Ryder’s 40th birthday present

Page 11

Page 12

If you've noticed an error in this article please click here to report it so we can fix it.

Ryder’s purchase of Hill Hire made the headlines a fortnight ago – here the men in charge explain their decision

Words: Justin Stanton

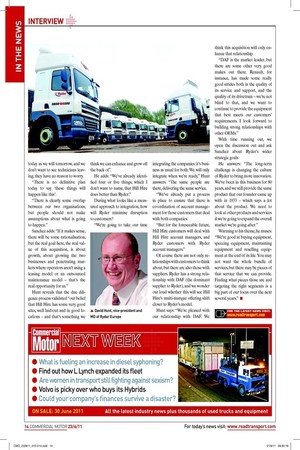

ON THE EVE of Ryder UK’s 40th birthday celebrations in the irst week of June, CM found itself having lunch with two of the rental and leasing giant’s most powerful executives: David Hunt, vicepresident and MD of Ryder Europe, and his boss, Robert Sanchez, president of Ryder’s Global Fleet Management Solutions arm, fresh in from its Miami HQ.

The timing was serendipity itself: just 24 hours before the meeting, Ryder announced its £151m takeover of Hill Hire.

Indeed, when that story broke, this writer was in a meeting with the British Vehicle and Rental Leasing Association where the topic of discussion had just turned to consolidation. We’d suspected Ryder would play an active role in events, and we’d known for a few weeks that something was brewing – we just didn’t know what.

By now we all know the facts: Hill Hire was identiied as a noncore asset by its banking parent back in 2008, but it wasn’t until early spring 2010 that Lloyds irst approached Ryder; and on 8 June 2011, Ryder’s purchase of Hill Hire was announced – at £16m less than book value – creating a combined business with 10,000 CVs.

So what attracted Ryder to Hill Hire? Sanchez says: “Its position in the market place was attractive to us. We were interested in growing our position in the tractor market.” Nearly two-thirds of Hill Hire’s leet are tractors, while Ryder’s leet is dominated by rigids, thus the two make a good it. However, Ryder is a conservative business, always taking a low-risk approach, so Hill Hire had to offer more than just greater exposure to a key market sector – its culture had to dovetail with Ryder’s.

“It’s an extremely complementary acquisition,” Hunt explains, “with a strong brand and a good health and safety record, and it’s strong on compliance, matching Ryder’s values.” He adds that Hill Hire’s approach to credit risk, write-downs and residual values matches Ryder’s. But what about integration and rationalisation?

Hunt answers: “We purchased Hill Hire as part of our ongoing growth strategy for the UK. We want to take our time: we have the same number of trucks and trailers today as we will tomorrow, and we don’t want to see technicians leaving; they have no reason to worry.

“There is no deinitive plan today to say ‘these things will happen like this’ .

“There is clearly some overlap between our two organisations, but people should not make assumptions about what is going to happen.” Sanchez adds: “If it makes sense, there will be some rationalisation, but the real goal here, the real value of this acquisition, is about growth, about growing the two businesses and penetrating markets where operators aren’t using a leasing model or an outsourced maintenance model – that’s the real opportunity for us.” Hunt reveals that the due diligence process validated “our belief that Hill Hire has some very good sites, well laid-out and in good locations – and that’s something we think we can enhance and grow off the back of” .

He adds: “We’ve already identiied four or ive things, which I don’t want to name, that Hill Hire does better than Ryder.” During what looks like a measured approach to integration, how will Ryder minimise disruption to customers?

“We’re going to take our time integrating the companies: it’s business as usual for both. We will only integrate when we’re ready,” Hunt answers. “The same people are there, delivering the same service.

“We’ve already put a process in place to ensure that there is co-ordination of account management for those customers that deal with both companies.

“But for the foreseeable future, Hill Hire customers will deal with Hill Hire account managers, and Ryder customers with Ryder account managers.” Of course there are not only relationships with customers to think about, but there are also those with suppliers. Ryder has a strong relationship with DAF (the dominant supplier to Ryder), and we wonder out loud whether this will see Hill Hire’s multi-marque offering shift closer to Ryder’s model.

Hunt says: “We’re pleased with our relationship with DAF. We think this acquisition will only enhance that relationship.

“DAF is the market leader, but there are some other very good makes out there. Renault, for instance, has made some really good strides both in the quality of its service and support, and the quality of its drivetrain – we’re not blind to that, and we want to continue to provide the equipment that best meets our customers’ requirements. I look forward to building strong relationships with other OEMs.” With time running out, we open the discussion out and ask Sanchez about Ryder’s wider strategic goals.

He answers: “The long-term challenge is changing the culture of Ryder to bring more innovation. We’ve been in this business for 80 years, and we still provide the same product that our founder came up with in 1933 – which says a lot about the product. We need to look at other products and services if we’re going to expand the overall market we’re going after.”

Warming to his theme, he muses: “We’re good at buying equipment, speccing equipment, maintaining equipment and reselling equipment at the end of its life. You may not want the whole bundle of services, but there may be pieces of that service that we can provide. Finding what pieces those are and targeting the right segments is a big part of our focus over the next several years.” ■

FOR THE LATEST NEWS VISIT:

www.roadtransport.com