, interest can be claimed under the Late Payment Act 1998, currently at the rate of 8.5% a year. Alternatively, contractual interest can be claimed pursuant to any applicable terms and conditions, or statutory interest can be claimed in all other cases under the County Court Act 1984 at the rate of 8%.

It is important to establish the correct identity of the customer before issuing proceedings, as there can be time and cost implications if the wrong party is sued. Once proceedings are issued, unless the customer — now known as the defendant — pays the amount claimed in full or defends the action, a county court judgment (CCJ) will be obtained. Although a CCJ will affect a customer's credit rating and can therefore be viewed as a success, obtaining payment from the customer is another matter altogether.

There are various ways to enforce payment of a judgment debt, but success will depend on what information is known about the customer, what their current circumstances are and whether the customer is a company or an individual.

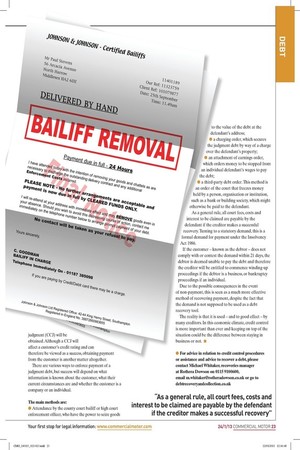

The main methods are: • Attendance by the county court bailiff or high court enforcement officer, who have the power to seize goods to the value of the debt at the defendant's address; • a charging order, which secures the judgment debt by way of a charge over the defendant's property; • an attachment of earnings order, which orders money to be stopped from an individual defendant's wages to pay the debt; • a third-party debt order. This method is an order of the court that freezes money held by a person, organisation or institution, such as a bank or building society, which might otherwise be paid to the defendant.

As a general rule, all court fees, costs and interest to be claimed are payable by the defendant if the creditor makes a successful recovery. Turning to a statutory demand, this is a formal demand for payment under the Insolvency Act 1986.

If the customer – known as the debtor – does not comply with or contest the demand within 21 days, the debtor is deemed unable to pay the debt and therefore the creditor will be entitled to commence winding-up proceedings if the debtor is a business, or bankruptcy proceedings if an individual.

Due to the possible consequences in the event of non-payment, this is seen as a much more effective method of recovering payment, despite the fact that the demand is not supposed to be used as a debt recovery tool.

The reality is that it is used – and to good effect – by many creditors. In this economic climate, credit control is more important than ever and keeping on top of the situation could be the difference between staying in business or not. • • For advice in relation to credit control procedures or assistance and advice to recover a debt, please contact Michael Whitaker, recoveries manager at Rothera Dowson on 0115 9100600, email m.whitaker@rotheradowson.co.uk or go to debtrecoveryandcollection.co.uk • Set an upper credit limit for each customer.

• Identify whether the customer is a limited company, partnership, LLP or individual/sole trader.

• Obtain a credit report before trading with the customer (business or individual).

• If there are any concerns as to a customer's financial circumstances, obtain a risk tracker —this will alert you to any changes in a company's status or credit rating.

• Credit terms must be understood and signed by each customer.

• The customer must tell you within a set time if a delivery has not been received.

• Consider offering a discount or rebate for quick payment if it is possible.

• Advise customers that you will use Late Payment Act legislation in the event of late/non-payment. This might be used on quotations, order acknowledgements, invoices and reminder letters.

• Invoice promptly.

• Call to check that goods have arrived.

• Keep unpaid sales invoices in date order, showing the oldest outstanding invoices.

• Send reminder letters and make calls after expiry of any deadlines given.

• Always focus on the largest debts first, followed by the oldest.

• Chase up early any customers you suspect may have problems paying.

• Don't allow additional credit if someone exceeds your credit limits.

• Check and record the total credit outstanding across the whole of the business once a month.

• Keep records of the problems and conversations you have with customers.

• If an invoice is disputed, ask for reasons for the dispute in writing.

• Ensure everyone in the office knows about slow-paying customers and what the company policy for dealing with them is.

• Finally, act quickly and refer the matter to a debt collection specialist solicitor if internal credit control procedures do not result in payment.