Hauliers take note: they've got you covered

Page 36

Page 37

If you've noticed an error in this article please click here to report it so we can fix it.

If you're unlucky enough to get into wrangles with the law, costs can be crippling. A legal expenses insurance package could be the answer, and here we take a close look at one specially designed for the operator and driver

IMERCIAL vehicle drivers ating in foreign countries naturally less familiar with c conditions and regulaand can be very vulnerable e exigencies of foreign law. :ere are countries in Europe re a driver, if he is involved serious road accident, can himself in prison even :gh he is totally innocent of offence. His ordinary vehicle rance is unlikely to help him ese circumstances.

) legal expenses insurance is obviously very imporfor international freight drivand owner-drivers. A corniy such as DAS Legal anses Insurance for example a policy with sections jfically designed to help ers in difficulty.

addition to independent 'ars, DAS has its own network 38 offices in 11 countries .ughout Europe who can be ad upon to assist drivers in difficulty with the law. The policies provide bail bonds to release drivers imprisoned following an accident and also ensure that they have expert legal representation in and out of court.

Similar protection is available for owners to obtain release of vehicles which otherwise could be impounded by the authorities for weeks, even months, after an accident.

If a third party is wholly or partly to blame for an accident to the vehicle, the owner has the right to claim damages for loss of use, as well as the cost of repairs, which may not be covered, or only partly covered, by his motor insurance policy.

Drivers themselves can be seriously injured or suffer damage to their personal property in a road accident through the fault of others, but unless they can prove this, they will be unable to recover damages from the negligent party.

Proving the negligence of others, particularly overseas, can be time-consuming, expensive and even impossible to achieve unless experienced onthe-spot assistance is readily available. The same can often be true when an innocent driver is trying to prove his innocence, without legal assistance.

These hazards, for the most part, are not covered by standard forms of motor insurance policy and they are risks which the legal expenses insurance contract is designed to cover.

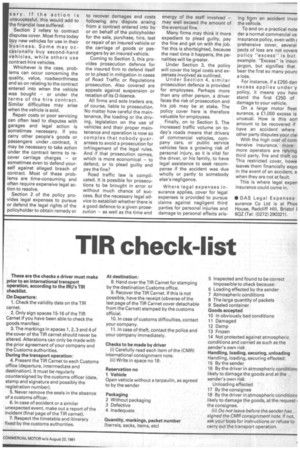

New insurance package DAS has recently introduced a new legal expenses insurance package for operators and drivers, writes Jahn C. Vann.

Basically, the policy again coy ers legal expenses and provides for the legal costs involved in the pursuit or defence of the policyholder's legal rights in or out of court.

Said Tony Holdsworth, general manager of DAS: "We provide the financial muscle to allow the policyholder to pursue claims fully and defend himself and his employees without the worry of potentially high costs of litigation."

Called the DAS Motor Legal Protection Policy, the new contract is in five optional sections, which can be taken singly or in combination.

Section 1 relates to accident loss recovery. Here, DAS will pursue claims for recovery of repair costs, policy excess, hire charges, loss of use or other similarly uninsured losses arising from an accident.

Suppose your lorry is damaged in a motor accident. It will take time to repair and you could be faced with a substantial hire charge. You would have to pay the repair costs if your policy covered third party, fire and theft risks only.

Also, even if your cover was comprehensive, a damage excess might well apply, resulting in your having to pay the first so many pounds of any damage to your lorry.

If the accident was caused wholly or partly by another party, you have a right of action to recover damages; but the cost and effort necessary to pursue this right might put you off and you may decide to take no action."

Of course, if you use an insurance broker, he may be willing to assist in recovering your hire damages or your policy excess. But you could be involved in legal costs when liability is disputed — which it often is — and a solicitor becomes neces sary. If the action is unsuccessful, this would add to the financial loss suffered.

Section 2 refers to contract disputes cover. Most firms today buy new vehicles for use in their business. Some may occasionally buy second-hand vehicles, while others use contract-hire vehicles.

Whichever is the case, problems can occur concerning the quality, value, roadworthiness and so on relating to the contract entered into when the vehicle was bought — or under the terms of the hire contract. Similar difficulties may arise when the vehicle is sold.

Repair costs or poor servicing can often lead to disputes with garages and legal action is sometimes necessary. If you carry other people's goods or passengers under . contract, it may be necessary to take action under the contract terms to recover carriage charges — or sometimes even tb defend yourself against alleged breach of contract. Most of these problems are time-consuming and often require expensive legal action to resolve.

Section 2 of the policy provides legal expenses to pursue or defend the legal rights of the policyholder to obtain remedy or to recover damages and costs following any dispute arising from a contract entered into by or on behalf of the policyholder for the sale, purchase, hire, test or repair of an insured vehicle or the carriage of goods or passengers by an insured vehicle.

Coming to Section 3, this provides prosecution defence for the insured firm to defend itself or to plead in mitigation in cases of Road Traffic or Regulations prosecution. Also covered are appeals against suspension or recati on of its 0-licence.

All firms and sole traders are, of course, liable to prosecution. No matter how careful the maintenance, the loading or the driving, legislation on the use of vehicles and their proper maintenance and operation is now so complex that nobody guarantees to avoid a prosecution for infringement of the legal rules. And if that prosecution comes, which is more economical — to defend, or to plead guilty and pay the fine?

Road traffic law is complicated. It is possible for prosecutions to be brought in error or without much chance of success. But the necessary legal advice to establish whether there is a good defence to a given prosecution — as well as the time and energy of the staff involved — may well exceed the amount of the eventual fine.

Many firms may think it more expedient to plead guilty, pay the fine and get on with the job. Yet this is shortsighted, because the next time it happens, the penalities will be greater.

Under Section 3, the policy will cover the legal costs and expenses involved as outlined.

Under Section 4, similar prosecution defence is provided for employees. Perhaps more than any other person, a driver faces the risk of prosecution and his job may be at stake. The policy cover here is therefore valuable for employees.

Finally, on to Section 5. The increased traffic volume on today's roads means that drivers of commercial vehicles, company cars, or public service vehicles face a growing risk of personal injury, so it is vital for the driver, or his family, to have legal assistance to seek recompense if the accident was due wholly or partly to somebody else's negligence.

Where legal expenses insurance applies, cover for legal expenses is provided to pursue claims against negligent third parties for personal injuries and damage to personal effects aris

ing from an accident invol the vehicle.

To end on a practical note der a normal commercial ve insurance policy, even with prehensive cover, several pects of loss are not covere policy "excess" is but example. "Excess" is insuri jargon, but signifies that bear the first so many pounc a loss.

For instance, if a £250 danexcess applies under y policy, it means you hayf stand the first £250 of damage to your vehicle.

On a large motor fleet surance, a £1,000 excess is unusual. How is this sod amount to be recovered if have an accident where other party disputes your clai With the high cost of corn hensive insurance, more more operators are relying third party, fire and theft co This restricted cover, howe leaves them financially expo in the event of an accident, e when they are not at fault.

This is where legal expen insurance could come in.

• DAS Legal Expenses surance Co Ltd is at PhoE House, Redcliff Hill, Bristol I 6QZ (Tel: (0272) 290321).