Cost, Tonnage and Productivity

Page 74

Page 75

Page 76

If you've noticed an error in this article please click here to report it so we can fix it.

D OAD TRANSPORT, as with any other progressive industry, 1-■ has always been under pressure to increase productivity, stemming inevitably from the fact that it is a competitive industry. More recently, however, there has been renewed interest in this subject following the first interim report on road haulage by the Prices and Incomes Board.

Naturally the main issue which arose here was in connection with drivers' wages and the associated problem of overtime working. More recently some new wage agreements have highlighted this problem of reconciling the average working week of a lorry driver with the national average for a working week.

Whilst this is undoubtedly a major problem for road transport operators there are several associated problems which have direct bearing on productivity. Foremost amongst these are terminal facilities and road congestion. In the majority of cases neither of these are within the control of the operator. Moreover there has been an unfortunate tendency, from the operator's point of view, for conditions to deteriorate. As a result productivity, far from increasing, has often decreased. In some instances operators engaged on local collection and delivery work have found it the 'lesser of two evils to employ smaller vehicles than hitherto— for example, 4-tonners instead of 5-tonners—because urban congestion just did not allow 5 tons of goods to be collected or delivered in the average working day.

Towards larger vehicles Nevertheless, at the other end of the scale—namely in mediumand long-distance operation—there has been a continuing trend towards the use of larger vehicles. The motor manufacturing industry has responded to this demand with the result that the quantity producers have increased their range by the addition of larger and larger vehicles.

Then, as from August 21, 1964, an amendment to the Motor Vehicles (Construction and Use) Regulations gave official support to this trend towards the use of larger vehicles up to 32 tons gross weight where the prescribed requirements were met.

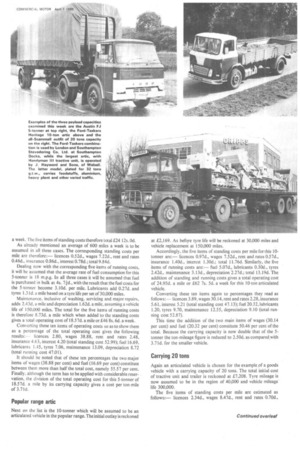

Accordingly, it is appropriate to examine the operating costs of the larger vehicles now permitted and compare them with existing smaller vehicles. For the purpose of this exercise three vehicles are chosen in geometrical progression of 5-, 10and 20-ton carrying capacity. All will have diesel engines and be fitted with standard platform bodies.

In order that the comparison will be as valid as possible an average weekly mileage standard to all three vehicles has been chosen, namely 600 miles per week. Having made this choice, it is nevertheless recognized that it might be considered an unduly high mileage for the smallest vehicle and Correspondingly low for the largest vehicle. Nevertheless, a standard figure is preferable to varying mileages which would substantially vary the operating costs per mile.

Dealing first with the 5-tonner, the initial cost is reckoned at £1,308. With an unladen weight of 2 tons 17 cwt. the weekly cost of licences would amount to £1 6s. Od.

The basis Earlier reference was made to the first report of the Prices and Incomes Board in which it was stated that the average hours for which drivers were paid was around 57 a week. Accordingly, this figure will be the basis of calculating wages in all three instances. Additionally, allowance will be made for the amendments proposed in RH (83) published last month. As a result the total cost of wages to the employer will be estimated at £18 Is. Od., which amount includes additions for insurance contributions and allowance for holidays with pay.

Rent and rates in respect of garaging the vehicle are estimated to cost £1 3s. Od. and vehicle insurance £2 2s. 9d. a week. This latter amount is based on an annual premium of £106 18s. Od. to provide comprehensive cover in a medium-risk area. Interest charged at 74 per cent on the initial outlay adds the equivalent of £1 19s. 3d. a week. The five items of standing costs therefore total £24 12s. Od.

As already mentioned an average of 600 miles a week is to be assumed in all three cases. The corresponding standing costs per mile are therefore:— licences 0.52d., wages 7.22d., rent and rates 0.46d., insurance 0.86d., interest 0.78d.; total 9.84d.

Dealing now with the corresponding five items of running costs, it will be assumed that the average rate of fuel consumption for this 5-tonner is 18 m.p.g. In all three cases it will be assumed that fuel is purchased in bulk at 4s. 70., with the result that the fuel costs for the 5-tonner become 3.10d. per mile. Lubricants add 0.27d. and tyres 1.31d. a mile based on a tyre life per set of 30,000 miles.

