Budget 'reward' hurts Britain's tipper operators

Page 5

If you've noticed an error in this article please click here to report it so we can fix it.

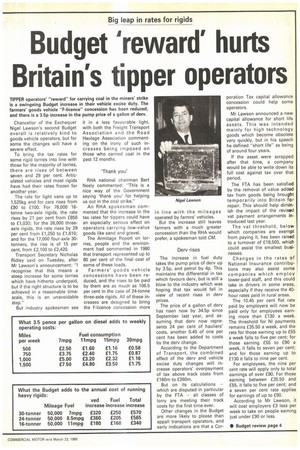

TIPPER operators' "reward" for carrying coal in the miners' strike is a swingeing Budget increase in their vehicle excise duty. The farmers' goods vehicle "F-licence" concession has been reduced; and there is a 3.5p increase in the pump price of a gallon of derv.

Chancellor of the Exchequer Nigel Lawson's second Budget overall is relatively kind to goods vehicle operators, but for some the changes will have a severe effect.

To bring the tax rates for some rigid lorries into line with those for the majority of lorries, there are rises of between seven and 29 per cent. Articulated vehicles and most rigids have had their rates frozen for another year.

The rate for light vans up to 1,525kg and for cars rises from £90 to £100. For 78,000 16tonne two-axle rigids, the rate rises by 21 per cent from £850 to £1,030; for the 26,000 threeaxle rigids, the rate rises by 29 per cent from £1,250 to £1,610; and for the 17,000 four-axle 30tonners, the rise is of 15 per cent, from £2,100 to £2,420.

Transport Secretary Nicholas Ridley said on Tuesday, after Mr Lawson's announcement: "I recognise that this means a steep increase for some lorries which have hitherto underpaid, but if the right structure is to be achieved in a reasonable timescale, this is an unavoidable step."

But industry spokesmen see it in a less favourable light, with both the Freight Transport Association and the Road Haulage Association commenting on the irony of such increases being imposed on those who carried coal in the past 12 months.

'Thank you' RHA national chairman Bert Neely commented: "This is a nice way of the Government saying 'thank you for helping us out in the coal strike."

An RHA spokesman commented that the increase in the tax rates for tippers could have an especially serious effect on operators carrying low-value goods like sand and gravel.

The Armitage Report on lorries, people and the environment had commented in 1980 that transport represented up to 80 per cent of the final cost of some of these loads.

Farmers' goods vehicle concessions have been reduced, and the rises to be paid by them are as much as 106.5 per cent in the case of 24-tonne three-axle rigids. All of these increases are designed to bring the F-licence concession more in line with the mileages operated by farmrs' vehicles.

But the increase still leaves farmers with a much greater concession than the RHA would prefer, a spokesman told CM.

Dery rises The increase in fuel duty takes the pump price of dery up by 3.5p, and petrol by 4p. This maintains the differential in tax which favours derv, but is still a blow to the industry which was hoping that tax would fall in view of recent rises in dery prices.

The price of a gallon of dery has risen now by 34.5p since September last year, and assuming that dery now represents 24 per cent of hauliers' costs, another 0.45 of one per cent has been added to costs by the dery change.

According to the Department of Transport, the combined effect of the dery and vehicle excise duty changes will increase operators' overpayment of tax above track costs from £160m to £260m.

But on its calculations — which are disputed in particular by the FTA — all classes of lorry are meeting their track costs for the first time ever.

Other changes in the Budget are more likely to please than appall transport operators, and early indications are that a Cor

poration Tax capital allowance concession could help some operators.

Mr Lawson announced a new capital allowance for short life assets. This was intended mainly for high technology goods which become obsolete very quickly, but in his speech he defined "short life" as being of around four years.

If the asset, were scrapped after that time, a company would be able to write down its full cost against tax over that period.

The FTA has been satisfied by the removal of value added tax from goods being brought temporarily into Britain for repair. This should help diminish the impact of the revised vat payment arrangements introduced last year.

The vat threshold, below which companies are exempt from paying it, has been raised to a turnover of £19,500, which could assist the smallest businesses.

Changes in the rates of National Insurance contributions may also assist some companies which employ lower-paid staff, and this could take in drivers in some areas, especially if they receive the 40hour rates paid in rural areas.

The 10.45 per cent flat rate paid by employers will now be paid only for employees earning more than £130 a week. The threshold for NI payments remains £35.50 a week, and the rate for those earning up to £55 a week falls to five per cent; for those earning £55 to £90 a week, it falls to seven per cent; and for those earning up to £130 it falls to nine per cent.

For employees, the nine per cent rate will apply only to total earnings of over £90. For those earning between £35.50 and £55, it falls to five per cent; and a seven per cent rate applies for earnings of up to £90.

According to Mr Lawson, it will cost employers £3 less per week to take on people earning just under £90 or less.