Reasonable Rates for Municipal Haulage

Page 46

Page 49

Page 50

If you've noticed an error in this article please click here to report it so we can fix it.

SINCi1 wrote the previous article,. but before it had 'appeared in print, I have received letters from hauliers inquiring as to the rates'. they should charge this year for haulage to public autho rities. They particularly ask what are reasonable increases over previous years. In that previous ankle I was discussing the subject' with 'a" sniall" Operator in a rural area, the owner of two vehicles, a lorry and a tipper.

The conversation. turned to an argument when he suggested that he could work at rates lower than those quoted in RH/D/20, but I think .1 was able to show him. that he could not cut those rates, and that -on the contrary, under present-day conditions he should charge higher rates if he was to make a reasonable profit.

I demonstrated that for his 2-ton lorry he should charge 7s. 8d. per hour, that covering 5 m.p.h. of actual, running, and an extra Sid. per mile for every mile in excess of five. That compares with RH/D/20 in which the rates quoted are 6s. 6d. per hour and 4id. per mile excess. . The difference between my view and that of the compiler's of RH/D/20 I would have thought might well arise from differences of opinion as regards a reasonable • percentage of profit. Actually, however, there is in my view hardly. any profit at all in that 6s. 6d. per hour and certainly none in the 4id. per mile excess.

I terminated the previous article on a request from this haulier that I would advise him as to what differences, if any, there would be between his charges for the 2-ton lorry and for the hire of a tipper of the same capacity. . "You' should charge more for the hire of a tipper," I answered. "The amount quoted in RH/D/20 is 8 per cent. Whether that agrees With my figures, I cannot at the moment say, but we might just as well look into it.

should be more than for a lorry, you usually have to pay more for the vehicle

to start with. Is not that your, experience?"

"Yes," he replied, "the difference in my case was £20."

"Very well, then," I said. "We will work the depreciation and interest out on the basis of £520, in the same way as we did for the lorry at £500.

al6

"First, we deduct the cost of a set of tyres which is the same as before, namely £50. That leaves £470for us to work on.

" You may expect to get a little more for a second-hand tipper than for a second-hand lorry having in view the fact that a new one would cost more."

"I'm not so sure of that," he said, "judging from past . experience. In the old days you were quite likely to get less for a tipper because it was as a rule more knocked about."

"Yes, I, see your point," I said " but just for the time being We will take it that given seasonable maintenance, and I shall allow for that in my costings, the condition of the two at the end of four years, should be the same and on that basis I am going to suggest £55 as being the secondhand value.

" If we take that £55 from the £470 we get £415. That,. spread over four years, is '£103 15s. per annum which is £2 is. 6d. per week. "The interest on £520 is £20 16s., as against t20 for the lorry That means that we must allow 8s. 4d. per week instead of Es.

"That may or may not be all the difference in so far as the standing charges are concerned," I said. "The one doubtful point is that Road Fund licenee. Sometimes a tipper comes out rather heavier than a lorry, in which case you may have to pay another £2 10s. per year tax. How is it in your case?"

"There's no difference in mine," he said. "The tax is the same for each."

"That saves us a lot of trouble," I said. "But incidentally, if you do Want to keep the tax down 1 would recommend you next time you are buying a tipper to consider the of an aluminium alloy. body. That would effect a great saving in cost.

"You see the only difference, as far as standing charges are concerned, is the increase of Is. 6d. in the depreciation and 4d. in the interest. Now previously we got £9 18s. 6d. for the total of fixed costs, st.) that if we add Is. 10d. to that, we get £10 Os. 4d. as your standing charges for the tipper.

"If we divide that by 44 for the 44-hour week we get 4s. 61d., which we can call 4s. 7d. per hour for your actual cost. That is Id. more than the 4s. 6d. which we calculated for the lorry." "It hardly seems worth while bothering about," he said "Wait a minute," 1 said, "we are not there yet, in fact we have hardly begun. It is in the running costs that the big difference comes, for every item of running cost is greater as regards the tipper than it is for a lorry of the same capacity."

"Every one?" he said.

"Yes," I said, "every one. First of all you must remember that as a rule a tipping wagon has a tougher job to do than a lorry. It often has to go off the high roads into building sites, aerodrome grounds, quarries and so on. More often than not it has to tip its load when on soft ground with perhaps one wheel higher than the other so that the chassis is' being badly twisted. all the time. And then again, where do you pick up your loads? "

" Most of it,': he said, "is road stone and tarmacadam collected at a chute."

