A MODEL FOR DEREGULATION

Page 61

Page 62

Page 63

If you've noticed an error in this article please click here to report it so we can fix it.

New Zealand has pre-empted Britain in liberalising its PSV services, but operating conditions there are very different. Allan Winn reports

• Although it has a very similar land area to Britain, New Zealand has a population of just 3.5 million people, roughly two thirds of whom live on the northern of the two main islands. With such a thinlydistributed population, road transport is highly important, especially as there is little economic justification for a comprehensive rail network. Even so, there are fewer than 90,000km of classified roads in the country, with around one third of those being unsealed gravel.

Despite the importance of road transport, it was traditionally limited to a feeder system to the government-owned railways. At its most restrictive, this prevented hauliers from competing with more than 64.3km (40 miles) of railway except for carrying special "exempt" loads. Conversely, in certain parts of the country the lack of a railway prompted the authorities to declare the road transport system to be a "notional railway", on which haulage rates and passenger fares were subsidised to bring them into line with those prevailing on the railways. The railways also operated (and still do) both long-distance and feeder bus and coach services.

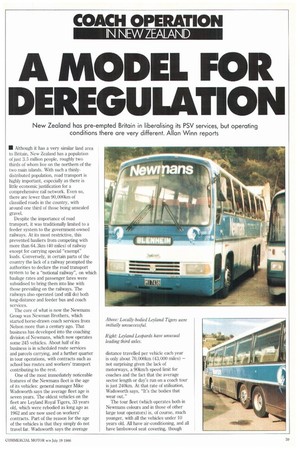

The core of what is now the Newmans Group was Newman Brothers, which started horse-drawn coach services from Nelson more than a century ago. That business has developed into the coaching division of Newmans, which now operates some 245 vehicles. About half of its business is in scheduled route services and parcels carrying, and a further quarter in tour operations, with contracts such as school bus routes and workers' transport contributing to the rest.

One of the most immediately noticeable features of the Newmans fleet is the age of its vehicles: general manager Mike Wadsworth says the average fleet age is seven years. The oldest vehicles on the fleet are Leyland Royal Tigers, 33 years old, which were rebodied as long ago as 1962 and are now used on workers' contracts. Part of the reason for the age of the vehicles is that they simply do not travel far. Wadsworth says the average

distance travelled per vehicle each year is only about 70,000km (43,000 miles) — not surprising given the lack of motorways, a 90km/h speed limit for coaches and the fact that the average sector length or day's run on a coach tour is just 240km. At that rate of utilisation, Wadsworth says, "It's the bodies that wear out."

The tour fleet (which operates both in Newmans colours and in those of other large tour operators) is, of course, much younger, with all the vehicles under 10 years old. All have air-conditioning, and all have lambswool seat covering, though reclining seats have only arrived in the past two years. Most are air-suspended, but none has a toilet — with such short journey distances, and frequent stops on tourist routes to take in the scenery, toilets are not considered essential. Couriers are rare, being used only for Japanese tour parties — elsewhere the driver has a voice-actuated microphone.

To European eyes the coaches seem low — and they are. Although the legal maximum height is similar to Britain's at 4.2m, Newmans runs nothing higher than 3.5m so that it can guarantee getting under the cross-bracing of New Zealand's distinctive timber truss bridges (plant superintendent Ken Richardson says there is one on one of Newmans' routes actually labelled at 3.4m . . ).

Almost half of the Newmans fleet is now Volvo, with 110 of them expected to be in service by the end of this year. A return to traditional British suppliers was made a couple of years ago with eight Leyland Tiger 245s, but they have not been as successful as hoped. Because of New Zealand's very low weight limits on two-axled vehicles, all new Newmans coaches are three-axled, and the Leyland-approved local tag-axle conversion of the Tigers put undue strain on their chassis, which cracked. The Tigers have also turned out to be almost 0.5 tonne heavier than Volvo BlOMs with the same bodywork, and are heavier on tyres and fuel according to Richardson.

