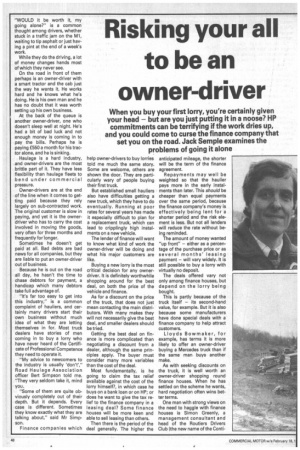

Risking your all to be an owner-driver

Page 50

Page 51

If you've noticed an error in this article please click here to report it so we can fix it.

When you buy your first lorry, you're certainly given your head — but are you just putting it in a noose? HP commitments can be terrifying if the work dries up, and you could come to curse the finance company that set you on the road. Jack Semple examines the problems of going it alone

"WOULD it be worth it, my going alone?" is a common thought among drivers, whether stuck in a traffic jam on the Ml, waiting to tip asphalt or just having a pint at the end of a week's work.

While they do the driving, a lot of money changes hands most of which they never see.

On the road in front of them perhaps is an owner-driver with a smart tractor and the cab just the way he wants it. He works hard and he knows what he's doing. He is his own man and he has no doubt that it was worth setting up his own business.

At the back of the queue is another owner-driver, one who doesn't sleep well at night. He's had a bit of bad luck and not enough money is coming in to pay the bills. Perhaps he is paying £550 a month for his tractor alone, and he is sinking.

Haulage is a hard industry, and owner-drivers are the most brittle part of it. They have less flexibility than haulage fleets to bend under commercial pressure.

Owner-drivers are at the end of the line when it comes to getting paid because they rely largely on sub-contracted work. The original customer is slow in paying, and yet it is the ownerdriver who has to carry the cost involved in moving the goods, very often for three months and frequently for longer.

Sometimes he doesn't get paid at all. Bad debts are bad news for all companies, but they are liable to put an owner-driver out of business.

Because he is out on the road all day, he hasn't the time to chase debtors for payment, a handicap which many debtors take full advantage of, "It's far too easy to get into this industry," is a common complaint of hauliers, and certainly many drivers start their own business without much idea of what they are letting themselves in for. Most truck dealers have stories of men coming in to buy a lorry who have never heard of the Certificate of Professional Competence they need to operate it.

"My advice to newcomers to the industry is usually 'don't'," Road Haulage Association officer Bert Simpson told me. "They very seldom take it, mind you.

"Some of them are quite obviously completely out of their depth. But it depends. Every case is different. Sometimes they know exactly what they are talking about," said Mr Simpson.

Finance companies which help owner-drivers to buy lorries told me much the same story. Some are welcome, others are shown the door. They are particularly wary of people buying their first truck.

But established small hauliers also have difficulties getting a new truck, which they have to do eventually. Running at poor rates for several years has made it especially difficult to plan for a replacement truck, which can lead to cripplingly high instalments on a new vehicle.

The lender of finance will want to know what kind of work the owner-driver will be doing and what his major customers are like.

Buying a new lorry is the most critical decision for any ownerdriver. It is definitely worthwhile shopping around for the best deal, on both the price of the vehicle and finance.

As for a discount on the price of the truck, that does not just mean contacting the main distributors. With many makes they will not necessarily give the best deal, and smaller dealers should be tried.

Getting the best deal on finance is more complicated than negotiating a discount from a dealer, although the same principles apply. The buyer must consider many more variables than the cost of the deal.

Most fundamentally, is he going to claim the tax relief available against the cost of the lorry himself?, in which case he buys on a bank loan or on HP; or does he want to give the tax relief to the finance company in a leasing deal? Some finance houses will be more keen and able to sell leasing than others.

Then there is the period of the deal generally. The higher the anticipated mileage, the shorter will be the term of the finance agreement.

Repayments may well be weighted so that the haulier pays more in the early instalments than later. This should be cheaper than equal payments over the same period, because the finance company's money is effectively being lent for a shorter period and the risk element is less. But not all lenders will reduce the rate without being reminded.

The amount of money wanted "up front" — either as a percentage of the purchase price or as several months' leasing payment — will vary widely. It is still possible to buy a lorry with virtually no deposit.

The deals offered vary not only among finance houses, but depend on the lorry being bought.

This is partly because of the truck itself — its second-hand value, for example. But it is also because some manufacturers have done special deals with a finance company to help attract customers.

Lloyds Bowmaker, for example, has terms it is more likely to offer an owner-driver buying a Mercedes truck than if the same man buys another make.

As with seeking discounts on the truck, it is well worth an owner-driver shopping round finance houses. When he has settled on the scheme he wants, hard negotiation often wins better terms.

