FIGHTING FOIl CHEAP LITR

Page 36

Page 37

If you've noticed an error in this article please click here to report it so we can fix it.

Now is the time to shop around for a better deal on derv. Karen Miles looks at sor cost saving ideas

• Operators complain about the size of their 'excessive' fuel bills — oil companies say they are the victims of a 'highly competitive' market. Who is right?

The 96,000 commercial operators in Britain between them run more than 434,000 vehicles, and all these tanks are filled by 12 or so oil companies.

According to the oil industry — and to those operators forced to admit it — the past year has seen heavy fuel bill rebating. Presumably operators have used their teeth to bite into the oil companies' Achilles heel: falling world oil prices. Privately, senior oil industry sources have said that if operators have not bee canny enough to capitalise, then it's the: fault.

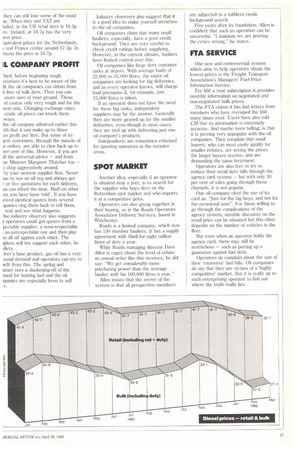

Oil Price Assessments, the independent company which monitors oi prices in the UK and Europe, also watches retail and bulk dery prices. Its figures show that February 1985 saw the average net bulk price of a litre of dery at around 36.5p and since then the price has fallen just under nine penc to the present 27.7p. Over the same period retail dery prices have fallen fron 42.7p to the present average of 39.1p a litre.

So, looking at the bulk negotiated prices, how does you company fare? Don't shoot yourself if you wonder whei you have gone wrong — remember it's only an average. But if you have hit the mark exactly don't be complacent.

It's a good idea to push the oil companies now. Despite the death, dooi and disaster which presently surrounds the oil market, oil experts are predictini that barrel prices will rise again very soon. When this happens operators will lose the psychological edge that they have gained through the present rock bottom barrel prices.

Before you start nailing the oil companies to the floor it's important to note three points.

First, there is no point in changing your supplier just for a decimal point improvement in price. Good reliable, guaranteed and understanding service must not be forgotten.

Second, the well-aired opinion among operators that they pay the highest fuel bills in Europe is true, but the blame car be placed at the Government's door, not the oil companies'. At present, duty alone stands at 16.39p a litre.

.Excluding duty and VAT, at $184 per m3, the UK bulk dery price is the lowesi in Europe. The Netherlands, for example, stands $10 per m3 above it.

The picture is not quite so rosy for th oil companies when retail dery is studied they can still lose some of the usual ne. When duty and VAT are luded, in the UK retail dery is 19.2p re. Ireland, at 24.7p has the very lest price.

1quivalent prices for the Netherlands, and France centre around 17.5p. In many the price is 16.7p.

IL COMPANY PROFIT

'bird, before beginning tough otiations it's best to be aware of the fit the oil companies can obtain from h litre of bulk derv. Then you can more sure of your ground. These of course only very rough and for the sent only. Changing exchange rates crude oil prices can knock them rways.

)ne oil company admitted earlier this ath that it can make up to three .ce profit per litre. But some of its ;est customers, through the muscle of e orders, are able to claw back up to per cent of this. However, if you are ill the universal advice — and from ne Minister Margaret Thatcher too — o shop aggressively around.

1'ry your nearest supplier first. Never ise to see an oil rep and always get r or five quotations for each delivery, ou can afford the time. Bluff on other :es you have been 'told'. If you have eived identical quotes from several npanies ring them back to tell them, wait and see what happens.

)ne industry observer also suggests t operators could get quotes from a pectable supplier, a semi-respectable Ian unrespectable one and then play m all off against each other. The pliers will not support each other, he dicts.

)erv's base product, gas oil has a very sonal demand and operators can try to iefit from this. The spring and nmer sees a slackening-off of the nand for heating fuel and the oil npanies are especially keen to sell -v.

Industry observers also suggest that it is a good idea to make yourself attractive to the oil companies.

Oil companies claim that many small hauliers, especially, have a poor credit background. They are very careful to check credit ratings before supplying. However, in the current climate, hauliers have limited control over this.

Oil companies like large dery container tanks at depots. With average loads of 22,000 to 24,000 litres, the major oil companies are looking for big deliveries, and as every operator knows, will charge load premiums if, for example, just 15,0(10 litres is taken.

If an operator does not have the need for these big tanks, independent suppliers may be the answer. Generally they are more geared up for the smaller deliveries, even though in most cases, they are tied up with delivering just one oil company's products.

Independents are sometimes criticised for ignoring operators in the remoter areas.

SPOT MARKET

Another idea, especially if an operator is situated near a port, is to search for the supplier who buys dery on the Rotterdam spot market and who imports it at a competitive price.

Operators can also group together in their buying, as in the Roads Operators Association Delivery Services, based in Winchester.

Roads is a limited company, which now has 130 member hauliers. It has a supply agreement with Shell for eight million litres of dery a year.

While Roads managing director Dave Allen is cagey about the level of rebate an annual order like this receives, he did say: "We get considerably more purchasing power than the average haulier with his 100,000 litres a year."

Allen insists that the secret of the system is that all prospective members are subjected to a ruthless credit background search.

Five years after its foundation, Allen is confident that such an operation can be successful. "I maintain we are proving the cynics wrong," he states.

FTA SERVICE

One new and controversial system which aims to help operators obtain the lowest prices is the Freight Transport Association's Managers' Fuel Price Information Service.

For £60 a year subscription it provides monthly information on negotiated and non-negotiated bulk prices.

The F-rA claims it has had letters from members who have recouped the £60 many times over. Users have also told CM that its information is extremely accurate. And maybe more telling, is that it is proving very unpopular with the oil companies. They complain that small buyers, who can most easily qualify for smaller rebates, are seeing the prices the larger buyers receive, and are demanding the same treatment.

Operators are also free to try to reduce their retail dery bills through the agency card system — but with only 10 per cent of sales going through these channels, it is not popular.

One oil company cited the use of its card as: "Just for the big boys, and not for the occasional user". For those willing to go through the complications of the agency system, sizeable discounts on the retail price can be obtained but this often depends on the number of vehicles in the fleet.

But even when an operator holds the agency card, there may still be restrictions — such as putting up a guarantee against bad debt.

Operators do complain about the size of their 'excessive' fuel bills. Oil companies do say that they are victims of a 'highly competitive' market. But it is really up to each enterprising operator to find out where the truth really lies.