Making a Profit on PRIVATE HIRE

Page 54

Page 57

If you've noticed an error in this article please click here to report it so we can fix it.

Costs for Four Different Types of Vehicle are Assessed in This Article, Which also Shows What Can Reasonably be Earned. by Them Throughout the Year

AT this time of the year the business of private-hire coaches is in the Doldrums. Indeed, the outstanding disadvantage of this branch of the road transport industry. is its irregularity. It has advantages compared with that of tours and excursions; it does not need so expensive an administration, there is no-difficulty in relation to the sale of tickets, booking, the, allocation of seats and so on. Also, in the cases of well-known operators, orders are usually placed direct and the payment of agency commissions is avoided. Indeed, I believe that it is illegal to pay such commissions in connection with the' private hire of coaches. There is usually work available every week-end throughout the year. In the winter there are football teams and their, supporters to be catered for, and in the summer cricket elevens and their folloWers-.` In the winter, the conveyance of parties to theatres, dances, concerts and similar functions finds a certain amount of work for the mid-week. In addition there are meets of variqus hunts and races. ' In connection with these. events, it is 'usually possible if a little.energy be .exerted and,a little_money Spent in advertising, to suggest the. enjoyment of making .up parties to go by coach to attend them. Perhaps I should make it clear that when I mention advertising I do not mean advertising to the menabets of the proposed party individually, but advertising the fact that the coach is available-for hire. It should be well known by now. that it is illegal' to advertise in -conneetion With theforrning of a partY. for the use of a

coach,on private hire. --

Often it pays to take a certain amount of risk. I have in mind the sort of thing that a south-country coach propr:etor told me he did in Connection with:trips to London for outstanding events, of which a Cup Tie may genie as an example. He suggests to the organizer of the party' that it might be a good-idea to finish' off a day's outing with a visit to the theatre, 'and having gained acquiescence, the operator himself arranges the purchase of the theatre tickets and does all that hecart-to facilitate that extensiOnOf the

. . ._ , . , .

Meeting Requirements . .

The organization best adapted to cater for this class of work may comprise a small fleet including. vehicles having capacities of 20, 26 and 32 seats. In that way it is easy to meet the requirements of various sizes of party most

economically. •

That is not to say, however, that the 'ownerof one vehicle cannot make good in this class of business. He can, but he is handicapped in that the size of the party he can convey is determined by the size of his vehicle If on the majority of occasions the number in the party be no more than 15 or 16, and if his vehicle be a 32-seater, his prospects of profit are considerably' diminished. On the other hand, as the figures of cost which I shall show in this article will demonstrate, a 32-seater does offer a much better opportunity of making a profit, other things being equal, than a smaller vehicle.

In considering the question of costs and the appropriate charges, which, of course, should be calculated on the basis of cost, regard must be had to the important condition that the vehicle is not likely to be in regular use throughout the year. During "the summer, five, six and even seven days a week may see the vehicle on the road, but in the winter there must inevitably be many weeks when the vehicle is used for one day only. • a36 There is, moreover, the important consideration that the public tendency to travel by road is less strong during the winter than during the summer, although the desire to travel may exist. This aspect of the problem emphasizes the conflicting needs of fixing rates on cost and grading charges in accordance with the law of supply and demand.

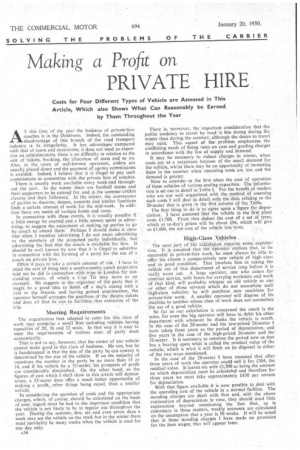

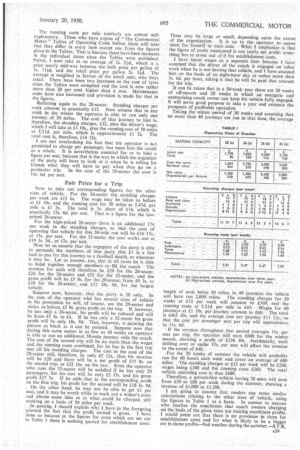

It may be necessary to reduce charges in winter, when costs are at a maximum because of the small demand for . the vehicle, whilst there may be an opportunity of increasing them in the summer when operating costs are less and the demand is greater, Now to consider in the first-place the cost of operation of these vehicles of various seating capacities.. The information is set out in detail in Table I. For the benefit of readers who are not well acquainted with the -Method of assessing . such costs 1 will deal in detail with the 'data relating to the 20-seater that is given in the fist Column of the Table.

