Lease of life in credit squeeze

Page 71

Page 72

If you've noticed an error in this article please click here to report it so we can fix it.

Brian Chalmers-Hunt. visits Crane Fruehauf Finance and finds out how a fully integrateçl financial specialist can help to make life that much easier for 'Orward-planning hauliers

ICENT YEARS have seen one the toughest trading periods er for the road haulage inIstry and astute transport inagers can see even more oblems on the horizon.

For example, harmonisation th the EEC will certainly be a iallenge. The eight-hour EEC iving day leading to higher sts and the fitment of tachoaphs causes enough worry; en there is the EEC's proposal tax lorries by axle weight ther than unladen weight, lich could cause another amatic jump in excise duty for e heavier vehicle.

Those hauliers still in busiiss today have survived one of e largest and toughest recesans and even though there lye been failures, the worst is )bably over. This year is unLeis/ to be a year for rejoicing, ough. What is needed now is a :althy increase in industrial :tivity to put a smile back on e haulier's face.

One of the industry's great rengths in these difficult years that there is a great number businesses with only a few thicles so that vehicle operaon can be flexible and resansive to changes. However, ie average haulage business is ?,coming larger and of course rries are getting bigger.

Specialisation in the freight iovement market has become icreasingly pronounced among rger hauliers who have tended move away from traditional roupage or casual work.

The days when the smaller aerator could obtain a vehicle n hire purchase and then go ut to ply for hire are gone, not only because of the growir 'sophistication of the market b also the deluge of rules ar regulations which now surrout the haulier.

The increase in use of artic lated lorries is demonstrated I the rise in trailer sales. Thr years ago UK production i creased by almost 50 per ce over the previous year 17,177 units.

Crane Fruehauf has su gested that approximately f per cent of trailer purchases a financed by third parties thoul the figure could well be high, Of these CF estimates that hall acquired by leasing camper with about 20 per cent to years ago. CF has over 5,0( trailers out on lease contracts.

Trailers are an ideal subje for a lease contract because th have a long life and maini nance costs are relatively la They are usually easy to dispo of at the end of the lease peric unless they are specially bodie and secondhand values hold well.

When considering buying trailer there are four possibilities. Cash purchase is not ideal now that a basic flat-bed unit costs around E5,200.

More sophisticated trailers such as reefers cost more than E20,000, making it an expensive acquisition. Most buyers usually ask the bank for money. Those who prefer not to buy outright via a bank loan can use hire purchase, leasing or contract hire.

Many equipment manufacturers can arrange finance for their customers but not many have their own finance subsidiaries, as does Crane Fruehauf. CF's wholly owned subsidiary Crane Fruehauf Finance was set up six years ago and is intended to provide finance to CF customers. Its turnover from over 500 customers ranging from owner-drivers to major national companies is more than E6m a year.

It offers straightforward hire purchase or leasing, but the main aim is to tailor finance packages to the individual's requirements. Representatives are normal product salesmen from Crane Fruehauf, who pass details on to the finance company for further discussion.

Crane Fruehauf Finance specialises in transport and is able to offer flexible terms and a speedy answer. In many instances a customer has requested a straightforward hire-purchase but has been recommended a different approach better suited to his needs.

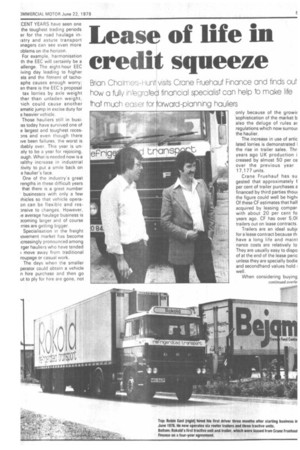

One customer who benefitted is Robin East. In June 1976 he started his own company, Rokold Refrigerated Transport, and was introduced to Crane Fruehauf Finance by the dealer from whom he was acquiring his first tractive unit and trailer.

Initially he wanted to buy a DAF 2800 DKS unit and lease the trailer, but on CF's advice decided on a four-year leasing contract for the outfit.

Robin says he got useful advice from his accountant, bank manager and CF representatives. Now, after three years, he has just taken delivery of a new E28,000 DAF 2800 and 12-metre CF reefer unit on lease from CF. This brings the fleet to a total of six reefer trailers and three tractive units financed either by either hire purchase or lease contract. They carry temperature-controlled goods throughout Western Europe.

The help he got from CF advisers enabled him to launch his own business with virtually no capital and get him to the financially strong position that he enjoys today, he told us.

Eric Ball, managing director of Cavell European Ltd, Jersey, started business three years ago with his present engineering director Philip Randle. He leased his first 12-metre tilt trailer from Crane Fruefauf Finance several weeks after starting business.

The first tractive unit was a Mercedes 1626 bought through a big-name international finance company. But Mr Ball was unhappy about terms and terminated the agreement after two years. Since then, all finance has been arranged through CF Finance.

Because Mr Ball's company is registered in Jersey, it is more advantageous from the tax point of view to lease than pay cash or hire-purchase. So CF Finance leases him his complete fleet but permits him to sell vehicles at the end of the agreement.

Cavell European Ltd has 10 trailers and five tractive units operating between the UK, France, Spain and Portugal mainly on contract work.

When asked, Mr Ball said his company was using CF Finance because it meant he could call on any part of the organisation for advice. It also safeguarded him for his spare parts requirements which, if not readily available, could keep a unit off the road for weeks.

Forward planning has become increasingly complex as demands on hauliers become more diverse, so a company such as Crane Fruehauf Finance can help take some' of the weight off.

Some operators are beginning to use a mixture of leasing, hire-purchase and outright purchase. For the more modest fleet, leasing has become an established pattern of financial life. The main reason is that it is almost impossible for a small operator to evaluate his fleet properly and therefore make t right management decisions.

For the large and diver fleet, a specialist vehicle leasi company is in a far better pc tion to discuss the mileage life a particular vehicle and asse depreciation against maini nance costs.

Transport executives also t leasing to replace or acqu more vehicles on credit with( calling upon the compam bank manager. With interi rates increasing once again a the cost of new money in t forefront of the company sec tary's mind, leasing must ni be an accepted way of life — a 1978 was a record year 1 leasers.

When I asked Hugh O'Ne general manager, Crane Frt hauf Finance Ltd, why ma more operators were seeking I company's assistance, he tc me it was because his comf ny's representatives were E perienced in transport and better able to advise a prospE tive client and tailor produce

financial package to suit. Hc can one person ta

authoritatively about °Hi, equipment one minute ar commercial vehicle operatic the next?