What’s under your cab?

Page 26

Page 28

Page 29

If you've noticed an error in this article please click here to report it so we can fix it.

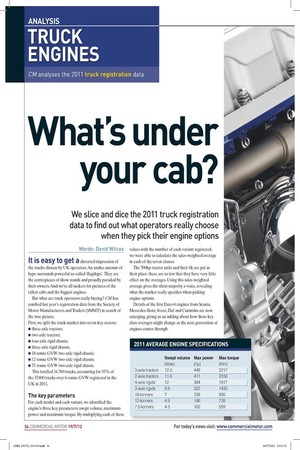

We slice and dice the 2011 truck registration data to find out what operators really choose when they pick their engine options

Words: David Wilcox It is easy to get a distorted impression of

the trucks chosen by UK operators. An undue amount of hype surrounds powerful so-called ‘lagships’. They are the centrepieces of show stands and proudly paraded by their owners. And we’re all suckers for pictures of the tallest cabs and the biggest engines.

But what are truck operators really buying? CM has combed last year’s registration data from the Society of Motor Manufacturers and Traders (SMMT) in search of the true picture.

First, we split the truck market into seven key sectors: • three-axle tractors; • two-axle tractors; • four-axle rigid chassis; • three-axle rigid chassis; • 18-tonne GVW two-axle rigid chassis; • 12-tonne GVW two-axle rigid chassis; • 7.5-tonne GVW two-axle rigid chassis.

This totalled 34,700 trucks, accounting for 93% of the 37,400 trucks over 6-tonne GVW registered in the UK in 2011.

The key parameters

For each model and each variant, we identiied the engine’s three key parameters: swept volume, maximum power and maximum torque. By multiplying each of these values with the number of each variant registered, we were able to calculate the sales-weighted average in each of the seven classes.

The 700hp tractor units and their ilk are put in their place: there are so few that they have very little effect on the averages. Using this sales-weighted average gives the silent majority a voice, revealing what the market really speciies when picking engine options.

Details of the irst Euro-6 engines from Scania, Mercedes-Benz, Iveco, Daf and Cummins are now emerging, giving us an inkling about how these key class averages might change as the next generation of engines comes through.

SWEPT VOLUME

A sales-weighted average swept volume of just 12.3 litres for three-axle tractor units seems a touch low, bearing in mind the big-hitters such as Volvo’s 12.8-, Daf’s 12.9and Scania’s 12.7-litre engines. But they are offset by Mercedes’ Actros and Axor units, both with (different) 12-litre engines. The 10.8-litre engine in Renault’s Premium and in more than 60% of Volvo’s 6x2 FM tractors also pulled down the average, as did Iveco’s 10.3-litre Cursor. At 12.4 litres, MAN’s D26 is closest to the class average, powering the majority of the TGX and TGS units that took MAN to second place in the three-axle tractor unit sector last year.

Only about 250 of the 15,000 or so three-axle units registered last year have 16-litre engines, so they have little bearing on the overall figure.

This class average seems destined to rise with the advent of Euro-6, probably to about 12.5 litres. We already know that Mercedes’ current pair of 12-litre engines will be replaced by the new 12.8-litre OM471 engine. Similarly, Iveco’s Cursor 10 will be succeeded by an 11.1-litre Cursor 11 at Euro-6.

Mercedes’ heavy influence

The average swept volume of engines powering two-axle tractors was 11.9 litres, heavily influenced by the fact that more than 35% of all the units in this sector are 12-litre Mercedes Axors. The average was depressed by the overwhelming majority of two-axle Volvo FM buyers deciding that the Renault-derived 10.8-litre engine, rather than Volvo’s 12.8-litre engine, was perfectly good enough.

Conversely, despite working at no more than 32-tonne GVW, even weight-conscious tipper, tanker and mixer buyers seem reluctant to forego cubic capacity, keeping the 8x4 class average at a generous 12 litres. In this sector more Volvo FM/FMX buyers chose 12.8 litres instead of 10.8 litres. Similarly, the majority of Daf’s customers prefer the 12.9-litre MX rather than the 9.2-litre PR in their 8x4 chassis.

The additional weight of Euro-6 engines and their emissions kit might persuade 8x4 buyers to consider smaller engines. Mercedes’ forthcoming OM470, to be fitted in lighter Actros tractors and multi-wheelers, should fit the bill. It is a straight-six 10.7-litre engine with outputs ranging from 355hp to 422hp. It weighs 150kg less than the 12.8-litre OM471 in the new Actros and 50kg less than the OM457 in the current Axor, despite the extra Euro-6 emissions kit. Because it has precisely the same design life as the OM471, says Mercedes, durability is not an issue.

Averages commensurate with gross weight

The averages in the other sectors are broadly commensurate with gross weights. The 7-litre average in the 18-tonne sector disguises a diversity of swept volumes, from Iveco’s 5.9-litre Tector engine in the Eurocargo to Scania’s 9.3-litre five-cylinder engine. This is another sector where the average seems set to edge up in the Euro-6 era, even though the Cummins six-cylinder ISBe in the top-selling Daf models is to remain at 6.7 litres.