Maintenance, inclusive of washing, servicing and major repairs, adds 2.43d. a mile and depreciation 1.62d. a mile, assuming a vehicle life of 150.000 miles. The total for the five items of running costs is therefore 8.73d. a mile which when added to the standing costs gives a total operating cost of 18.57d. a mile or £46 8s. 6d. a week.

Converting these ten items of operating costs so as to show them as a percentage of the total operating cost gives the following results: licences 2.80, wages 38.88, rent and rates 2.48, insurance 4.63, interest 4.20 (total standing cost 52.99); fuel 16.69. lubricants 1.45, tyres 7.06, maintenance 13,09, depreciation 8.72 (total running cost 47.01).

It should be noted that of these ten percentages the two major items of wages (38.88 per cent) and fuel (16.69 per cent) constitute between them more than half the total cost, namely 55.57 per cent. Finally, although the term has to be applied with considerable reservation, the division of the total operating cost for this 5-tonner of 18,57d. a mile by its carrying capacity gives a cost per ton-mile of 3.71d.

Popular range attic Next on the list is the 10-tonner which will be assumed to be an articulated vehicle in the popular range. The initial outlay is reckoned

at £2,169. As before tyre life will be reckoned at 30,000 miles and vehicle replacement at 150,000 miles.

Accordingly, the five items of standing costs per mile for this 10tonner are:— licences 0.97d., wages 7.52d., rent and rates 0.57d., insurance 1.40d.. interest 1.30d.: total 11.76d. Similarly, the five items of running costs are:— fuel 5.07d.., lubricants 0.30d., tyres 2.42d., maintenance 3.13d., depreciation 2.27d.; total 13.19d. The addition of standing and running costs gives a total operating cost of 24.95d. a mile or £62 7s. 5d. a week for this 10-ton articulated vehicle.

Converting these ten items again to .percentages they read as follows:— licences 3.89, wages 30.14, rent and rates 2.28, insurance 5.61, interest 5.21 (total standing cost 47.13); fuel 20.32, lubricants 1.20, tyres 9.70, maintenance 12.55, depreciation 9.10 (total running cost 52.87).

This time the addition of the two main items of wages (30.14 per cent) and fuel (20.32 per cent) constitute 50.46 per cent of the total. Because the carrying capacity is now double that of the 5tonner the ton-mileage figure is reduced to 2.50d. as compared with 3.71d. for the smaller vehicle.

Carrying 20 tons

Again an articulated vehicle is chosen for the example.of a goods vehicle with a carrying capacity of 20 tons. The total initial cost of tractive unit and trailer is reckoned at £7,208. Tyre mileage is now assumed to be in the region of 40,000 and vehicle mileage life 300,000.

The five items of standing costs per mile are estimated as follows:— licences 2.34d., wages 8.47d., rent and rates 0.70d., insurance 2.90d., intesest 4.33d.; total 18.74d. Similarly, the five items of running costs are: —fuel 6.97d., lubricants 0.33d., tyres 4.54d., maintenance 4.40d., depreciation 4.08d.; total 20.32d. As a result the total operating cost for this 20-ton artic is 39.06d, a mile or £97 12s. lid, a week.

Once again the corresponding percentages read as follows:— licences 5.99, wages 21.68, rent and rates 1.79, insurance 7.42, interest 11.09 (total standing cost 47.98); fuel 17.84, lubricants 0.85, tyres 11.62, maintenance 11.26, depreciation 10.45 (total running cost 52.02).

Significantly, the two major items of wages (21.68 per cent) and fuel (17.84 per cent) now amount to less than half the total, namely 39.52 per cent. The ton-mileage figure, however, is still further reduced to 1.95d.

Because of the higher carrying capacity of this 20-tonner the wages paid to the driver (here reckoned at £21 3s. 6d. a week) are the highest of the three vehicles but the percentage (21.68) is the the lowest. This arises because of the higher cost of interest and depreciation, among other items stemming from the initial outlay of £7,208 as compared with around £2,000 or less for the two smaller vehicles.

Reverting to the earlier comment as to the choice of the average weekly mileage of 600, it was recognized that this would be unusually low for a vehicle of the size of this 20-ton artic. It is therefore interesting arbitrarily to double the cost of wages onthe assumption that double-shift working is operating. Weekly wages would then amount to £42 7s. Od. which gives a percentage of still only 24.97 compared with 38.88 for the 5-tonner when worked single shift.

Finally, when the 20-tonner is working double shift the cost per ton-mile figure (at 1,200 miles a week) comes down to 1.69d. compared with 1.95d. when single-shift working applies. These amounts compare with 3.71d. per ton-mile for the 5-tonner and 2.50d. for the 10-tonner.