know the law

Page 64

Page 65

If you've noticed an error in this article please click here to report it so we can fix it.

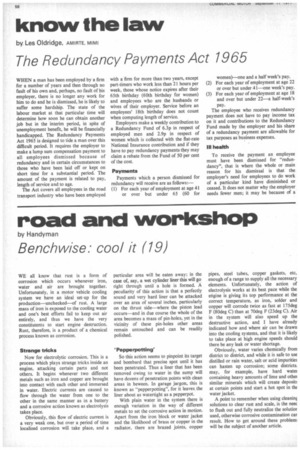

by Les Oldridge, AMIRTE, MIMI

The Redundancy Payments Act 1965

WHEN a man has been employed by a firm for a number of years and then through no fault of his own and, perhaps, no fault of his employer, there is no longer any work for him to do and he is dismissed, he is likely to sutler some hardship. The state of the labour market at that particular time will determine how soon he can obtain another job but in the interim period, in spite of unemployment benefit, he will be financially handicapped. The Redundancy Payments Act 1965 is designed to tide a man over this difficult period. It requires the employer to make a lump sum compensation payment to all employees dismissed because of redundancy and in certain circumstances to those who have been laid off or kept on short time for a substantial period. The amount of the payment is related to pay, length of service and to age.

The Act covers all employees in the road transport industry who have been employed with a firm for more than two years, except part-timers who work less than 21 hours per week, those whose notice expires after their 65th birthday (60th birthday for women) and employees who are the husbands or wives of their employer. Service before an employees' 18th birthday does not count when computing length of service.

Employers make a weekly contribution to a Redundancy Fund of 6.3p in respect of employed men and 2.9p in respect of women which is collected with the flat-rate National Insurance contribution and if they have to pay redundancy payments they may claim a rebate from the Fund of 50 per cent of the cost.

Payments

Payments which a person dismissed for redundancy will receive are as follows:— (1) For each year of employment at age 41 or over but under 65 (60 for women)—one and a half week's pay.

(2) For each year of employment at age 22 or over but under 41—one week's pay.

(3) For each year of employment at age 18 and over but under 22—a half-week's Pay.

The employee who receives redundancy payment does not have to pay income tax on it and contributions to the Redundancy Fund made by the employer and his share of a redundancy payment are allowable for tax purposes as business expenses.

III health

To receive the payment an employee must have been dismissed for "redundancy", that is where the whole or main reason for his dismissal is that the employer's need for employees to do work of a particular kind have diminished or ceased. It does not matter why the employer needs fewer men; it may be because of a trade recession, because he is closing down his business or that he has installed mechanical handling equipment which does the work of several men previously employed.

Dismissal for misbehaviour or ill health, quite clearly, does not rate as "redundancy". The fact that ill health does not qualify a man is particularly unfortunate in the case of a driver who fails his hgv driving licence medical examination. Unless his employer can find him another job which does not entail driving he is in just the same position as the redundant worker but without the benefit.

If an employee has become redundant and his employer offers him work in another department, which he accepts, then he is not entitled to redundancy payment but his new work will count as continuous service with the old. If he'refuses the alternative work he is not entitled to redundancy payment providing the offer was made in writing by the employer while the employee was still working for him, the new employment is suitable and the employee was unreasonable in refusing it.

Special provision The Act makes special provision for the employee who receives notice because of redundancy but who wants to leave before his notice expires. One can visualize circumstances where a driver, having been given a month's notice because his boss has lost a contract, secures a new post where he is tequired to make an immediate start. In this sort of case the driver must give his employer notice in writing that he wants to leave earlier and or the employer does not object to his leaving then he remains entitled to his redundancy payment. If the employer does object he must serve a written request on the driver to withdraw his notice and warning him that he will contest any liability to pay redundancy payment.

Industrial Tribunal If the employee leaves in spite of this notice then the employer may withhold the payment and the employee may then appeal to the Industrial Tribunal, The Tribunal will examine the case and in particular the employer's reasons for wanting the man to work out his full notice and the latter's reason for wanting to leave earlier. The Tribunal may award no payment, part payment or the full amount depending on the merits of the case.

Where there is a change in the ownership of a business and the employees are retained by the new owners no redundancy payments need be made. If a business closes as the result of the death of its owner then the deceased's personal representatives are liable for redundancy payments under the Act.

Disputes about the right to payments nay be referred to Industrial Tribunals and :hose wishing to appeal may obtain an ipplication form for this purpose from their employment exchange.

There is a very good guide to the Act ebtainable, free of charge, from offices of he Department of Employment and Proluctivity.