GROUND CREW

Page 118

Page 119

If you've noticed an error in this article please click here to report it so we can fix it.

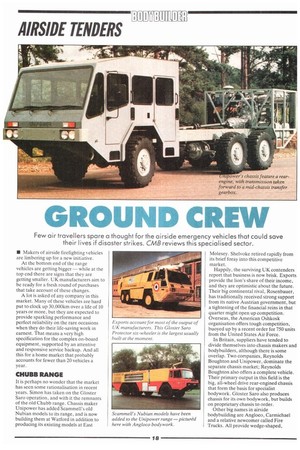

Few air travellers spare a thought for the airside emergency vehicles that could save their lives if disaster strikes. CMB reviews this specialised sector.

• Makers of airside firefighting vehicles are limbering up for a new initiative.

At the bottom end of the range vehicles are getting bigger— while at the top end there are signs that they are getting smaller. UK manufacturers aim to be ready for a fresh round of purchases that take account of these changes.

A lot is asked of any company in this market. Many of these vehicles are hard put to clock up 30,000km over a life of 10 years or more, but they are expected to provide sparkling performance and perfect reliability on the rare occasions when they do their life-saving work in earnest. That means a very high specification for the complex on-board equipment, supported by an attentive and responsive service backup. And all this for a home market that probably accounts for fewer than 20 vehicles a year.

CHUBB RANGE

It is perhaps no wonder that the market has seen some rationalisation in recent years. Simon has taken on the Gloster Saro operation, and with it the remnants of the old Chubb range. Chassis maker Unipower has added Scammell's old Nubian models to its range, and is now building them at Watford in addition to producing its existing models at East Molesey. Shelvoke retired rapidly from its brief foray into this competitive market.

Happily, the surviving UK contenders report that business is now brisk. Exports provide the lion's share of their income, and they are optimistic about the future. Their big continental rival, Rosenbauer, has traditionally received strong support from its native Austrian government, but a tightening of the financial reins in that quarter might open up competition. Overseas, the American Oshkosk organisation offers tough competition, buoyed up by a recent order for 750 units from the United States Air Force.

In Britain, suppliers have tended to divide themselves into chassis makers and bodybuilders, although there is some overlap. Two companies, Reynolds Boughton and Unipower, dominate the separate chassis market; Reynolds Boughton also offers a complete vehicle. Their primary output in this field is the big, all-wheel drive rear-engined chassis that form the basis for specialist bodywork. Gloster Saro also produces chassis for its own bodywork, but builds on proprietary chassis to order.

Other big names in airside bodybuilding are Angloco, Carmichael and a relative newcomer called Fire Trucks. All provide wedge-shaped, forward-control fire tenders of a type which found its first full flowering in Chubb's old Pathfinder range and is now the norm. Most also provide smaller vehicles on a variety of less specialised chassis.

An important development in the market has been sparked off by a change in the rules laid down by the American National Fire Prevention Association.

The first vehicle to reach an incident is generally a small Rapid Intervention Vehicle, which in the past has carried 1,100 litres of water. The new-generation RIV has the same performance standards (notably acceleration to 80km/h in under 25 seconds), but carries 4,500 litres of water.

SMALL VERSIONS

This means that instead of mounting their bodies on chassis such as a Range Rover or an American Dodge Power Wagon, manufacturers are developing small versions of their standard forwardcontrol models. Carmichael, for instance, has had one in service at Newcastle since last year, on a chassis developed jointly with Unipower. Gloster Saro plans to show one based on its own 4x4 chassis in the International Fire Show at the National Exhibition Centre in September, and Angloco also has a design ready.

Simon Gloster Saro's new model will combine the performance of its Meteor range with the fire-fighting capabilities of its existing Protectors.

SGS managing director John Pugh says: "The new CFR will be the first of a new range, designed with the Single European Market in mind and to comply with both NFPA and ICAO requirements." Over 200 Protectors are now in service.

An indication of the size of these vehicles is given by the fact that Unipower now offers its 19-tonne gross RE4 two-axle chassis chassis in RIV form — and claim it can reach 80km/h in just 19 seconds.

Smaller vehicles have not faded from the picture, however. Unipower continues to import and uprate the Power Wagon for firefighting applications, and such chassis provide a base for RIV-style vehicles from manufacturers such as HCB Angus, which usually concentrates on the municipals market.

At the top end of the range there are signs that the favoured vehicle size is settling at no more than 12,000 litres on a 6x6 chassis, as opposed to nearer 14,000 litres in the late 1970s. The idea, presumably, is to tackle an incident with smaller but more numerous vehicles. Chassis maker Boughton offers an 8 x 8, but reports relatively little demand for it. Unipower's range extends to 6 x bs. It is developing a wide-track version of its top-weight RE6 model, which is 2.9m across instead of the usual 2.4 and offers more crew space with improved stability.

Performance is partly a function of weight, which is one reason why Fire Trucks has been making increasing use of glass fibre in its bodywork.

Angloco, although not currently offering GRP construction, does use it on some of its other vehicles, such as crewcab water tenders.

When it comes to driveline components, this is very much a world of bespoke designs. While engines are generally Detroit Diesel or Cummins and gearboxes are usually Allison automatics, Boughton and Unipower both make components such as power take-off units in-house. Unipower, in particular, favours the power divider system of driving pump equipment; this allows the vehicle to move under its own power while ancillary equipment is working. One benefit of working according to internationally agreed standards is that the makers are less constrained than commercial truck builders by varying local legislation. Yet customer preference still affects detail specification. In terms of classification for fire prevention, airports can fall into any of nine different categories, and the class will indicate how much or how little equipment is required on each vehicle. In the automotive world, nothing is ever simple.