One man with strong views on the need to haggle with finance houses is Simon Greenly, a management consultant and head of the Routiers Drivers Club (the new name of the Conti nental Freight Drivers Club). The club claims a high proportion of owner-drivers among its 3,000 members, "A lot of small operators might never take the trouble to take competitive quotes. Everything is negotiable these days," he says.

Above all, owner-drivers should get an accountant who can help them to plan their business and advise on the best form of finance for a new lorry.

A competent, impartial accountant should cost between £100 and £300 a year and his advice could be vital.

Finance houses will be impressed by owner-drivers who have an accountant. Several I contacted also identified a second strength behind some owner-drivers.

"The best people have wives who are former book-keepers (not bookies). I'm quite happy when I see that," said one finance man. "She has the whole interest of the firm at heart."

Buying a new truck is much easier than paying for it, particularly for an owner-driver, who has little to fall back on if he hits a bad spell.

Lenders see owner-drivers as particularly dangerous. "Some come along with no idea of what is involved and tell me they are going to buy a vehicle. 'Not with my money you're not' is all I say to them," one told me.

Liverpool-based TGWU officer Bob Robinson commented: "A lot of people think being an owner-driver is a get rich quick job. They are biting the dust every day."

Drivers come into some money, perhaps through redundancy, and decide to have a go, but they do not often have the business acumen needed, he said, "They get a promise of work which either doesn't materialise or doesn't last long. The HP piles up and they have only an axle to go and they go under. Its tragic.

"My advice is put your money on a horse because you get a better run for your money."

Bill Farnorth, the RHA's manager in the North-west, who has a higher proportion of ownerdrivers in his district than most, has a similar view.

Some owner-drivers run a properly managed business and do well. But others drift in with little knowledge thinking they are going to make a fortune and end up as cannon fodder for middle men in haulage, Mr Farnorth said.

Some drivers take on terrifying HP commitments and the middle men know they have to work for whatever they are offered.

"This has a domino effect on the industry as a whole and wrecks any attempt to lift rates to a proper level. It's a cancer on our industry."

Getting finance is not a problem, according to Simon Greenly. But finance companies tend to have links with makers which can lead to a conflict between the eagerness to sell a vehicle and a due regard to the owner-driver's ability to pay, he said.

Many owner-drivers are chronically short of equity capital needed to give the firm a sound base.

Finance companies are aware of the problem. "We have a duty not to give a guy a deal which could be helping him to put his head in a noose," Chris Rails of OAF Trucks Finance volunteered.

Owner-drivers are normally being asked to put down at least six months' payments on a lease deal. Finance companies generally are demanding more equity from owner-drivers. Otherwise, they get onto a treadmill they cannot get off, Mr Rails said.

The trouble with a small company buying a vehicle without putting down a deposit is that if something does go wrong — the work dries up, illness, or bad debts — there is insufficient value in the vehicle itself to pay off what is owed to the lender. Particularly if he is borrowing from a bank, he is liable to lose his house if he is a home-owner.

Around 1980, many ownerdrivers were given expensive long leasing and HP deals with virtually no cash down on signing. The haulage industry was buoyant then, but soon collapsed, and many small hauliers were left fighting a losing battle to keep up with payments. They cnuld not afford either to stop working or to carry on.

Many in the industry have been reminded of the problem by Ebro's recently announced deal on light lorries, where six months' rental is partially refunded to buyers to help pay the deposit on the lorry.

Haulage is a risk. You can make a lot of money and you can lose everything.

But as Bert Simpson commented: "Almost all RI-IA members started with one vehicle at one time or other."

Cost of repair and maintenance on a Mercedes 16255 tractive unit. The figures are supplied by Mercedes' Transport Consultancy and includes average dealer prices. Mileage is assumed to be 100,000km a year. The low cost in the first year is due to the maker's new vehicle warranty. Transport Consultancy was reluctant to estimate the cost in the sixth, seventh and eighth years owing to lack of accurate information, but guessed roughly at around £5,500. An owner-driver could save 15 per cent if he did much of the work himself well. If he did it badly, it could cost 25 per cent more.

What an owner-driver can expect to have to pay buying now. These examples* show typical deals done by Lloyds Bowmaker for small hauliers buying Mercedes' most popular tractor, the 1625S. The terms offered to individual companies, vary according to his circumstances and the finance market generally.

Advance: £26,645 excluding vat Hire Purchase: (a) £2,619.48 down on signing plus 33 monthly instalments of £873.16 (b) £1,818.51 down on signing plus 57 monthly instalments of £606.17 Leasing: (a) £2,509.17 plus vat paid as first rental on signing plus 33 monthly payments of £836.39 plus vat (b) £1,621.89 plus vat paid as first rental on signing plus 57 monthly payments of £540.63 plus vat.

*Courtesy of Lloyds Bowmaker.