WOULD YOU CREDIT IT?

Page 26

Page 27

If you've noticed an error in this article please click here to report it so we can fix it.

Some fuel charge cards offer direct cost savings, others don't. But nearly all allow improved management control and security. We look at what's available.

• More than a third of British transport managers do not know how much they spend per week on fuel, according to a survey conducted this year for Shell. And six out of 10 have no set policy about where their drivers should buy fuel when they are out on the road.

These findings suggest that many transport managers treat fuel purchases in the same haphazard way as a lot of motorists — keeping an eye out for a bargain, but accepting expensive fuel with a philosophic shrug.

Combating this basic lack of knowledge is one of the key functions of the numerous fuel charge cards now available in the UK. Users of most cards receive regular, itemised lists of fuel withdrawals, showing the date and unit price of each drawing. Many offer a great deal more, with tailored exception reporting to highlight anomalies.

From the way they are promoted, it might appear that these cards also offer direct cost savings in terms of cheaper diesel. Certainly some do, but others can incur higher costs than simply paying the pump price. But against that must be set the benefits of improved management control and security. Nearly all cards also offer at least some credit, although at present charges are mostly made fortnightly by direct debit, usually within 14 days of invoicing; so the maximum credit period is one month.

There are two basic categories of cards: retail-based cards, which essentially provide a method of buying from forecourts in a structured way; and bunkering cards, which in theory involve advance purchases in bulk, and usually allow a set price to be nogotiated by individual users. However, some of the more recent cards, such as Diesel Direct, are a hybrid of the two.

The retail cards date from the 1940s, when the original agency schemes were created. Agency cards offer a relatively Limited range of facilities, but provide the attractions of security and control.

AGENCY NAMES

There are now four cards using the word agency in their names — BP, Esso, Mobil and Shell. BP and Shell Agency cards are still available reciprocally at both networks of filling stations (a legacy of the former Shellmex and BP marketing partnership). Mobil Agency cards are limited to its own network, and so are Esso's Agencylink cards.

In spite of its traditional-sounding name, Agencylink is a recent development, and offers slightly more flexibility than the other agency cards. Where users are charged a fixed schedule price (which means average weekly pump price for the make). Agencylink users can select between that and pump price.

Both Esso and Shell also offer a chargecard. These are aimed more at motorists than truck operators, and offer more elaborate fleet analysis in return for a small card fee (E1.50 per month in the case of Esso).

Several oil companies have moved on from the more basic card schemes to tailor products specially for large commercial vehicles, Shell was among the first with its fully automated self-service Transderv network. Some Transderv features (such as card-swipe at point of sale) are now available in a version of the company's Euroshell card called Euroshell Prime.

Kuwait Petroleum and Mobil have had more consistent success with their International Diesel Service and Mobil Diesel Club schemes, which continue to focus attention on sites that are specially suited to large commercial vehicles, Now more oil companies offer truck-related schemes, including Esso with its Diesel Card and Gulf with its G-Stop.

These modern truck-related schemes veer towards the style of the independent bunkering schemes. The Esso card is administered by PCS, a subsidiary of haulier Russell Davies, and requires users to make an advance purchase. There is a service charge of 1.4p per litre.

Another oil company offering a bunkering-based scheme is Phillips Petroleum, which makes use of the Diesel Direct system for some of its Route-Mate outlets. Phillips has no retail sites but allows users to draw non-Phillips fuel.

BUNKERING CARDS

Bunkering cards were brought to prominence by ex-haulier CH Jones of Walsall, which set up the Keyfuels network more than five years ago, and later followed with the Diesel Direct system. The theory behind these bunkering cards is that subscribing operators pre-purchase fuel (usually a minimum of at least 10,000 litres) to meet their own requirements, and it is delivered to sites nominated by the card group. The operators are then eligible to draw fuel from anywhere in the system.

A couple of oil companies have tried establishing their own bunker card schemes in recent years; but they could hardly make the same claim to impartiality.

Diesel Direct was developed by CH Jones to cater for smaller users who could not meet the minimum throughput limit of 20,000 litres placed on Keyfuels users. It works by allowing other fuel companies (suppliers or agents) to purchase fuel in bulk in the same way as Keyfuels users, then to make this available to their own customers via the card at a discount, Another company exploiting bunkering techniques is the Harpur group, which has controlled both Dialcard and Overdrive cards since acquiring Dialcard from Barclays Bank in 1991. Harpur buys fuel in bulk at competitive rates, and charges a list price which can be significantly below retail.

With such large savings apparently available, why don't more oerators use these bunkering systems? There are drawbacks, such as the smaller scope of their networks and out-of-the-way location of some sites. For coverage and flexibility, agency cards could be a better bet.

However, retail card independents such as PHH are still flourishing. Besides offering its own All Star card, PHH provides card services to BP, Conoco and Texaco. It claims its All Star card offers a price at least 2p per litre below the prevailing national average for the week. PHH also offers its own version of the Diesel Direct bunkering card.

International transport adds an extra dimension to the card scene. Until recently the prime contenders were DKV, whose multi-function card is now available in 30 countries; and UTA, whose card is restricted more tightly to fuel purchases. However, these have now been challenged by the Euroshell card, and by BP. An attractive feature of Euroshell is that Shell will undertake to reclaim VAT abroad on the user's behalf for a commission of up to 20%. DKV and UTA already offer similar schemes via third-party agencies, and DKV is about to launch a scheme of its own.

A further European contender is the Pan Diesel card, a multi-national multi-company initiative in which Texaco is the UK partner. The others are Agip in Italy, Elf in France, Petrogal in Portugal and Repsol in Spain.

As UK card systems turn abroad, the battle at home is being joined.

0 by Peter Rowlands

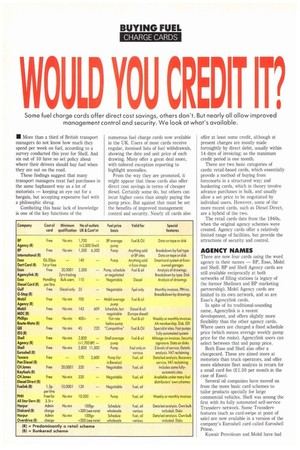

The chart lists principal fuel cards from oil companies and card specialists available to users of large goods vehicles operating mainly in Britain. Other cards (eg Conoco's Jet Card and PHH's main All Star card) are available for smaller vehicles. Specialist international cards such as DKV and UTA are not listed; nor are the many cards from oil distributors (eg Charringtons) which is an agent of the Diesel Direct scheme.

We asked all companies to tell us how many sites could accept vehicles of more than 7.5 tonnes. Some have listed their entire network, but operators of large commercial vehicles should check before assuming all outlets can accept them.

Dialcard and Overdrive cards are available at 12,000 retail sites, and in addition to the bunkered sites they can be used at 300 locations offering diesel at a fixed discount rate. Not all these take large commercial vehicles.

BP, Esso and Shell offer a chorgecard in addition to those listed, mainly for business users. It incurs a card fee but offers extensive management reporting.