Steady flow

Page 52

Page 53

If you've noticed an error in this article please click here to report it so we can fix it.

Some years ago I was asked to help a company, described by the owner as a ",C12 million company" which was under pressure from its bank.

I discovered that this was merely £12m turnover and was not in any way related to assets, profit or cashflow. Vehicles acquired to handle new business represented hire purchase and lease repayments which had already overwhelmed the business it could not be saved from a receiver appointed by the bank.

It is perfectly possible to appear to be making a reasonable profit without generating enough cash, and this is where life becomes particularly dangerous. There are three characteristics of the haulage industry which make operators particularly prone to cashflow dangers: • Many haulage costs are short term liabilities. For example, fuel accounts for an average 22% of an operator's costs and credit is limited (normally load over load). Wages and Subsistence account for 29% and are payable weekly. Tax and insurance account for 7°. and are payable in advance or by instalments. Tyres and repairs account for 15% and are generally payable monthly. Together these items represent more than 70% of costs.

• Replacement or additional vehicles must either be paid for in cash or, after initial deposits, by regular hire purchase or lease payments.

• Customers are notoriously slow in paying for their transport services—and operators are notoriously bad at chasing debtors.

Faced with this pattern of demands on revenue, it is vital that hauliers accept the need to manage and control their cash.

Take the example of ABC Transport, which has a turnover of Lim a year and, by some miracle, is budgeting for a profit in the current year of ,C40,000.

It has one major contract which accounts for about 60% of its business, a second accounting for about 20%, and a few other smaller customers. Everything has been going according to plan and it is within the agreed overdraft limit of £100,000.

Suddenly, at the beginning of February, the boss of a big company, Smith & Co, phone; to say he is very sorry that, because of a "temporary problem" he will not be able to pay ABC in full during February for work done in January.

This just happens to be the month when ABC is taking delivery of a new vehicle, upon which a deposit needs to be paid, and when VAT payment is due for the quarter which ended on 31 January. The boss of Smith 8r. Co assures ABC that he can get back to normal by the end of April.

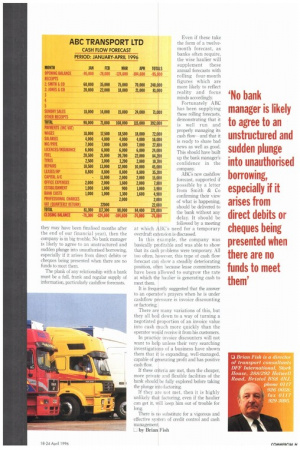

ABC's cashflow forecast needs to be scrapped and a new one prepared (see table). This shows that, because of these problems, ABC is going to be around 05,000 over its agreed overdraft limit at the end of February. So what can the haulier do?

If ABC has been relying on an annual meeting with its bank manager to discuss the latest audited accounts (even though they may have been finalised months after the end of our financial year), then the company is in big trouble. No bank manager is likely to agree to an unstructured and sudden plunge into unauthorised borrowing, especially if it arises from direct debits or cheques being presented when there are no Finds to meet them.

The plank of any relationship with a bank must be a full, frank and regular supply of information, particularly cashflow forecasts. Even if these take the form of a twelvemonth forecast, as banks often require, the wise haulier will supplement these annual forecasts with rolling four-month figures which are more likely to reflect reality and focus minds accordingly.

Fortunately ABC has been supplying these rolling forecasts, demonstrating that it is well run and properly managing its cash flow-and that it is ready to share bad news as well as good. This should have built up the bank manager's confidence in the company.

8.800

35,200

2,000

15,000

2,000

7,800

1,000

3,900

1.600

4,900

2,000

22,000

84.400

371,000

:!

ABC's new cashflow forecast, supported if possible by a letter from Smith & Co confirming their view of what is happening, should be delivered to the bank without any delay. It should be followed by a meeting at which ABC's need for a temporary overdraft extension is discussed.

In this example, the company was basically profitable and was able to show that its cash problems were temporary All too often, however, this type of cash flow forecast can show a steadily deteriorating position, often because lease commitments have been allowed to outgrow the rate at which the haulier is generating cash to meet them.

It is frequently suggested that the answer to an operator's prayers when he is under cashflow pressure is invoice discounting or factoring.

There are many variations of this, but they all boil down to a way of turning a negotiated proportion of an invoice value into cash much more quickly than the operator would receive it from his customers.

In practice invoice discounters will not want to help unless their very searching investigations of a business have shown them that it is expanding, well-managed, capable of generating profit and has positive cash flow.

If these criteria are met, then the cheaper, more private and flexible facilities of the bank should be fully explored before taking the plunge into factoring.

If they are not met, then it is highly unlikely that factoring, even if the haulier can get it. will 'seep him out of trouble for long.

There is no substitute for a vigorous and effective system of credit control and cash management.

LI by Brian Fish