Easy leasing for these who c uld

Page 29

Page 30

Page 31

Page 32

If you've noticed an error in this article please click here to report it so we can fix it.

buy by Johnny Johnsen THIE DEMAND for vehi le leasing continues to mere' se but operators might not fin it so easy to obtain as in he past, at least from the fina e houses. Because the res Its of their other investments h ve followed the depressed patt rn of the national economy, m I St finance houses are finding he amount of money available ir equipment leasing considera ily reduced.

There is, however, a "buy rs' market" in truck rental.

The normal supply id demand situation has ten d to make leasing from fina e houses more expensive this, in turn, has reduced e number of organisations th the requisite financial esources to obtain this facili y. For, make no mistake about it, leasing is not an easy way or those without sufficient cap al to obtain vehicles and ot er equipment. Less well finan ed organisations should cons er hire purchase.

Paradoxical as it mi ht seem, only individuals nd companies with a sound fin ncial basis easily able to uy the equipment that they require are those likely to be granted leasing facilities w atever the source from wh ch they seek it.

Financial sources

Now as never before it is mportant for the prospect ye lessee to shop around nd there are other sources of money as well as the rec g nised finance houses. he vehicle manufacturers a d their dealership networks ill often offer assistance and there are independent organisations with capital to spare who are willing to enter into leas ng agreements.

Leasing is, of course, -tiot merely confined to the acquisition of vehicles. It can be u ed to obtain all kinds of plant and machinery as well as containers, pallets, telephone and telecommunications equipment, office furniture and machinery such as copying machines and so on. The main advantage is that it reserves capital, which would otherwise be tied up in fixed assets, for other activities.

There are other, less obvious, advantages however. Because it involves a series of regular payments, it can assist with budgeting and management forward planning such as cash flow forecasting. It might also be considered a hedge against inflation from the fact that the future cash outgoings are based on prices and trends current when the lease is negotiated. The lessor has, therefore, no way of increasing the payments to counter interim increases which would otherwise affect the transaction. This last can be a doubleedged weapon for neither has the lessee any option about terminating the lease though some organisations will tailor the lease to end at alternative periods, usually with a penalty clause if it is terminated at one of the earlier stipulated dates.

The lessee never actually owns the equipment leased and the capital allowances available for the purchaser is claimed by the lessor. This is usually reflected in the payments which the lessee is asked to undertake so that in effect he does benefit from such capital allowances. As well, the payments are an allowable expense against the lessee's assessment for Corporation Tax.

Returnable

While the equipment does not become the property of the lessee, and it becomes returnable to the lessor at the end of the lease, the lessee will benefit from the residual value of the returned asset. The sum realised on the sale of the equipment is either passed to the lessee after a cash adjustment for expenses incurred or set off against the next leasing agreement.

If all these apparent advantages appeal to the prospective lessee, then he should consider how and from where he is to obtain the lease.

As already stated, the finance houses are an obvious source but not necessarily the best or only source. Certainly they should be asked to quote so that comparison may be made with any other organisations approached. In any case, it is advisable, especially now, to shop around even between the different finance houses.

The next obvious source for vehicle leasing is among the leasing schemes offered through the organisation set up by the vehicle manufacturers for this purpose. This will, however, restrict your choice of vehicle to those produced by the relevant manufacturer.

Most manufacturers have schemes of this nature though British Leyland and DAF, for instance, do not themselves operate the scheme. British Leyland encourages its dealer ship to offer leasing facilities on an individual basis and DAF organises the scheme for its dealers though it is up to the dealer himself to operate it.

Certainly Bedford, Ford and Foden have vehicle finance and leasing plans and it might be useful to use these as examples though they are not the only manufacturers' finance schemes available.

The Bedford scheme is known as Master Hire and a lease under this scheme can run up to three years on vans and longer on trucks. On the larger vehicles, the mainten ance charges might be subject to periodic review if this is included. Contracts can be flexible and tailored to the requirements of the lessee within laid down parameters.

Ford financing is obtained through the company's Ford Motor Credit Co Ltd operating through the dealer network. This does, in fact, offer contract hire and conditional sale as well as leasing facilities.

Under this scheme, security is taken in the vehicles only and no other assets of the lessee are affected. At the end of the original, or primary, period the operator returns the truck to Ford Credit which will dispose of it and credit the sale proceeds to the operator. Alternatively, the operator has the option of entering into a secondary— more indefinite—period if he so desires.

Types of lease

There are various types of leasing available from Ford as there are with other manufacturers. These include full amortized leases where the asset is fully depreciated over the life of the lease; open-ended leasing in which the customer bears the risk of depreciation and the capital repayment is related to an anticipated depreciation figure, and net finance out maintenance and contract hire with maintenance.

Foden has a triple-option leasing plan. The first of these options is the payment of a fixed basic rate for a maximum of five years, the second option involves an agreed payment for servicing to be included and the third adds a vehicle replacement clause involving replacement of the vehicle if it is off the road for 48 hours or more.

The permutations can be virtually endless, that is why it will pay to shop around to see what can be had for the least money.

If you prefer that somebody else should shop around for you, you might like to consider an organisation like Commercial Truck Services in Bolton.

