Budget ups dery tax but freezes VED

Page 3

If you've noticed an error in this article please click here to report it so we can fix it.

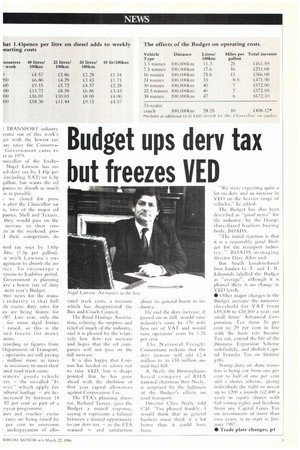

TRANSPORT industry come out of this week's ;et with the lowest tax .ase since the ConservaGovernment came to Cr in 1979.

lancellor of the ExcheNigel Lawson has Maxi dery tax by 1.43p per (including VAT) or 6.5p gallon, but wants the oil panics to absorb as much is as possible.

; we closed for press s after the Chancellor sat n, two of the major oil panics, Shell and Texaco, they would pass on the increase to their cus:Ts at the weekend, pro3 their competitors do irol tax rises by 1.65p litre (7.5p per gallon), in with Lawson's enagement to absorb the inises. To encourage a ,ersion to lead-free petrol. Government is planning avc a lower rate of duty next year's Budget.

:tter news for the trans

industry is that full de excise duty rates for es are being frozen for ,/87. Last year, only the

for some rigid lorries raised, so this is the 3nd freeze for many ators.

:cording to figures from Department of Transport, operators are still paying million more in taxes is necessary to meet their

• ated road track costs. 'rulers' goods vehicle ices the so-called "Faceswhich apply for :ultural haulage are beincreased by between 14 52 per cent as part of a .-year programme.

JSCS and coaches excise

• rates are being raised by per cent to overcome

• underpayment of all-'

cated track costs, a measure which has disappointed the Bus and Coach Council.

The Road 1 laulage Association, echoing the surprise and relief of much of the industry, said it is pleased by the relatively low dery tax increase and hopes that the oil companies will not pass on the full increase.

It is also happy that Lawson has heeded its advice not to raise VED, but is disappointed that he has gone ahead with the abolition of first year capital allowances against Corporation Tax.

The PTA's planning director, Richard Turner, gave the Budget a muted response, saying it represents a balance between a missed opportunity to cut dery tax as the ETA wanted and satisfaction about its general boost to industry.

I le said the dery increase, if passed on in full, would raise industry's costs by £70 million net of VAT and would raise Operators' costs by 1.25 per cent.

The National Freight Consortium reckons that the dery increase will add 112.4 million to its s:55 million annual fuel bill.

A. Neely, the Birminghambased company of RHA national chairman Bert Neely, is surprised by the lightness of the Budget's efic:cts on road transport.

Director Clive Neely told CM: "I'm pleased frankly. I would think that in general hauliers must think it a lot better than it could have been,

"We were expecting quite a lot on dery and an increase in VED on the heavier range of vehicles.he added.

The Budget has also been described as "good news" for the industry, by the Hampshire-based hauliers buying body. ROADS.

"The initial reaction is that it is a reasonably good Budget for the transport industry,ROADS managing director Dave Allen said.

But South London-based fruit haulier G. T. and T. R. Edmunds labelled the Budget as "average'', although it is pleased there is no change in VED levels.

• Other major changes in the Budget increase the turnover threshold for VAT from £19,500 to £20,500 a year, cut small firms,' Advanced Corporation Tax from 30 per cent to 29 per cent in line with the basic rate Income Tax cut, extend the life of the Business Expansion Scheme indefinitely. and abolish Capital Transfer Tax on lifetime gifts.

Stamp duty on share transfers is being cut from one per cent to half of one per cent and a shares scheme, giving individuals the right to invest up to £200 a month (£2,400 a year) in equity shares with full voting rights and freedom from any Capital Gains Tax on investments of more than two years, is to start in January 1987.

• Trade plate changes, p4