Italian methods at Langley

Page 26

If you've noticed an error in this article please click here to report it so we can fix it.

• The profit level "was a nice surprise", says Iveco Ford director of commercial operations, Alan Fox, referring to IFT's £9,6 million net profit figure for 1988. His boss, company chairman, Dr Felice Cantarocco, agrees — although his task for 1989 is to increase that figure. After all, he says: —Ile investment has to be paid for."

Both men are surprisingly modest about where the profit came from. It took nine months to clear the Fordowned stock of vehicles going through Langley, none of which made any profit for IFT. Fox also points out that the market increased, as well as IFT's share of it, and "additional efficiencies" engendered by the company have helped it to show a gain for the first time since the merger in July 1986.

Apart from Cantarocco, there are few Italian Iveco personnel working at the old Ford plant in Langley. A quiet, neat man, Cantarocco perhaps exemplifies the Iveco approach to its overseas operations. "We have to rely on the people, it would be silly to invade them," he says. The UK operation has largely been left to work itself back into profit since the merger, although there will be few sad faces in Italy at the thought that it has happened sooner, and better than expected.

Downturn

Now it has to consolidate its position as the UK's leading CV builder over 3.5 tonnes, although if Fox is to be believed, that task will not be an easy one: "The UK market will not remain at its current high level," he asserts, explaining that iFr expects the 1989 end figures to match 1988's, which means a big downturn for the rest of the year.

Fox sees the van market as remaining fairly static at its current levels, but feels that the over-3.5-tonne market is subject to "cyclical waves" of economic activity, and is entering a trough. "It should not be as big as 1981 and 1982," he says hopefully — but Cantarocco adds: "Unless something is coming from outside." Both men see opportunities and threats in the forthcoming Single European Market. Largest among those threats is the Japanese. "The SEM will create a single type approval certificate for trucks in all the member countries," says Fox. "It will be a simple market to enter for the Japanese." It is clear that they both agree with the comments made by Iveco managing director, Giorgio Garuzzo, about the need to protect the European truck builders.

It should also be said that IFT faces a serious threat from their closest UK rival, Leyland Daf, and the Italian hybrid's market share has been under attack recently, particularly in the 7.5-tonne market.

Neither man will be drawn into a mud slinging battle about the competition, although Fox has a sneaking suspicion that Leyland Dafs recent market share gains may have something to do with the forthcoming flotation of the company on the stock market.

The opportunities of the Single European Market will be mainly due to operators modernising their fleets to take advantage of the new fuelsaving engine technology.

Cantarocco too sees the SEM as providing a superb market opportunity, although he adds: "New legislation requires a lot of work and money and investment, which was not the case 20 or 30 years ago." This leads one to ask whether the Iveco Ford Cargo, now nine years old, should be replaced with something more modern?

He feels that the Ford IDSeries' 16-year production life was "perhaps too long." It is not feasible today to think that a product will last 16 years and keeping up with legislation," he says. But both men assert that the Cargo is still a modern truck, and IFT is still introducing changes, and ploughing in investment.

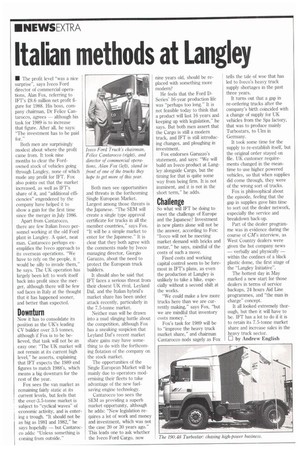

Fox endorses Garuzzo's statement, and says: "We will build an Iveco product at Langley alongside Cargo, but the timing for that is quite some way from being firm. It is not imminent, and it is not in the short term," he adds.

Challenge

So what will IFT be doing to meet the challenge of Europe and the Japanese? Investment in new plants alone will not be the answer, according to Fox: "Iveco will not be meeting market demand with bricks and motar," he says, mindful of the costs of such a move.

Fixed costs and working capital control seem to be foremost in IFT's plans, as even the production at Langley is unlikely to take a hike, especially without a second shift at the works.

"We could make a few more trucks here than we are currently making," says Fox, "but we are mindful that inventory costs money."

Fox's task for 1989 will be to "improve the heavy truck market share," and chairman Cantarocco nods sagely as Fox tells the tale of woe that has led to lveco's heavy truck supply shortages in the past three years.

It turns out that a gap in re-ordering trucks after the company's birth coincided with a change of supply for UK vehicles from the Spa factory, that was to produce mainly Turbostars, to Ulm in Germany.

It took some time for the supply to re-establish itself, but the original order stayed on file. UK customer requirements changed in the meantime to use higher powered vehicles, so that when supplies did come through, they were of the wrong sort of trucks.

Fox is philosophical about the episode, feeling that the gap in supplies gave him time to sort out the dealer network, especially the service and breakdown back-up.

Part of the dealer programme was in evidence during the course of CM's interview, as West Country dealers were given the hot company news — verbally and physically — within the confines of a black plastic dome, the first stage of the "Langley Initiative".

The hottest day in May marked a new start for those dealers in terms of service backups, 24 hours Aid Line programmes, and "the man in charge" concept.

It all looked extremely thorough, but then it will have to be. IFT has a lot to do if it is to retain its 7,5-tonne market share and increase sales in the heavy truck sector.

CI by Andrew English