CANUTE CATCHES THE TIDE

Page 68

Page 69

If you've noticed an error in this article please click here to report it so we can fix it.

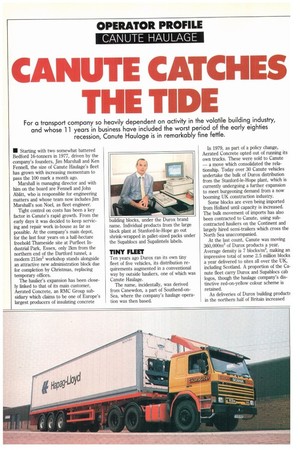

For a transport company so heavily dependent on activity in the volatile building industry, and whose 11 years in business have included the worst period of the early eighties recession, Canute Haulage is in remarkably fine fettle.

• Starting with two somewhat battered Bedford 16-tonners in 1977, driven by the company's founders, Jim Marshall and Ken Fennell, the size of Canute Haulage's fleet has grown with increasing momentum to pass the 100 mark a month ago.

Marshall is managing director and with him on the board are Fennell and John Ablitt, who is responsible for engineering matters and whose team now includes Jim Marshall's son Noel, as fleet engineer.

Tight control on costs has been a key factor in Canute's rapid growth. From the early days it was decided to keep servicing and repair work in-house as far as possible. At the company's main depot, for the last four years on a half-hectare freehold Thameside site at Purfleet Industrial Park, Essex, only 2km from the northern end of the Dartford tunnel, a modern 215m2 workshop stands alongside an attractive new administration block due for completion by Christmas, replacing temporary offices.

The haulier's expansion has been closely linked to that of its main customer, Aerated Concrete, an RMC Group subsidiary which claims to be one of Europe's largest producers of insulating concrete building blocks, under the Durox brand name. Individual products from the large block plant at Stanford-le-Hope go out shrink-wrapped in pallet-sized packs under the Supablocs and Supalintels labels.

TINY FLEET

Ten years ago Durox ran its own tiny fleet of five vehicles, its distribution requirements augmented in a conventional way by outside hauliers, one of which was Canute Haulage.

The name, incidentally, was derived from Canewdon, a part of Southend-onSea, where the company's haulage operation was then based. In 1979, as part of a policy change, Aerated Concrete opted out of running its own trucks. These were sold to Canute — a move which consolidated the relationship. Today over 30 Canute vehicles undertake the bulk of Durox distribution from the Stanford-le-Hope plant, which is currently undergoing a further expansion to meet burgeoning demand from a now booming UK construction industry.

Some blocks are even being imported from Holland until capacity is increased. The bulk movement of imports has also been contracted to Canute, using subcontracted hauliers on the Continent and largely hired semi-trailers which cross the North Sea unaccompanied.

At the last count, Canute was moving 360,000m3 of Durox products a year. Average density is 7 blocks/m3, making an impressive total of some 2.5 million blocks a year delivered to sites all over the UK, including Scotland. A proportion of the Canute fleet carry Durox and Supablocs cab logos, though the haulage company's distinctive red-on-yellow colour scheme is retained.

As deliveries of Durox building products in the northern half of Britain increased through the 1980's — as did Canute's other transport operations, notably ISO container haulage — working relationships were established with hauliers in the North, including Frank Stokes of Worksop, Nottinghamshire.

Last year, when that company's founder retired, Canute successfully negotiated its first takeover, adding at a stroke 22 trucks to its fleet and giving the company a strategically important second base on a one-hectare site with its own 370m2 workshop. The Stokes name has been retained, in a revised livery which embodies Canute Haulage's identifying colours.

Under the terms of its contract with Durox, Canute is able to haul loads of similarly-handled building products, such as bricks, paving slabs and pipes. Many of the manufacturers concerned, like Armitage, Steetley, London Brick and Nottingham Brick, have plants in the Midlands and north of England, enabling full advantage to be taken of the new depot at Worksop.

