Mileage Allowance

Page 62

Page 65

If you've noticed an error in this article please click here to report it so we can fix it.

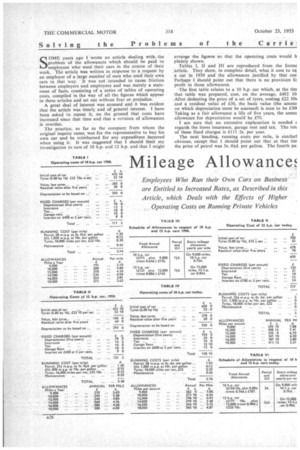

SOME years ago I wrote an article dealing with the problem of the allowances which should be paid to employees who used their cars in the course of their work. The article was written in response to a request by an employer of a large number of men who used their own cars in that way. It was not intended to cause friction between employers and employees and was merely a statement of facts, consisting of a series of tables of operating costs, compiled in the way of all the figures which appear in these articles and set out without fear or prejudice.

A great deal of interest was aroused and it was evident that the article was timely and of general interest. I have been asked to repeat it, on the ground that costs have increased since that time and that a revision of allowances is overdue.

The practice, so far as the company from whom the original inquiry came, was for the representative to buy his own car and be reimbursed for any expenditure incurred when using it. It was suggested that I should limit my investigation to cars of 10 h.p. and 12 h.p. and that I might arrange the figures so that the operating costs would b plainly shown.

Tables 1, II and Ill are reproduced from the forme .article. They show, in complete detail, what it cost to ru a car in 1950 and the allowances justified by that cos Perhaps 1 should point out that there is no provision fc profit in those allowances.

.The first table relates to a 10 h.p. car which, at the tim that table was prepared, cost, on. the average, £402 10: .After deducting the price of a set of tyres, costing £22 lOs and a residual value of £30, the basic value (the amour on which depreciation must be assessed) is seen to be £30( Taking as a fair allowance a life of five years, the annuk allowance for depreciation would be £70.

am sure that no extensive explanation is needed z regards the items insurance, garage rent and tax. The totE of these fixed charges is £111 2s. per year.

The next heading, running costs per mile, is similarl obvious, except that I should point out that at that tim the price of petrol was 3s. 04-d. per gallon. The fourth pa:

Table I shows what the allowance should be for a iety of mileages per annum rising from a minimum of 10 to a maximum of 18,000. The figures are given per um and per mile.

'able II shows corresponding figures for a 12 h.p. car ed to cost £450 initially. The-company whence came the ;Mal inquiry asked me to lay out the figures in a :icular way and this is shown in Table III, which, I think, is some explanation.

• was the custom, I was told, to pay the traveller a fixed ual allowance plus 1 id. per mile to cover expenditure )etrol and oil. The fixed allowance was designed to cover )ecific annual mileage-9,000 in the case of the 10 h.p. and 12,000 in the case of the 12 h.p. car. An extra wance was paid annually for every mile over the 9,000 2,000, as the case might be.

'aking first the data relating to the 10 h.p. car, I calculate . the owner should receive a total of £191, which is the 1 annual cost for a 9,000-mile year, as shown in the le. In order to arrive at that amount, I took fixed charges 111 a year and added 0.64d. per mile. The latter figure rrived at by deducting the 141. allowance for petrol and from the total running cost of 2.14d. per mile. Thus 0 multiplied by 0.64d., which is £24, added to the £111 .&

£135 annual allowance.

'here is still the extra allowance to be assessed: it is paid every mile the vehicle runs over the 9,000 minimum. It amount incurred on account of assumed expenditure on s and maintenance, which is (see Table I) 0.30d. plus d., 0.72d. in all.

he figures for the 12 h.p. car are also set out in Table II. Table III I give the details of the rates which should nade on account of the allowances. I first deduct the per milt for petrol from the running cost of 2,38d. mile, leaving 0.88d. Similarly the 0.83d. per mile for :ss mileage is the sum of the figures for tyres and ntenance.

11 these amounts, Ineluded in Tables I, If and III, relate )sts in 1950. Tables IV, V 4nd VI give the corresponding current today. It will be observed that there is a considerable increase. The biggest rise is in the cost of the vehicles themselves, brought about by the addition of purchase tax. In the case of the 10 h.p. car the price has risen from £402 10s. to £600. The running costs per mile, instead of being 2.14d. are now 2.76d., an increase of about 29 per cent. In the case of the 12 h.p. car the original figure was 2.38d. and is now 3.15d. The increase is thus approximately 32 per cent. The fixed charges are affected only in respect of the item interest on first cost.

There is a point of particular interest in the figures set out in Table VII giving the increases in cost per mile as percentages. It should be noted that the percentage interest declines as the annual mileage increases. The previous table, published some years ago, showed the reverse to be the case: the percentage increased as the annual mileage rose. The reason is quite simple. In the data applied in the former case the principal item, that which showed the biggest increase as between the two sets of figures, was in respect of the running costs and the outstanding item was petrol. There was no difference insofar, as the standing charges were concerned. Consequently, the running costs were the governing factor in the comparison. The biggest increase was in respect of the running costs and in consequence, as the mileage increased so also did the percentage in the total of cost per mile.

Two Items Affected Now, the biggest increase is in respect of the initial cost of the vehicle, which actually affects two iteins in the standing charges. Any increase in annual mileage therefore tends to reduce the overall cost per mile, as an increase in mileage run brings about a diminution in the standing charges per mile. Simply put, assume that the standing charges are £500 per annum and the mileage 10,000. The incidence of the standing charges is 1.2d. per mile. If the running cost is 3d. per mile the total is 4.2d. Now suppose the annual mileage is 20,000. The standing charges per . mile will be only 0.7d. per mile and the total cost per mile 3.7d.

Let us suppose that the standing charges arc the same in both cases but that the cost of petrol has doubled. The total of running costs has increased by 1.30d. At 10,000 miles per annum the increase would still be 1.30d. as it would also at 20,000 miles, and the percentage increase of cost per mile would be nil.

As in the previous article, I propose to extend this inquiry to include data showing how the costs of operating goods vehicles have increased. Data relating to the costs of operating a 2-tonner are given in Table VIII.

Both sets of figure are taken from "The Commercial Motor Tables of Operating Costs." It is interesting to note that the percentage increase in total cost is 21, the actual difference being £3 15s. per week, nearly £195 per annum. -Going to the opposite extreme, 1 give, in Table IX, the

corresponding figures for a 15-tonner. S.T.R.