MAKING THE MOST OF MONEY continued

Page 54

If you've noticed an error in this article please click here to report it so we can fix it.

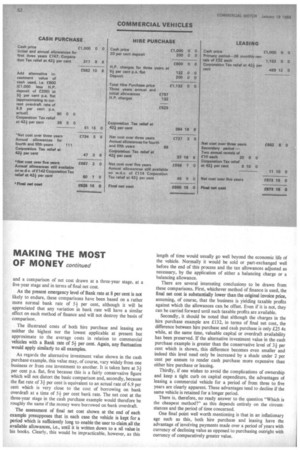

and a comparison of net cost drawn at a three-year stage, at a five-year stage and in terms of final net cost.

As the present emergency level of Bank rate at 8 per cent is not likely to endure, these comparisons have been based on a rather more normal bank rate of 5+ per cent, although it will be appreciated that any variation in bank rate will have a similar effect on each method of finance and will not destroy the basis of comparison.

The illustrated costs of both hire purchase and leasing are neither the highest nor the lowest applicable at present but approximate to the average costs in relation to commercial vehicles with a Bank rate of 5+ per cent. Again, any fluctuation would apply similarly to all examples.

As regards the alternative investment value shown in the cash purchase-example, this value may, of course, vary widely from one business or from one investment to another. It is taken here at 3+ per cent p.a. flat, first because this is a fairly conservative figure which will not distort the basic comparison and, secondly, because the flat rate of 3+ per cent is equivalent to an actual rate of 6.9 per cent which is very close to the cost of borrowing on bank overdraft at a time of 5+ per cent bank rate. The net cost at the three-year stage in the cash purchase example would therefore be roughly the same if the money were borrowed on bank overdraft.

The assessment of final net cost shown at the end of each example presupposes that in each case the vehicle is kept for a period which is sufficiently long to enable the user to claim all the available allowances, i.e., until it is written down to a nil value in his books. Clearly, this would be impracticable, however, as this length of time would usually go well beyond the economic life of the vehicle. Normally it would be sold or part-exchanged well before the end of this process and the tax allowances adjusted as necessary, by the application of either a balancing charge or a balancing allowance.

There are several interesting conclusions to be drawn from these comparisons. First, whichever method of finance is used, the final net cost is substantially lower than the original invoice price, assuming, of course, that the business is yielding taxable profits against which the allowances can be offset. Even if it is not, they can be carried forward until such taxable profits are available.

Secondly, it should be noted that although the charges in the hire purchase example are .E132, in terms of final net cost, the difference between hire purchase and cash purchase is only £25 4s while, at the same time, valuable capital or overdraft availability has been preserved. If the alternative investment value in the cash purchase example is greater than the conservative level of 34 per cent which is shown, this difference becomes even smaller and indeed this level need only be increased by a shade under 2 per cent per annum to render cash purchase more expensive than either hire purchase or leasing.

Thirdly, if one wishes to avoid the complications of ownership and keep a tight curb on capital expenditure, the advantages of leasing a commercial vehicle for a period of from three to five years are clearly apparent. These advantages tend to decline if the same vehicle is retained for a longer period.

There is, therefore, no ready answer to the question "Which is the cheapest method?" as this depends entirely on the circumstances and the period of time concerned.

One final point well worth mentioning is that in an inflationary age such as this, both hire purchase and leasing have the advantage of involving payments made over a period of years with currency of declining value as opposed to purchasing outright with currency of comparatively greater value.