CM operating cost assessment: Volvo F88

Page 43

If you've noticed an error in this article please click here to report it so we can fix it.

An artic compared at 32 and 38 tons gcw

IN CONSIDERING the operation of a 38-ton-capacity unit of this type even at the present permissible gross weight of 32 tonsit should not be overlooked that there are cost penalties to be met.

Two cost comparisons should be made; one is a comparison between the average 32-ton-gross unit and the potential 38-ton unit operated at 32 tons. The other comparison to be made is between the average unit and the 38-ton vehicle at maximum capacity.

If the average unit it assumed to be represented by the figures shown in CM Tables of Operating Costs, then the following cost factor by cost factor comparisons can be made.

If the potential 38-ton vehicle is preferred, there will be an increase in road tax in the region of £54 a year or £1.20 a week on the basis of 45 week maximum use each year. The unladen weight of the F88 unit is 6 tons Ilcwt and that of the trailer 4 tons 5cwt a total of 10 tons 16cwt. That 16cwt is unfortunate as the odd hundredweight adds an extra £13.50 a year to the road fund licence.

Had the total unladen weight been 10 tons 15cwt then the annual difference between this outfit and the average would have been £41.50less than 1 a week.

Such standing cost factors as wages, rent and rates and insurance are imponderables and these are unlikely to be affected by the choice of vehicle. They can, therefore, be assumed to be common to the operation of both units. Interest will, however, be affected.

To make the comparison more fair, the interest factor in the Cost Tables has been enhanced by two increments of 9 per cent to represent the average increases imposed by the manufacturers in July and December, last year. This gives a weekly interest figure of £35.55 a week.

The cost of the F88 unit is given as £12,489 and assuming a trailer cost of about £2,000 the total cost has been estimated at £14,500. At the annual rate of interest of 12 per cent taken in the Cost Tables, this would give a weekly interest cost for the F88 of £38.66 an increase of £3.11 a week.

Moving on to running costs, the additional penalty of running a 38-tongross weight Unit at full becomes more apparent in the fuel cost. At 32 tons gross, the unit returns a fuel consumption of 6.5mpg or 7.15p a mile compared with the 7mpg or 6.64p a mile shown in the Tables. At 38 tons gross, the comparison is even more marked for the consumption was down to 5.8mpg or up to 8.02p a mile.

Lubricants, tyres and maintenance can be said to be common to both the average and the comparative vehicle.

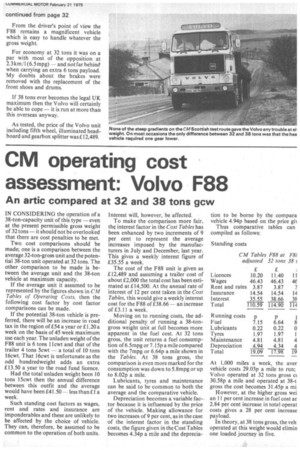

Depreciation becomes a variable factor because it is influenced by the price of the vehicle. Making allowance for two increases of 9 per cent, as in the case of the interest factor in the standing costs, the figure given in the Cost Tables becomes 4.34p a mile and the deprecia tion to be borne by the compara vehicle 4.94p based on the price gi Thus comparative tables can compiled as follows: At 1,000 miles a week, the aver vehicle costs 29.03p a mile to run; Volvo operated at 32 tons gross cc 30.58p a mile and operated at 38-t gross the cost becomes 31.45p a mi However, at the higher gross wei an 11 per cent increase in fuel cost at 2.84 per cent increase in total operat costs gives a 28 per cent increase payload.

In theory, at 38 tons gross, the veh operated at this weight would elimin one loaded journey in five.