"Yes, I know those chutes," I said. "You get a couple of tons of stone dropped straight into the lorry from a height of about10 ft. 'Experienced operators have told me that the maintenance costs' of a tipper are anything from 25 to 50 per cent: more than on an ordinary lorry."

"Yes, I grant you that," he said, "but why should the fuel cost be higher?"

"There are two reasons why," I replied. "First of all the mere fact that the vehicle is so often off main roads and in difficult situations means that it has to do a lot of low gear work and that is a very important factor in increasing fuel consumption per mile.

"Secondly, you use the engine power for driving the tipping gear and all the time the engine is running it is using petrol. Now it may not use a great deal while it is doing that, but you must remember that the vehicle is not moving and a very small addition to the quantity of petrol used when the vehicle is stationary makes a good deal of difference to the fuel consumption per mile."

"Yes, perhaps you are right," he said, "but why do you keep on saying 'fuel consumption per mile'?"

"For the simple reason that that is the usual basis for costing, and indeed I cannot think of any other which would meet the case. With an industrial engine or a stationary engine you would take fuel consumption per hour but that is no good to you." " 1 see," he replied.

"The next item in the running costs is lubricating oil. Now it is a common experience that, other things being equal, this rises in almost exact proportion to petrol consumption, so that we can take it that there will he an increase on much the same lines, as the increase in petrol consumption.

"Next," I said, " we come to tyres. The necessity of corning off the road and going into quarries and into the yards where you collect your tarmacadam and road stone means that the tyres get badly cut up, and I know for a fact that tyre cost is considerably greater in the case of a tipper than it is on a lorry.

" Indeed, 1 know of several operators who make a habit of putting cheap tyres on their tippers. The idea they appear to have is that whether you put a good tyre on or a cheap tyrc it makes no difference because it is not so much wear as actual damage due to bad surfaces, that is the trouble, and an expensive or what I would prefer to call a good-class tyre, does not in the experience of these men give any better results..

" Whether that is so or not I would not like to say. There are differences of opinion. But you can take it that instead of 16,000 miles per set, which was what we reckoned as regards the lorry, you will get only somewhere about 12,090 or 13,000 miles, Now let's see what we have for running costs compared with the other figures. Previously we had 2.55d. per mile for petrol: for your tipper you should take 2.80d. For oil, previously we had 0,10d.: this time we will take 0.1 Id. Tyres previously were ;Id. per mile, now we will take 0.93d. For maintenance, for which we took 1.10d. in the case of the lorry, I am going to add 30 to 331 per cent, which brings it to 1.4'3d. " Adding those up we get 5.27d. per mile as opposed to 4.50d.

"Previously, we took five miles at 40. which is Is. 100., then we added our standing charges of 4s. 6d. which gave us a total of 6s. 40. Adding 20 per cent. profit to that means adding Is. 30., giving a figure of 7s. 8d. as the charge per hour.

"Now similarly with this tipper, instead of 4s. 6d. for standing charges we have 4s. 7d., instead of 40. per mile we have 5.27d. and five times that is 20., giving as a total cost of 6s. 90. Twenty per cent. of that is is. 40. which means that you must charge 8s. 2d. an hour for your tipper as compared with 7s. 8d. for the lorry. You should charge 60. per mile for excess mileage over and above five per hour which is the basis of the costing." Realizing that there are many operators who are interested in this problem of charges for lorries and tippers on municipal and similar work, I have drawn up the accompanying tables which give the details for vehicles of capacity from 2 tons to 7-8 tons inclusive.

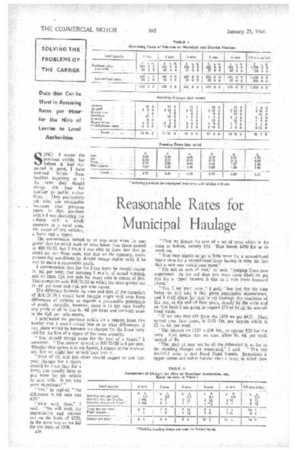

The method of calculation is the same as that described in this and the previous article. Table I shows details of cost relative to lorries. In Table II those costs are summarized so as to give cost per hour, cost per mile, a profit of 20 per cent. and a rate per hour on the assumption that the mileage per hour is five.

Tables III and IV give corresponding figures for tippers and it is important to note that all the data refer to vehicles operated in a Grade I Area or transferred thereto from a Grade II Area. SIR.