Accidental strategist

Page 24

Page 25

If you've noticed an error in this article please click here to report it so we can fix it.

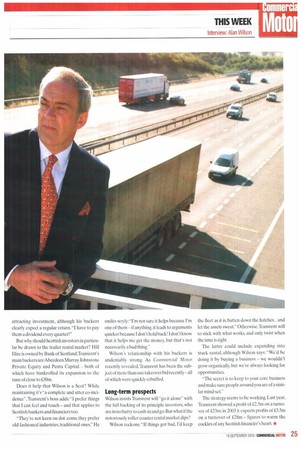

Not everyone wants to be number one. Hav ing steered Transient from "enfant terrible" to mature market player, 11/D Alan Wilson is happy to stick rather than twist — and bust.

Brian Weatherley learns why.

AskAlartWilson if he wants fourth-placed Transrent to top the UK trailer rental league and he recoils in mock horror. "No! In fact I don't even want to get to number three! I see no point whatsoever in trying to do so."

That's typical Wilsonspeak' — short, sharp and to the point. Offer an opinion he concurs with, and he invariably replies "correct".

But he's by no means monosyllabic. Quizzed on the current state of the UK trailer rental market, Wilson stretches out of his seat, moves straight to a flipchart in the corner of the room and delivers a precise, and impressively off-thethe-cuff five-minute overview, which includes all the major movers and shakers.

It's the kind of bottom-line presentation that investors (and journalists) love.

Yet for all his protestations,Transrent's star could continue to ascend, albeit by default.

"If we do, it will be by accident not design," acknowledges Wilson. Depending on who you talk to, TIP and Transamerica (in first and second place) are either treading water or have gone away altogether, while their owners GE Capital and AEGON wrestle with longterm strategy.

According to Wilson, that's provided third and fourth-placed Hill Hire and Transrent with some real 'open-field' running.

"The reality in the marketplace is more often than not that TIP and Transamerica aren't being asked to quote — it's more likely to be Hill Hire or us in the frame.

Transrent has 5,500 trailers under its direct control and ownership, with a further 2,500 "managed" — meaning the assets are not on its books.

Endless renewal

Fleet utilisation is currently running at 84.6%. -That's exactly the same as three years ago and significantly higher than our competitors," says Wilson, who insists he'll peg the fleet at 6,500 trailers.

"That's where the plan takes us; any more will be 'off the books'." The message is clear: residual exposure will be firmly capped. So how well has Wilson handled his residuals —especially as Transrent has already completed its first fleet renewal cycle while celebrating its fifth birthday in March?

His answer is instructive. -We've sold 500 already and made money on them on all of them bar 2.5%. We did better than our original predictions." Moreover, every one was retailed to end users. "I achieved .E10,000 on a five-year old trailer based on its condition plus maintenance records and the modern spec that's what did it." When we politely suggest that the original residual values may have been "soft", Wilson grimaces; " You have to do it like this — there isn't any other way.

"You've got to rotate your stock at 10% per annum in order to keep your fleet fresh, and that means selling every year."

Transrent's modern fleet has been a clear drawing card in the marketplace — as has Wilson's undoubted record when it's come to attracting investment, although his backers clearly expect a regular return. "I have to pay them a dividend every quarter!"

But why should Scottish investors in particular be drawn to the trailer rental market? Hill hire is owned by Bank of Scotland;Transrent's main backers are Aberdeen Murray Johnstone Private Equity and Penta Capital — both of which have bankrolled its expansion to the tune of close to £30m.

Does it help that Wilson is a Scot? While maintaining it's "a complete and utter co-incidence", Transrent's boss adds: "I prefer things that I can feel and touch — and that applies to Scottish bankers and financiers too.

"They're not keen on dot. corns. they prefer old fashioned industries, traditional ones." He smiles wryly:"I'm not sure it helps because I'm one of them — if anything, it leads to arguments quicker because I don't hold back! I don't know that it helps me get the money. but that's not necessarily a had thing."

Wilson's relationship with his backers is undeniably strong. As Commercial Motor recently revealed. Transrent has been the subject of more than one takeover bid recently—all of which were quickly rebuffed.

Long-term prospects Wilson insists Transrent will -go it alone" with the full backing of its principle investors, who are in no hurry to cash-in and go. But what if the notoriously roller-coaster rental market dips?

Wilson reckons: "If things got bad, I'd keep the fleet as it is, batten down the hatches... and let the assets sweat." Otherwise,Transrent will to stick with what works, and only twist when the time is right.

The latter could include expanding into truck rental, although Wilson says: "We'd be doing it by buying a business — we wouldn't grow organically. but we're always looking for opportunities.

"The secret is to keep to your core business and make sure people around you are of a similar mind-set."

The strategy seems to be working. Last year, Transrent showed a profit of L2.5m on a turnover of £23m: in 2003 it expects profits of £3.5m on a turnover of £28m — figures to warm the cockles of any Scottish financier's heart. •