All of the bodywork on Newmans coaches is locally-made, nowadays by Coachwork International in which the Newmans Group has a stake. Having tried all-alloy coachwork, the company has reverted to aluminium-clad steel framed bodies for rollover strength. The observant European would recognise the Plaxtons front screen on the current bodies, but probably not the side glass which comes from Denning in Australia. The choice of Volvo or Leyland chassis is largely dictated by the need to keep rear axle weight down, which favours an underfloor engine over a rear engine. Newmans did buy numbers of the midengined Mercedes-Benz 037, but with that model's demise the German marque fell from favour.

The total market for PSVs in New Zealand is very small: it amounted to just 219 large and 38 small buses and coaches last year. Among the premium chassis builders, Volvo was market leader with 43 registrations: the other significant Europeans were MAN with 21 and Leyland with 14, while the Bedford name (usually attached to a Japanese lsuzu chassis here in New Zealand featured on 27 light (under 3,500 kg) and 11 heavy vehicles. The big sellers are Isuzu in its own right with 66 registrations, and Hino with 41 — many of these are urban bus chassis.

The most distinctive thing about Newmans coachwork is that much of it is dual-purpose, because of the company's heavy involvement in parcels work.

Wadsworth says that across the country, some 45% of the company's route-service revenue came from parcels. This has led to the use of `composites' designed to carry passengers and freight. There are 21 of these (plus another three 'semicomposites' with less freight capacity) in Newmans service. Each has seating for 21, with 27m3 of freight area behind.

Wadsworth says the company could go even further, to 'passenger trucks' on which it could have exemption from some of the goods haulage restrictions, but as he points out with a new coach costing anything up to $NZ300,000 (about 210,000) "That's a very expensive fivetonne truck!" In addition to its express parcels service, Newmans takes on a much more social role in some of the more isolated areas of the country. As the only regular scheduled operator, it takes on deliveries of newspapers, mail and even milk on coach services.

Apart from the actual axle-weight restrictions, there is a strong incentive to run three axles on New Zealand coaches. Commerical vehicles there are taxed on 'road-user charges' based on declared vehicle weight and configuration and actual distance travelled, as measured by the legally-required hub odometer.

Richardson points out that a three-axle coach costs the company only $122/1,000km in road-user charges, against 8200/1,000km for the same-weight vehicle on two axles.

While hub odometers are compulsory, tachographs are not: Newmans has about 10 vehicles fitted with them, for use in route proving and driver workload monitoring. Any temptation to fit them to all vehicles is resisted, says Wadsworth, because of the cost of analysis apart from anything else, with up to four drivers using each coach every day. Drivers are allowed two 51/2-hour shifts per day, with a minimum 30-minute rest period in the middle.

The conditions under which these vehicles and drivers operate differ greatly from those of a couple of years ago in New Zealand, and from those of today in Britain. New Zealand introduced what it refers to as 'Qualitative Licensing' in 1983 for trucks, and in 1984 for PSVs. Under this, licences are quite freely available. Wadsworth describes the system as "loose", pointing out that there's nothing to stop an operator getting a licence for a minibus and then using a 45-seater.

Under the system, existing operators cannot oppose the granting of a licence to a new operator on economic grounds alone. The only real basis for an objection is the public interest — a successful objection would have to show both that there is an adequate service already and that the existing operator would suffer economic hardship if the new licence were granted.

The effect, says Wadsworth, is that there can now be three operators where before there was only one — although this has not showed up as much in the tours field. That is largely because even before the changes it was relatively easy to get a tours licence if the vehicle operator had the backing of a tour company.

Freeing of bus licensing has coincided with a hefty cut in urban transport subsidies: the most dramatic eivdence of that being a recent rise in fares in the capital, Wellington, by 40%. Although moves like this might seem to open the way for competition, there are snags. Wadsworth points out, for instance, that there are few financial gains to be made from running minis or midis rather than full-size buses in New Zealand, as the wage costs are the same for all sizes of vehicle.

The next stage in the deregulation process is to be the putting-out to tender of school bus routes. With a population spread so thinly, school buses are an essential part of New Zealand's life. In the past, these school runs have been handed down on a "father's rights" sort of system, never tendered for. Operators have been paid for their services on a formula based on vehicle value, with the total coming to some $NZ60 million a year. Now, it seems, some 2,500 school bus runs are going to be put out to tender in the next three years — a situation which Wadsworth predicts may lead to "a degree of chaos. . . "Concern has been voiced that competitive tendering may lead to a lowering of standards in the vehicles. El