WONDERFUEL LPG IN THE DOLDRUMS

Page 54

Page 55

Page 56

If you've noticed an error in this article please click here to report it so we can fix it.

LPG may be cheaper than conventional fuels, but sound economic arguments are needed to convince operators to convert to it. So far, government policy has done little to stimulate demand, as Brian Weatherley reports

AS A PRACTICAL alternative to petrol or diesel, Liquefied Petroleum Gas or LPG as it is most commonly known has never achieved its full potential in the UK. Its success, or rather lack of it, has been governed less by its own inherent qualities than by economic forces.

LPG is basically a range of hydrocarbon gases produced in liquid form, either from natural gas or during the refining of crude oil. When it was first offered in Britain in 1971 it was r subject to excise duty. Not surprisingl many equipment manufacturers and vehicle converters geared themselves u for a massive sales boom off the back cheap LPG. However, in 1973 the Chancellor of the Exchequer placed an excise duty on it equivalent to half tha levied on petrol.

Although LPG was still cheaper thai petrol, its price advantage was suddeni less attractive. It was not until the late Seventies, following the second world oil crisis, that the rocketing price of petrol refocussed attention on LPG.

Six years on the subsequent collapse of oil prices has once again closed the all-important price gap between petrol and LPG. Significantly, during this period the price of LPG has not fallen by a corresponding level. The industry is now in the doldrums, according to Geoff Sholl, sales manager for 1-IKL G Power the biggest supplier of LPG Gas Carburation equipment in Britain.

Of the total UK automotive market. Sholl estimates that less than 0.2 per cent, or 36,000 vehicles (mainly cars at vans), are currently running on LPG figure he readily accepts as "miniscule' However, Shull feels that Britain ha done little to aid the development of tl LPG market unlike on the Continen where reduced tax on the fuel or vehicles using it has provided a stimulus. "Britain is the only country i Europe to show no inclination to go tc gas."

So what are the advantages of LPG? Despite the reduced price gap between petrol and LPG, bulk buyers can still save a significant amount of their fuel bills by using LPG.

On Budget Day (last Tuesday) the duty on a litre of petrol was raised to 19.5p compared with the 9.7 p levied on a litre of LPG. The average price of litre four-star petrol is 39.8p, while a litre of LPG (bought on one of the few fore.courts that actually stocks it) is nos around 33p.

WITH the environmental spotlight shilling with increasing strength on exhaust nissions, it is worth remembering that PG-powered engines are much cleaner arning. They produce up to 10 times ss carbon monoxide than petrol, while ydrocarbons and nitrous oxides are ftween 20 to 30 per cent less.

Unlike petrol, LPG contains no lead Iditives. As it remains a gas down to 40°C, it gives excellent cold engine ailing: unlike with petrol, no ivapourised fuel is introduced into the dinders to wash away the oil film in ie cylinders and increase top-end and ston ring wear when starting from )Id.

While the idea of carrying around a 7essurised LPG gas tank may not Teal to every operator, it does have le advantage. Being sealed, it iminates the risk of evaporation and. Lore importantly, theft.

Further, as there is less pollution of Le engine oil, the oil change interval on PG engines is usually longer than on :trol units, thereby saving money on Iters and, because of its cleaner inning, on spark plugs.

There are drawbacks, however.

iwing to its lower calorific values, LPG gives a reduced power output of around eight per cent at wide-open throttle compared with an equivalent petrol engine. Turbocharging can, however, overcome this power loss.

Switching to LPG also increases an engine's fuel consumption by some 15 per cent, although buying it at a cheaper rate should even this out.

While it is possible to run an LPG engine using the same ignition riming setting as a petrol unit, the lack of lead in LPG causes its own problems. In a conventional petrol engine, the lead additives in the fuel form an oxide layer around the exhaust valve seats which has a cushioning effect between the valve and seat.

In the LPG engine, however, the lack of lead and the protective layer it forms can cause valve-seat recession and, ultimately, burnt exhaust valves.

HKL director Hedley Hewitt agrees that LPG can aggravate certain engines, but he is confident that the valve problems encountered in some early LPG-powered engines are "on the way out, as more and more petrol engines are being designed to run on unleaded fuel right from the start and are fitted with hardened valve seats as standard."

For LPG operators that do have valve

problems. HKL supplies special valve inserts, although Hewitt recommends that anyone thinking of changing over to LPG should consider the kind of engine that will have to use the new fuel.

In particular, he suggests that all Ford petrol engines intended for use with LPG should be specified with Ford's own induction-hardened cylinder head.

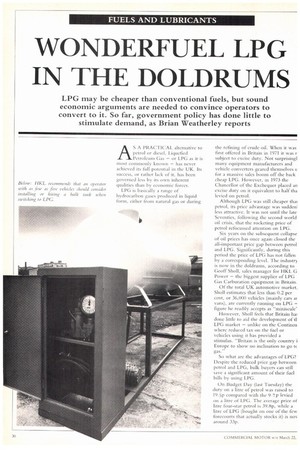

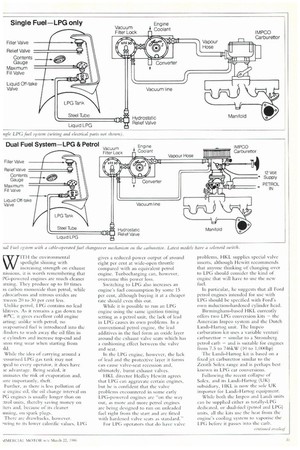

Birmingham-based HKL currently offers two LPG conversion kits — the American linpco system and the Dutch Landi-Hartog unit. The Impco carburation kit uses a variable venturi carburettor — similar to a Stromberg petrol carb — and is suitable for engines from 7.5 to 746kW (10 to 1,000hp) The Landi-Hartog kit is based on a fixed jet carburettor similar to the Zenith Solex range and is perhaps best known in LPG car conversions.