Mercedes’ new OM936 engine for 18-tonners is a 7.7-litre unit, replacing the current 6.4-litre engine: come Euro-6, the swept volume of Iveco’s six-cylinder Tector engine goes up from 5.9 litres to 6.7 litres.

Euro-6 will have a similar effect on 7.5-tonners, where Mercedes engines will go up from 4.25 litres to 5.1 litres and Iveco’s fourcylinder Tectors are enlarged from 3.9 litres to 4.5 litres. With swept volumes of 5.2 litres and 3 litres respectively, Isuzu and Fuso are nowhere near the current class average of 4.3 litres, but illustrate the point that there are more ways than one to skin a 7.5-tonne cat.

The current generation of engines is capable of higher specific outputs than ever before, with engines such as Renault’s gutsy 10.8-litre DXi11 (and Volvo’s D11C variant) packing a huge punch. That helped to depress the average swept volume in the tractor unit sector during 2011, but so far there is little other evidence of the downsizing that is the talk of the car business these days. Iveco’s 3-litre engine in 7-tonne GVW Dailys and 7.5-tonne GVW Fuso Canters is a step in that direction, but as far as the mainstream truck market is concerned, average engine size at Euro-6 is likely to rise, not fall.

POWER

Right at the outset we stress that our class average calculations are based on imperial horsepower conversions from the kW ratings. This means they are 1.4% lower than PS or metric hp figures in specifications and rounded up for nominal ratings on badges.

It was not that long ago that any tractor unit’s power rating starting with a ‘4’ was impressive. But our analysis shows that as far as three-axle tractors are concerned, that ‘4’ now needs to be half way to a ‘5.’ The 2011 class average stands at 449hp: the average nominal rating on their badges is 455hp. We expect the true average to rise to 460hp once Euro-6 is fully implemented.

The 411hp average for 4x2 tractors is pretty much in line with the three-axle average, bearing in mind the reduction in gross plated weight.

Looking at the tractor unit market as a whole, totalling around 18,400, just shy of 7% had nominal power ratings of 500hp or more. And many of them were right on the cusp, sporting a 500 badge but an imperial hp rating of 493hp. Just 3% of all tractors had an indisputable imperial 500hp-plus.

There are still lots of 400hp tractors out there

Tractors with less than 400hp are perceived by some to be dead in the water these days, but our analysis of the SMMT 2011 data shows they are slightly more numerous than those with more than 500hp. Just over 3% of all new tractor units registered last year have nominal power ratings starting with a ‘3,’ but if you include those bearing a 400 badge (ie an imperial rating of 394hp) that proportion rises to almost 7%.

It is unwise to hang too much on the data for three-axle rigid chassis. This is a complex sector populated by a variety of refuse collection vehicles (RCVs), 6x4 tippers, an increasing number of 6x2 distribution vehicles and a liberal sprinkling of drawbar prime-movers. The average of 322hp is skewed downwards by just over 1,000 RCVs (about a quarter of the entire three-axle sector), most with 290hp300hp. The three-axle distribution vehicles have anything from 280hp to 340hp; many of the drawbars boast more than 400hp. Limiting 7.5-tonners to no more than 90km/h (56mph) a few years ago should have reined back the gradual rise in their power ratings over the years. Nevertheless, last year’s average of 162hp still leaves these little trucks with 21.6hp/tonne, the healthiest of all the sectors analysed.

And having seen Mercedes’ and Iveco’s Euro-6 engine plans, that figure seems certain to rise. Even the least powerful version of Mercedes’ new 4-cylinder 5.1-litre OM904 engine is 154hp and there are three ratings above that, topping out at 228hp. Iveco’s new 4.5-litre Tector will come in 158hp, 184hp and 204hp variants.

If you are thinking of moving up from 7.5 tonnes to 12 tonnes, the market there averages out at just under 200hp. In fact, very few 12-tonners fit that profile. More than 40% have nominal ratings of 180hp and about 25% have 220hp badges, so those are the main two power options. The balance comprises trucks with 160hp, 210hp, 240hp and 250hp ratings. This broad spread just happens to produce a sales-weighted average that is an atypical 196hp.

TORQUE

Due to automated gear-shifting, it is rare to extract every last bit of horse-power out of a big truck’s engine. More than ever before, the emphasis instead is on making full use of torque – and what a lot there is. The average for three-axle tractors registered last year is a mighty 2,217Nm, with 4x2 units at 2,036Nm. Considering what’s in store for us at Euro-6, we expect those averages to rise to 2,265Nm and 2,075Nm. On the basis that Euro-6 will bring a slight increase in the swept volume of 18-tonners’ engines too, their average torque figure will likely kick upwards as well. Our analysis shows that it stood at 930Nm last year; we suspect it will stand at about 980Nm in a few years’ time. All Scania’s P-series and MAN’s TGM 18-tonners already exceed this projected torque value, driving up the class average. Conversely, the most popular (240hp nominal) rating of the 6.4-litre engine in Mercedes’ Axor 18-tonner offers a below-par 850Nm. The comparable rating of the 7.7-litre OM936 Euro-6 engine in the Axor’s replacement, the Antos, boasts a far healthier 1,000Nm – hence our assertion that this is yet another class average on the up.