XPANDING PROFITS

Page 37

Page 38

If you've noticed an error in this article please click here to report it so we can fix it.

Foden has won just over 1% of the British truck market over 3.5 tonnes this year — but it's in profit and has some ambitious plans for expansion.

• Foden Trucks of Sandbach is small: so far this year it has captured just over 1% of the British market for trucks over 3.5-tonnes GVW. What sets it apart from most of its competitors, however, is that it makes a profit. The amount is not disclosed in the accounts of Paccar, Foden's American parent of seven years, but it is a genuine profit, according to managing director Mark Pigott.

Probably even more impressive than its profitability is the fact that seven years ago Foden was bankrupt, saddled with enormous debt and a factory big enough to build several times its then annual production. Today, it occupies just a fraction of its formerly rambling site in Cheshire and employs a fraction of its previous manpower.

Pigott doesn't let that faze him: "Although we are not the largest, remember that two of the largest companies in the world have effectively pulled out of trucks, yet we are making profits," he observes.

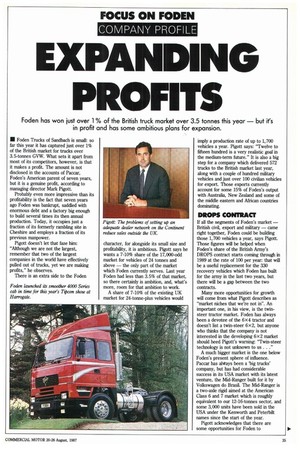

There is an extra side to the Foden character, for alongside its small size and profitability, it is ambitious. Pigott says he wants a 7-10% share of the 17,000-odd market for vehicles of 24 tonnes and above — the only part of the market which Foden currently serves. Last year Foden had less than 3.5% of that market, so there certainly is ambition, and, what's more, room for that ambition to work.

A share of 7-10% of the existing UK market for 24-tonne-plus vehicles would imply a production rate of up to 1,700 vehicles a year. Pigott says: "Twelve to fifteen hundred is a very realistic goal in the medium-term future." It is also a big step for a company which delivered 572 trucks to the British market last year, along with a couple of hundred military vehicles and just over 100 civilian vehicles for export. Those exports currently account for some 15% of Foden's output with Australia, New Zealand and some of the middle eastern and African countries dominating.

DROPS CONTRACT

If all the segments of Foden's market — British civil, export and military — came right together, Foden could be building those 1,700 vehicles a year, says Pigott. Those figures will be helped when Foden's share of the British Army's DROPS contract starts coming through in 1989 at the rate of 100 per year: that will be a useful replacement for the 330 recovery vehicles which Foden has built for the army in the last two years, but there will be a gap between the two contracts.

Many more opportunities for growth will come from what Pigott describes as "market niches that we're not in". An important one, in his view, is the twinsteer tractor market. Foden has always been a devotee of the 6x 4 tractor and doesn't list a twin-steer 6x2, but anyone who thinks that the company is not interested in the developing 6 x2 market should heed Pigott's warning: "Twin-steer technology is not unknown to us. . ."

A much bigger market is the one below Foden's present sphere of influence. Paccar has abgays been a 'big trucks' company, but has had considerable success in its USA market with its latest venture, the Mid-Ranger built for it by Volkswagen do Brasil. The Mid-Ranger is a two-axle rigid aimed at the American Class 6 and 7 market which is roughly equivalent to our 12-16-tonnes sector, and some 3,000 units have been sold in the USA under the Kenworth and Peterbilt names since the start of the year.

Pigott acknowledges that there are some opportunities for Foden to undertake a parallel down-sizing on the British market, but he is not blind to the problems. For a start, Foden doesn't have the cab needed for a 16(or 17-) tonner. Pigott says there are three possibilities, including trying to use the big 4000 Series cab, but the real choices for a lighter vehicle would be either a new Foden cab or a cab shared with another manufacturer. There has been no decision on such a venture as yet, but to justify the move, Pigott says he would want five to 7% of a market which accounted for around 10,500 units in Britain last year. He realises that it is a tough market to be in: "It's very, very, price-competitive, and some manufacturers are selling at below cost just to maintain a presence," he says.

DEALER NETWORK

A company like Foden would need a wider dealer network if it were to go down the 17-tonne route, and Pigott says he is already looking for more dealers. "I'd like another 10-15 points," he says, "in a combination of service, and sales-andservice outlets." Until recently, Foden had just 10 main dealers and 52 service points, but it has just added the three North London outlets of Ipswich Truck Sales, part of BRS.

The establishment of such a dealer network elsewhere is the main obstacle to any moves by Foden into areas like mainland Europe. "Until that can be overcome," says Pigott, "it is probably not financially realistic." Most of Europe, he points out, is very self-regulated in the way it buys the home product, and makes it hard for importers to succeed. In his view Britain, the USA and Australasia are the most open markets in the world — and by inference the ones in which Paccar companies can best succeed.

In most overseas markets the Japanese have a strong presence, and Pigott takes them seriously as future competitors. "They have problems with engines and weight," he says, "but when they are overcome the Japanese will be competitors."

At the moment, he says, artificial barriers prevent the Japanese from making too much progress, but with the advent of joint ventures he thinks that some of those import barriers could well be lifted.

In the meantime Foden's overseas eyes are firmly on its parent, with which it has an increasing amount of co-operation. Much of the testing on Foden's wellreceived 4000 Series vehicles was done in the USA, and the Air-Trac suspension now offered on Fodens was developed there. In return, Paccar is showing more interest in Foden's electrical and air systems, and Pigott says that future Kenworth and Peterbilt 'cab-over' (forward-control) technology will be influenced by Foden — the Paccar technical centre in Washington State recently bought a 4000 Series vehicle for evaluation. There is, he points out, a leaning towards more British technology — such as that of anti-lock braking and quiet vehicles — going to the USA.

BIGGEST WAVES

The biggest waves which Paccar and its British subsidiary have made here were probably those surrounding the bid which Paccar made earlier this year for Leyland Trucks. Piggott says that the rejected bid is all "water under the bridge" now, but sees no reason why the interest which Parrar showed in selling the Roadrunner in the USA should not continue. In the meantime, he says, "We've still got the ($100 million) cash!"

The current growth of Foden and Paccar on the British market is a little more low-key than ground schemes involving buying Leyland and selling the Roadrunner, but it is still very important for the dealers and operators. Foden has now launched its own roadside recovery/ rescue service, and all its dealers are now offering the Pac-Lease financial packages put together by Paccar Financial.

This is how Pigott sees Foden's position: "We're looking at new models, new product ranges, new dealers, more services — we're very confident that we're in the first division."

I=1 by Allan Winn