Following the recent collapse of Solex, and its Landi-Hartog (UK) subsidiary, IIKL is now the sole UK importer for Landi-Hartog equipment.

While both the limpet) and Landi units can he supplied either as totally-LPG dedicated, or dual-Mel (petrol and LPG) units, all the kits use the heat from the engine's cooling system to vaporise the 1.PG before it passes into the carb.

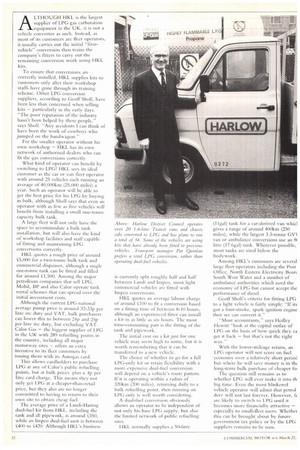

A[THOUGH HKL is the largest ,upplier of LPG gas carburation equipment in the UK, it is not a vehicle convertor as such. Instead, as most of its customers are fleet operators, it usually carries out the initial "firstvehicle" conversion then trains the company's fitters to carry out the remaining conversion work using HKL kits.

To ensure that conversions are correctly installed, HKL supplies kits to customers only after their workshop staffs have gone through its training scheme. Other LPG conversion suppliers, according to Geoff Sholl, have been less than concerned when selling kits — particularly in the early days. "The poor reputation of the industry hasn't been helped by these people," says Sholl. "Any accidents I can think of have been the work of cowboys who jumped on the bandwagon."

For the smaller operator without his own workshop — HKL has its own network of authorised dealers who can fit the gas conversions correctly.

What kind of operator can benefit by switching to LPG? HKL sees its ideal customer as the car or van fleet operator with around 25 vehicles each running an average of 40,000km (25,000 miles) a year. Such an operator will be able to get the best price for his LPG by buying in bulk, although Sholl says that even an operator with as few as five vehicles will benefit from installing a small one-tonne capacity bulk tank.

A large fleet will not only have the space to accommodate a bulk tank installation, but will also have the kind of workshop facilities and staff capable of fitting and maintaining LPG conversions correctly.

HKL quotes a rough price of around £5,000 for a two-tonne bulk tank and commercial dispenser, although a single one-tonne tank can be fitted and filled for around £1,500. Among the major petroleum companies that sell LPG. Mobil, BP and also Calor operate tank rental schemes that can spread over the initial investment costs.

Although the current LPG national average pump price is around 32-33p per litre inc duty and VAT, bulk purchasers can lower this to between 24p and 25p per litre inc duty, but excluding VAT. Calor Gas — the biggest supplier of LPG in the UK with 289 refuelling points in the country, including all major motorway sites — offers an extra incentive to its fleet customers by issuing them with its Autogas card.

This allows cardholders to purchase LPG at any of Calor's public refuelling points, but at bulk prices plus a 4p per litre card charge. This means they not only get LPG at a cheaper-than-retail price, but they also are no longer committed to having to return to their own site to obtain cheap fuel.

The average price of a Landi-Hartog dual-fuel kit from HKL, including the tank and all pipework, is around 050, while an Impco dual-fuel unit is between £4(X) to £420. Although HKL's business is currently split roughly half and half between Landi and Impco, most light commercial vehicles are fitted with Impco conversions.

HKL quotes an average labour charge of around C100 to tit a conversion based on a fitting time of between 8-10 hours, although an experienced titter can install a kit in as little as six hours. The most time-consuming part is the fitting of the tank and pipework.

The initial cost on a kit just for one vehicle may seem high to some, but it is worth remembering that it can be transferred to a new vehicle.

The choice of whether to go for a full LPG-only kit or retain flexibility with a more expensive dual-fuel conversion will depend on a vehicle's route pattern. If it is operating within a radius of 320km (200 miles), returning daily to a bulk refuelling point, then running on 1.PG only is well worth considering.

A dual-fuel conversion obviously allows an op-erator to be independent of not only his base [PG supply, but also the limited network of public refuelling sites.

HKL normally supplies a 50-litre (1Igal) tank for a car-derived van whiel gives a range of around 400km (250 miles). while the largest 3.5-tonne GVN van or ambulance conversions use an 81 litre (17.6gal) tank. Wherever possible, most tanks are sited below the bodywork.

Among HKL's customers are several large fleet operators including the Post Office, North Eastern Electricity Boar( South West Water and a number of ambulance authorities which need the economy of LPG but cannot accept the performance of diesel, Geoff Sholl's criteria for fitting LPG to a light vehicle is fairly simple: "If its got a four-stroke, spark ignition engine then we can convert it."

"Most accountants." says Hedley Hewitt "look at the capital outlay of LPG on the basis of how quick they ca get it back — but that's not the right y. "

With the lower-mileage return, an LPG operator will not score on fuel economy over a relatively short period but where he will save money is in th( long-term bulk purchase of cheaper fir.

The question still remains as to whether LPG will ever make it into th big time. Even the most blinkered vehicle operator will admit that petrol dery will not last forever. However, it are likely to switch to LPG until it becomes more financially attractive — especially to small-fleet users. Whether this can be brought about by future government tax policy or by the LPG suppliers remains to be seen.