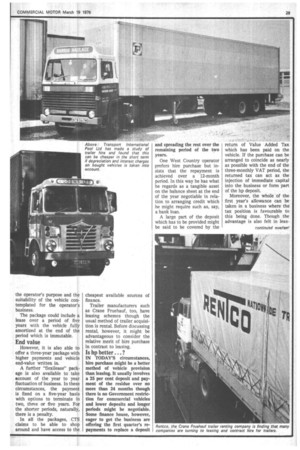

CTS offers what really amounts to a leasing consultancy service. This includes a complete financial package though, if the operator so desires, CTS will advise initially on the suitability of leasing for the operator's purpose and t suitability of the vehicle co templated for the operator business.

The package could include lease over a period of fi years with the vehicle full amortized at the end of t period which is immutable.

End value

However, it is also able t offer a three-year package wit-1 higher payments and vehic e end-value written in.

A further "flexilease" pac age is also available to ta account of the year to ye fluctuation of business. In the circumstances, the payme is fixed on a five-year bas with options to terminate two, three cc five years. F the shorter periods, natural] there is a penalty.

In an the packages, CT claims to be able to sho around and have access to t cheapest available sources of finance.

Trailer manufacturers such as Crane Fruehauf, too, have leasing schemes though the usual method of trailer acquisition is rental. Before discussing rental, however, it might be advantageous to consider the relative merit of hire purchase in contrast to leasing.

Is hp better ?

IN TODAY'S circumstances, hire purchase might be a better method of vehicle provision than leasing. It usually involves a 25 per cent deposit and payment of the residue over no more than 24 months though there is no Government restriction for commercial vehicles and lower deposits and longer periods might be negotiable. Some finance house, however, eager to get the business are offering the first quarter's repayments to replace a deposit and spreading the rest over the remaining period of the two years.

One West Country operator prefers hire purchase but insists that the repayment is achieved over a 12-month period. In this way he has what he regards as a tangible asset on the balance sheet at the end of the year negotiable in relation to arranging credit which he might require such as, say, a bank loan.

A large part of the deposit which has to be provided might be said to be covered by the return of Value Added Tax which has been paid on the vehicle. If the purchase can be arranged to coincide as nearly as possible with the end of the three-monthly VAT period, the returned tax can act as the injection of immediate capital into the• business or form part of the hp deposit.

Moreover, the whole of the first year's allowance can be taken a business where the tax position is favourable to this being done. Though the advantage is also felt in leas ing through the payments over a protracted period, with hire purchase it is of a more immediate nature.

For the operator with a large fleet and a heavy replacement programme, the alternative might be a mixture of leasing and hire purchase.

For instance, a batch of 30 replacement vehicles might be financed with the largest number of vehicles on lease that can be compatible with the largest capital allowance in relation to the company's tax position. This might be say, 10 leaving a further 20 vehicles to be purchased on hire purchase.

In this way the operator can get the best of both worlds by absorbing his capital allowance to the limit of his tax ability and also take advantage of the more attractive factors included in hire purchase.

The finance house, on its part, will be happy to get the busines and will inevitably offer the most advantageous hire purchase and leasing terms to obtain it.

... Or contract hire?

CONTRACT HIRE and rental are really horses of the same colour. The first implies a contract drawn up to cover a period longer than about 12 months while the second involves the more short-term use of a vehicle or trailer.

However, it is interesting to note that the reluctance of some companies to commit themselves to contracts which might be as long as five years has brought about some rethinking on the part of contract hire companies.

British Road Services, for instance, now offers a more flexible contract hire arrangement based on a period shorter than five years which has been considered the normal contract in relation to the vehicle life.

The optional contract charging system which BRS now offers links price changes to the Retail Price Index and involves an increasing contract charge with considerably lower charges at the beginning of the hire period.

In the trailer field, Crane Fruehauf's Rentco organisation has had the experience of a large part of its activity-25 per cent to be precise—changing from rental to contract hire. This could reflect the reluctance of even large companies to tie up capital in fixed assets and indicates a marked change in the attractiveness of ownership.

Cost advantage

Transport International Pool Ltd, with about 7,000 trailers for rent, has found that though renting might be somewhat dearer than owning trailers, there is a cost advantage in the short term. The high cost of owning resulting from depreciation and interest charges in the early years of trailer life can mean that during that period rental charges might actually be lower. As the requirement for hired trailers is usually over a short term, there are advantages in hiring.

Other organisations offering trailers or vehicles for rent, such as York Trailers, Ryders, Godfrey Davis and Hertz to name but a few, have found that operators are turning to rental rather than ownership. The trend is not confined to general purpose vehicles but is being extended to special purpose types such as low loaders, coil carriers, tank trailers and so on.

Here again it is wise to shop around for the rental terms which are the most advantageous for these differ from rental company to rental company.

The report of the chairman of the British Vehicle Rental and Leasing Association, Mr Michael A. Bone, in the March edition of BVLA News is particularly relevant in relation to truck rental.

The effect of inflation on the truck rental industry, says Mr Bone, has been such that the trend is for some rental companies to out their rates in order to get_ the business instead of increasing them to meet increasing costs.

Though Mr Bone might deplore this, it indicates that, for the operator, there is a "buyers' market" in rental.

However, the same principle applies here as applies to the apparent advantage of cutting haulage rates to get the business. If an operator is able to obtain what appears at first to be attractive rental terms in relation to what he had obtained in the past, he should be careful to ensure that standards — of maintenance, perhaps—have not been neglected in order to make those attractive terms possible.