Whitbread, which is behind brands such as Heineken and Stella

Page 52

Page 53

If you've noticed an error in this article please click here to report it so we can fix it.

Artois, hopes its new take-home dedicated distribution deal with Tibbett & Britten will reach the parts other carriers cannot reach.

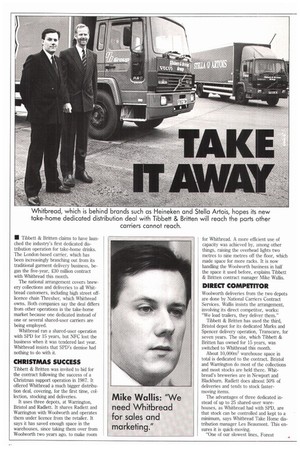

• Tibbett & Britten claims to have launched the industry's first dedicated distribution operation for take-home drinks. The London-based carrier, which has been increasingly branching out from its traditional garment delivery business, began the five-year, £30 million contract with Whitbread this month.

The national arrangement covers brewery collections and deliveries to all Whitbread customers, including high street offlicence chain Thresher, which Whitbread owns. Both companies say the deal differs from other operations in the take-home market because one dedicated instead of one or several shared-user carriers are being employed.

Whitbread ran a shared-user operation with SPD for 15 years, but NFC lost the business when it was tendered last year. Whitbread insists that SPD's demise had nothing to do with it.

CHRISTMAS SUCCESS

Tibbett & Britten was invited to bid for the contract following the success of a Christmas support operation in 1987. It offered Whitbread a much bigger distribution deal, covering, for the first time, collection, stocking and deliveries.

It uses three depots, at Warrington, Bristol and Radlett. It shares Radlett and Warrington with Woolworth and operates them under licence from the retailer. It says it has saved enough space in the warehouses, since taking them over from Woolworth two years ago, to make room for Whitbread. A more efficient use of capacity was achieved by, among other things, raising the overhead lights two metres to nine metres off the floor, which made space for more racks. It is now handling the Woolworth business in half the space it used before, explains Tibbett & Britten contract manager Mike Wallis.

DIRECT COMPETITOR

Woolworth deliveries from the two depots are done by National Carriers Contract Services. Wallis insists the arrangement, involving its direct competitor, works: "We load trailers, they deliver them."

Tibbett & Britten has used the third, Bristol depot for its dedicated Marks and Spencer delivery operation, Transcare, for seven years. The site, which Tibbett & Britten has owned for 15 years, was switched to Whitbread this month.

About 10,0000 warehouse space in total is dedicated to the contract. Bristol and Warrington do most of the collections and most stocks are held there. Whitbread's breweries are in Newport and Blackburn. Radlett does almost 50% of deliveries and tends to stock fastermoving items.

The advantages of three dedicated instead of up to 25 shared-user warehouses, as Whitbread had with SPD, are that stock can be controlled and kept to a minimum, says Whitbread Take Home distribution manager Les Beaumont. This ensures it is quick-moving.

"One of our slowest lines, Forest Brown, is held in one depot and fed out each night in exactly the quantity we need. Whitbread pale ale is produced in Blackburn, stocked at Warrington, and sent overnight to Bristol and Radlett as they require it," he adds. "Stockholding points have been reduced."

Whitbread is also more aware of its distribution costs under a dedicated than under a shared-user system. "We also get the benefit of Tibbett & Britten's continuing expertise," says Beaumont.

Tibbett & Britten is using 39 17-tonne Volvos and eight Volvo 38-tonne FL10s on the contract. The bodies and trailers are liveried in Whitbread's brands — Heineken, Stella Artois and White Label. A new Whitbread Take Home division logo will be introduced on 25 of the rigids next month.

The rigids use Don Bur Slide-a-Side and Spacemaster bodies. The trailers are Crane Fruehauf-chassis Boalloy Tautliners. All the rigids and tractive units are on contract lease from Dawson Rentals, the trailers from TIP.

When SPD had the contract it did only secondary deliveries — to shops and offlicences. Tibbett & Britten will use its artics to collect from the brewery, to move goods between depots, and to make bulk deliveries to larger customers, such as warehouses, cash and can-ys and the out-of-town distribution centres of the large retail chains, Tesco, Gateway and Sainsbury.

NO OVERLAP

Wallis and Beaumont will jointly control the operation. They insist there will be no overlap of responsibilities. "We need Whitbread for the sales and marketing side. If we were left on our own to run the operation we'd fall flat on our faces," says Wallis. "On the other hand, Les (Beaumont) isn't interested if Bill Smith has turned up today to drive his forklift."

Tibbett & Britten will be delivering to about 7,500 outlets, including 1,000 Threshers. It says it will rent extra trucks to cover the Christmas rush and that its own general distribution vehicles will be used to cover the more outlying parts of the Whitbread network, such as the north of Scotland and rural Wales.

Whitbread does most of its own pub deliveries in-house. It has 6,000 tied houses, 30 depots and a fleet of three to four hundred trucks. However, it also claims to have initiated the industry's first dedicated distribution contract five years ago, with NFC Contract Distribution.

It runs a joint company with the NFC subsidiary called Bar Delivery Services. It is based in Kentish Town and Dunstable and covers Whitbread pubs in London and the northern home counties.

"We beat TNT to that," says Beaumont. TNT, however, has said that its dedicated contract with brewer Buddingtons, which it won last year, was the first to cover an entire operation instead of being a regional "partnership".

Whitbread also claims to have been the first brewery to launch a separate division for its take home business, 15 years ago, and the first to use contract distribution when it began dealing with SPD. The Tibbett & Britten move, however, is the first time the division has used trucks with its own logo.

Tibbett Si Britten chairman John Harvey denies that the contract heralds a move into the more complex brewery-topub distribution market, following TNT and NFC. He says it is part of the company's "policy of diversification" away from garment distribution, and acknowledges that full-scale brewery deliveries require different vehicles, skills and trained employees.

However, he does concede that if a customer such as Whitbread, or large brewer such as Bass, approached Tibbett & Britten to set up an operation, the company would certainly give it consideration. "We see ourselves as being wholly customer driven." he says.

CASUAL HAULIERS

The company has been expanding its nongarment contract distribution activities since its management buy-out in 1986. Before that, the company had been making heavy losses.

It runs a dedicated warehouse for Asda at Lutterworth. Although the retailer uses casual hauliers for its deliveries, it is revising its distribution operation, and is likely to look for dedicated partners. Tibbett & Britten will be tendering for that contract.

It operates a depot for Unilever subsidiary Gibbs in Wakefield. The warehouse did belong to Unilever, but Wallis says Tibbett & Britten has saved enough space by running it more efficiently to offer extra room to Gibbs competitor Colgate. It is now expanding the depot.

It has the contract for three Marks and' Spencer's regional distribution centres and transport operations at West Thurrock, Essex; Tunbridge Wells, Kent and Nottingham. It runs these under its subsidiary Dartford Securities.

It has been working for Marks and Spencer for 16 years. The Woolworth and Whitbread operations come under its RCS arm. Woolworth is not using the Radlett depot at present. The retailer, which has its own big warehouses in Swindon and Rochdale, and whose empty trailers are in the yard, returns there in June.

Beaumont, who gained much of his distribution experience at BRS, hints that Whitbread's rivals may consider contracting out their take-home operations once the Tibbett & Britten partnership proves itself to be successful. Tibbett & Britten, however, is likely to have to look elsewhere for its next contract. Competing brewers will not want to use the same dedicated carrier for a similar operation. El by Murdo Morrison