MUDDY SITES

Of the 31 vehicles currently hauling Durox products 22 are rigid eight-wheelers able to negotiate most muddy sites without difficulty. They include Daf 2500s and a new batch of three Scalia P93s, both chassis types available in the long 6.1m wheelbase needed to accommodate two 4.3m platform bodies, one ahead of, and one behind, a mid-mounted Hiab 640 or HAP 860 lorry-loader crane.

Canute divides its vehicle purchases three ways, between Leyland Daf, Scalia and Mercedes-Benz. On the eight-wheeler front, Mercedes is currently hamstrung by the non-availability of a sufficiently-long wheelbase, but supplying dealer Lancaster Trucks of West Thurrock says a longer 8 x4 chassis, possibly powered by the naturally-aspirated Mercedes vee-eight diesel from the latest tractor models, will be offered in due course.

Jim Marshall has been impressed with the dogged reliability of Mercedes 1628 tractors in the fleet, to the extent that an order for 14 of the new-generation Powerliner 2 tractors, this time 6x 2s, de signated 2429, was placed at the Birmingham Motor Show in October. Some of the Mercedes twin-steer newcomers are being assigned to Purfleet and some to Worksop.

Three new Scania P113 tractors were bought at the same time as the P93 eightwheelers, from Scantruck, whose Purfleet dealership is a stone's throw from Canute's depot. Meanwhile six more Leyland Daf 2500 eight-wheelers have been ordered for delivery in April and August next year.

Artics on the Durox contract remain coupled. There is no need for pre-loading of trailers because turnaround is rapid, thanks to efficient use of mechanised loading methods, particularly fork-lift trucks, at the plant.

Container haulage remains a vital activity for Canute. Marshall dismisses the commonly-held belief that container work is best left to "traction-only" ownerdrivers, willing to cut rates to the bone.

The majority of Canute's container traffic is generated by a nucleus of 12 freightforwarding or shipping companies, with whom a reputation and a relationship has been built up over a number of years. Two of the biggest are Hapag-Lloyd and Containerlink, in whose colours six and four Canute tractors, respectively, are operated.

A total of 26 skeletals, all short 20footers (6m), are owned by Canute, enabling the company to offer a packagedeal container haulage service, in contrast to the arguably cheaper arrangement whereby the shipper leases skeletals, for haulage by traction-only hauliers.

Acquisition of Frank Stokes has played an important part in Canute's container haulage expansion. The Worksop depot services the big Manchester container terminal. Tilbury, Felixstowe and Southampton are the main ports served from Purfleet.

Since 1982 the number of daily container movements undertaken by Canute has risen from about 20 to over 90. In Marshall's view the company's two main categories of traffic — building blocks and containers — are neatly complementary. In winter, when the construction industry is quiet, import and export activity remains buoyant.

A quite different class of distribution is involved in a five-year contract just won by Canute, based at the Worksop depot, employing three 38-tonne artics and one curtainsided 17-tonner, all of them Mercedes chassis.

The new contract covers the delivery of garden centre products like peat and seed potatoes to 82 Wilkinson do-it-yourself outlets, from Carlisle in the North to Milton Keynes in the South.

Two years ago in the light of the rapid growth in turnover, and on the recommendation of the company's accountants, Canute installed a computer, not only to handle the accounts, but to monitor vehicle costs. Service schedules are also held on computer as part of a Lotus 123 proprietary software program.

COMPUTER BENEFITS

Marshall and Fennell admit that they were sceptical initially about the likely benefits of computerisation. They persevered, however, to the point of attending, along with two other members of the management team, evening classes on the subject. They are all now enthusiastic about how the computer has given the business a new perspective.

"We can now plan vehicle acquisitions on hard information rather than guesswork," says Marshall, adding that the ready availibility of computer data has provided reassurances on many aspects of company operations and has made management generally more "expansionminded".

o by Alan Bunting