Solving the Problems of the Carrier

Page 58

Page 59

If you've noticed an error in this article please click here to report it so we can fix it.

IWONDER whether every reader of the previous article fully appreciated its significance, especially in one particular direction. The matter is so important that I propose to refer to it again now and probably in subsequent articles.

As the direct result of operating at uneconomic rates, a small haulier's business, on being put up for sale, proved to be worth only £50, when, before a close examination of the costs and revenues disclosed the fact that the rates were uneconomic, it appeared to be worth nearly £1,000. Rate-cutting reduced the value of that business from £1,000 to practically nothing.

A New Aspect of Assessment.

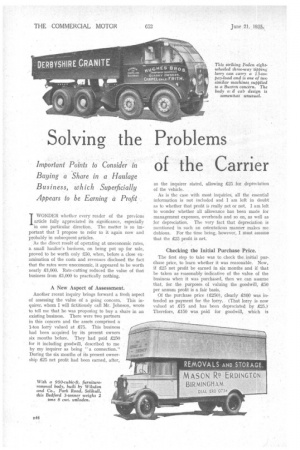

Another recent inquiry brings forward a fresh aspect of assessing the value of a going concern. This inquirer, whom I will fictitiously call Mr. Johnson, wrote to tell me that he was proposing to buy a share in an existing business. There were two partners in this concern and the assets comprised a 1-ton lorry valued at £75. This business had been acquired by its present owners six months before. They had paid £250 for it including goodwill, described to me by my inquirer as being " a connection."

During the six months of its present ownership £25 net profit had been earned, after, as the inquirer stated, allowing £25 for depreciation of the vehicle.

As is the case with most inquiries, all the essential information is not included and I am left in doubt as to whether that profit is really net or not. I am left to wonder whether all allowance has been made for management expenses, overheads and so on, as well as for depreciation. The very fact that depreciation is mentioned in such an ostentatious manner makes me dubious. For the time being, however, I Must assume that the £25 profit is net.

.Checking the Initial Purchase Price.

The first step to take was to check the initial purchase price, to learn whether it was reasonable. Now, if £25 net profit be earned in six months and if that be taken as reasonably indicative of the value of the business when it was purchased, then we can assume that, for the purposes of valuing the goodwill, £50 per annum profit is a fair basis.

Of the purchase price (£250), clearly £100 was intended as payment for the lorry. (That lorry is now valued at £75 and has been depreciated by £25.) Therefore, £150 was paid for goodwill, which is equivalent to three years' purchase, and, in all the circumstances, that figure' can be taken as perfectly reasonable. To-day, assuming that the goodwill is still the sa'rne, the total value is £225. I have advised the inquirer that if he be sure of the existence of 225 net profit when every expense has been allowed, he should pay £112 10s. for a third share.

Wages Included in the Net Profit.

Now suppose for the sake of argument—and it may be actual fact—that there is not £25 net profit available when all is paid. This may well be the case, for, as there are already two partners, one of whom presumably drives the Vehicle, while the other manages the business it is a moot point whether both have been paid reasonable wages before the profit is calcUlated.

if, as so often happens, they be operating on the principle That their wages are included in the net profits, -then a state of affairs. far different from the above exists,. Obviously, 2.25 for six months is quite insufficic,,nt to pay for the wages of a driver and a manager. Therefore, instead of the business earning £25 profit for six months, it is actually being run at a loss, and the conditions are thus similar to those disclosed in the previous article. , That is to say, ,there is no goodWill ; no profit at all is being-earned: The work upon which .the vehicle is engaged, is, from the point of view of profit earning, worthless, and,

if the vehicle is to be thrown upon the open market for sale; its value as an asset is probably about 220 to £25. In those circumstances my recommendation to the inquirer is that he should have nothing whatever to do with the proposition.

Here, again, the result of operating at uneconomic . rates has been to reduce the value of the business from approximately 2250, six months ago, to 220. My inquirer should, therefore, have the books relating to this business most carefully examined, having, in the course of that examination, the particular object of seeing that provision is made for every expense, not merely actual, but potential, as was described in the previous article. Another point arises out of this query. Mr. Johnson stated that, in the event of his investing in the business, it was proposed to purchase a new vehicle, a 3-tonner, for which 2400 was to be paid, the old vehicle being offered in part exchange.

The point that arises here is whether it is better to try to operate one large vehicle or two small ones. This is a question which can never be answered without knowing the conditions. In this case, supposing that the prospective deal goes through, there will be three working partners. If there is to be only one vehicle between the three of them, there will not be sufficient work available to keep them all actively engaged.

Better Profits from Two Vehicles.

On the other hand, with two small vehicles, instead of the one large one, it is often possible to earn a better dividend. Two clients can be served at once with two vehicles, whilst if a load be offered which is rather in excess of, shall I say, the extended capacity of either machine, the two can generally carry it at little more cost than that of the one larger machine.

In this connection, I may mention that I have often found it to be the case that if a large and a small vehicle be owned, the proprietor is inclined to the opinion that the small one keeps the large one. Only the other day I met such an operator, who told me that he had a Homier and a 4-tonner. He was able, he said, to keep the little machine on the road all day and every day with a paying load, whilst often enough he had the big one lying idle.

In the next issue I propose to deal with the problems of the agricultural haulier, and to quote costs and rates in relation to the transport of such loads as hops, sugar-beet, straw, hay, cattle and sheep. S.T.R.