Charges for Private-hire Coaches

Page 55

If you've noticed an error in this article please click here to report it so we can fix it.

likely that the figures in the publication to which you refer will be accepted as necessarily

A T a meeting of bus operators held recently in this " area, the question arose as to what was now an economical pence-per-mile basis to operate for private hire. Various rates were quoted, and as there is to be another meeting on the subject I would be glad if you could assist us with the costs which you think would form an economical basis.

The vehicles concerned would be 29-seater petrol and 32-seater six-cylindered oil-engine coaches doing, say, 18,000 to 25,000 miles per season.

Durham. J.S.

[According to my calculations, you should adjust your rate on a time-and-mileage basis of 10s. 6d. per hour plus 9d. per mile. Alternatively, you might take an all-in charge of ls. 9d. per mile. I do not think the latter method of assessing rates cart properly be applied to private hire, because there is so often a large amount of waiting time which would not be properly covered by a plain mileage charge. These figures are derived from the following data: Standing charges, . including licence, wages, rent and rates, insurance,' . interest, part depreciation and overheads, a total of L19 per week, to which I have added a profit margin of £4 per week, making a total of £23 per week for your fixed charges. The running cost of 9d. per mile takes into account fuel, lubricants, tyres, at present-day prices, maintenance and part depreciation, plus again a 25 per cent. profit margin.—S.T.R.]

A "LOSS OF USE" CLAIM

WE are in course of preparing a "loss of use" claim " for submission to our solicitors in respect of one of our vehicles. 10 assist us in our claith we are referring to your fine publication "The Commercial Motor" Tables of Operating Costs (39th edition, 1950-51). We are, however, experiencing some difficulty in linking up "standing charges and running costs" with "hauliers figures (charges)."

We would be very grateful if you would kindly confirm that the latter charges include the profit element, and if so, approximately what percentage of profit should we include in our claim, as the rates in some of the examples shown appear to vary. General overhead expenses, such as office and administration, are, we presume, completely ignored in your tables.

For your information, the vehicle concerned is a 7-ton petrol vehicle doing approximately 228 miles per week.

Your assistance in clarifying the matter of overheads and the profit element will be much appreciated.

Wolverhampton. G.C.P.

[There .is provision in the " Hauliers Figures (Charges)" for both administration charges and profit. The former are necessarily an assumed amount that is based on experience of average figures; the latter is at the rate of 20 per cent. on the operating cost, plus administration charges. Thus, in the figures for the total operating cost per week relating to a 7-8-tonner travelling 300 miles per week, the cost is given at £21 85. Add £5 for administrative expenses and we get £26 8s. Twenty per cent, of that is £5 6s., which gives the total figure of E31 14s., appearing under the corresponding heading in ':Hauliers Figures (Charges)." I would warn you that if your case goes to court you will be expected to produce actual figures for the cost both of operating the vehicle and for administration; it is not

LOW RATES FOR TIPPING WORK

I HAVE been in road transport since 1919, but as my 1 business has been nationalized I am now interesting myself in tipping work on contract licence and would be greatly obliged if you could guide me as to costing.

The rates paid seem to me very low and I would appreciate your opinion of them, together with if possible) your idea of costing on this class of work. The wagons used are W.D. Austin six-wheelers converted to four-wheelers (quite a sound job) carrying 8 tons with a petrol consumption equivalent to 9 m.p.g.

The rate paid to me is 5s. per ton, and the wagons have to travel 18 miles to start work, do four loads (a round trip each of 30 miles), and travel back to the depot. a total mileage of 156, and a total earning of £8. According to my idea of costing, based on long experience of general haulage, I think this is below cost.

Needless to say, I have been a reader of your journal for more years than care to think about and have often had help in various ways from you.

St. Helens. ANXIOUS.

[In my opinion you are not getting anything like enough for the use of the vehicle you specify in your letter. You should obtain at least Is. 4d. per mile, which is £10 8s. 8d. per week, and is the equivalent of 6s. 6d. per ton.—S.T.R.1

THE MAN-HOURS IN FLEET . MAINTENANCE

I AM particularly interested in the footnote by S.T.R. I to a letter, "What Maintenance Staff is Required," under "Opinions and Queries" in your issue dated May 25. I feel that information would be of great benefit to many of your readers.

I agree with S.T.R. that it is always difficult to assess labour requirements, as they depend entirely on the type of vehicle, nature of work performed and the mileage involved.

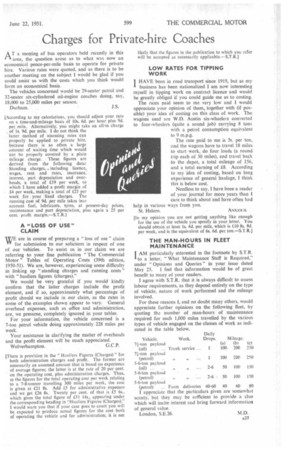

For these reasons I, and no doubt many others, would appreciate further opinions on the following fleet, by quoting the number of man-hours of maintenance required for each 1,000 miles travelled by the various types of vehicle engaged on the classes of work as indicated in the table below.