The first thing to chi is to agree upon a'figure flir depreciation. I have assumed that the vehide in the first place costs £1,700. From that deduct the cost of a set of tyres, which at to-day's prices Will be about £96, Which will give us £1,604, the net cost of the vehicle less tyres.

Yebicies ,

The next part of -the 41culation requires soMe,explanaz lion. It is assumed that theoperator realizes that, to be successful in priVate-hire work, he must always be able to offer his clients a comparatively new vehicle ,of high class and in good condition. That involves him in taking the .

vehicle out of that department of service long before it is . really worn out. A large operator, one who caters for contract service, with buses for carrying workmen and work of that kind, will probably relegate an old vehicle to one or other of those services which do not necessitate such !high-class vehicles; he will purchase , new machines for private-hire work. A smaller operator will dispose of his ,machine to another whose class of work does not necessitate the use of a good vehicle. So far as our calculation is concerned the result is the same, for even the big operator will have to debit his other department with whatever he thinks the vehicle is worth. • In the case of the 20-seater and the low-priced 26-seater I have taken, three years as the period of depreciation, and five years in the case of the high-priced 26-seater and the' 52-seater. It is necessary to mention the period now as that has a bearing upon what is called the residual. value of the -vehicle, which is what it will fetch on its disposal in either of the two ways mentioned. In the case of the 20-seater I have assumed that after three years of work the. operator could sell it for £304, the residual value. It leaves me with £1,300 as being the amount on which depreciation must be calculated and therefore for three years we must take approximately £430 per annum for depreciation. With that figure available it is now possible to deal with the operating cost of the vehicle in a normal fashion. The standing charges are dealt with first and, with the above explanation of depreciation in view, they should need little explanation beyond mentioning the fact that, as is customary in these matters, weekly accounts are calculated on the assumption that a year is 50 weeks. It will be noted that in these standing charges I have made no provision for the item wages; 'that will appear later.

The running costs per mile similarly are almost 'selfexplanatory. Those who have copies of The Commercial Motor " Tables of Operating Costs before them will note that they differ in every item except one from the figures given in the Tables. That is because there have been increases in the individual items since the Tables were published. Petrol, 1 now take at an average of 2s. 21d., which is a . price nearly mid-way between the bulk price per gallon of Is,. 1 lid. and the retail price per gallon 2s. 31d. The average is weighted in favour of the small user, who buys retail There have been two increases in the cost of tyres since the Tables were compiled and the cost is now rather more than 20 per cent, higher than it was. Maintenance costs have also increased and provision is made for that in the figures.

Referring again to the 20-seater. Standing charges per week amount to practically £12. Now assume that in any week in the winter the operator, is able to run only one journey of 50 miles. The cost of that journey to him is, therefore, the standing charges, £12, plus the driver's wage; which I will take at £1 10s., plus the running cost of 50 miles at 5.21d. per mile, which is approximately £1 2s. The total cost is, therefore, £14 12s, I am not overlooking the fact that the operator is noil permitted to charge per passenger, but must hire the coach as a whole. It is nevertheless essential for us to take a figure per seat, because that is the way in which the organizer of the party will have to look at it when he is telling his friends what they will have to pay when they go on ,a particular trip. In the case of the 20-seater the cost is 14s. 6d per seat.

Fair Price for a Trip

Now to take out corresponding figures for the other sizes of vehicle. For the 26-seater the standing charges per week are £13 6s. The wage may be taken as before at £1 10s. and the running cost for 50 miles at 5.47d. per mile is £1 3s. The total is ls. short of £16, which is practically 12s. 6d. per seat. That is a figure for the lowpriced 26-seater.

For the high-priced 26-seater there is an additional 17s. per week in the standing charges, so that the cost of operating that vehicle for this 50-mile run will he £16 17s., or 13s. per seat. For. the 32-seater the cost works out at £19 Is. 3d., or 12s. per seat. ' .

Now let us assume that the organizer of the party is able to persuade the members of that party that £1 is a fair sum to pay for this journey to a football match, or wherever it may be. Let us assume, too, that in all cases he is able to band together enough members to fill the coach. The revenue for each will therefore be £20 for the 20-seater, £26 for. the 26-seater and £32 for the 32-seater, and the gross profit will be 1.5 8s, for the'20-seater, from £9 3s. to £10 for the 26-seater, and £12 18s.9d. for the largest

vehicle. . .

Suppose now, however, that the party is 20, only, In the case of the operator who has several sizes of vehicle in his possession he will, of course, use the 20-seater and make, as before, £5 8s. gross profit on the trip. If, however, he has only a 26-seater, his profit will be reduced and will be from £3 3s. to £4. If he has only a 32-seater his gross profit will be only 18s. 9d. That, however, is painting the picture as black aa it can be painted. Suppose now that during this same winter in as few as 10 weeks an operator is able to run an additional 50-mile journey with the coach. The cost of the second trip will be no more than the wages and the running costs combined, for he has in the first trip met all his standing charges. The cost in the case of the 20-seater will, therefore, be only £2 12s., thus his revenue will he £20 and there will be a net profit of £17 8s. on the second trip, or £22 16s. on the two. Even the operator who runs the 32-seater will be satisfied if he has only 20 passengers, for his cost will be only £2 15s. and his gross profit £17 5s. If he adds that to the corresponding profit on the first trip, his profit for the second will be £18 3s. 9d.

On the other hand, he may not be able to .get El per seat, and it may be worth while to work out a winter's costs and obtain, some idea as to what could be charged, still working on a basis of 50 miles per week. In passing, I should explain why I have in the foregoing stressed the fact that the profit earned is gross. I have done so because in the -figures for costs which are set out in Table 1 there is nothing quoted for establishment costs. These may be large or small, depending upon the extent of the organization. It is up to the operator to assess them for himself "in each case. What I emphasize is that the figure of profit mentioned is not really net profit something has to come out of it for establishment costs.

I have taken wages as a separate item because I have assumed that the driver of the coach is engaged on other work when he is not driving that vehicle, and I have assessed him on the basis of an eight-hour day at rather more than 3s. 6d, per hour, taking it that he will be paid that amount for the trip.

It can be taken that in a 50-week year there are 30 weeks of off-season and 20 weeks in which an energetic and enterprising coach owner can keep his vehicle fully engaged. It will serve good purpose to take a year and estimate the prospects of profitable operation.

Taking the winter period of 30 weeks and assuming that no more than 40 journeys are run in that time, the average length of each being 50 miles, in 40 journeys the vehicle will have run 2,000 miles. The standing charges for 30 weeks at £12 per week will amount to £360, and the running costs at 5.2Id per mile to 143. Wages for 40 journeys at £1 10s. per journey amount to £60. The total is £463 10s. and the average cost per journey £11 I2s., so that the cost per passenger seat per trip will approximate toils. 6d.

If the revenue throughout that period averages 15s. per seat per trip, the operator will earn £600 for the winter season, showing a profit of £136 10s. Incidentally, each shilling over or under 15s. per seat will affect the revenue to the extent of £40.

For the 20 weeks of summer the vehicle will probably run for 60 hours each week and cover an average of 600 miles. The standing charges at £12 per week will be £240, wages being £180 and the running costs £260. The total vehicle operating cost is thus £680.

Therefore, a private-hire vehicle having 20 seats will earn from £50 to £60 per week during the summer, showing a revenue of £1,000 to £1,200.

I am going to assume that readers can make similar calculations relating to the other, sizes of vehicle, using the figures in Table I as a basis. In answer to anyone who reaches the conclusion that coach owners charging on the basis of the given rates are tnaking exorbitant profits, I would point out that there is no provision in them for establishment costs and for what is likely to be a bigger cut in those profits-bad weather during the summer,-S.T.R.