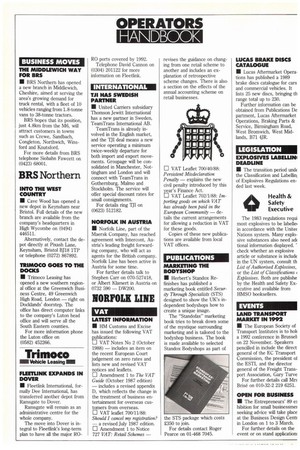

LATEST INFORMATION • HM Customs and Excise has issued the

Page 22

If you've noticed an error in this article please click here to report it so we can fix it.

following VAT publications: VAT Notes No 2 (October 1988) — includes an item on the recent European Court judgement on zero rates and lists new and revised VAT notices and leaflets.

111 Amendment 1 to The VAT Guide (October 1987 edition) — includes a revised appendix D. which reflects the change in the treatment of business entertainment for overseas customers from overseas.

El VAT leaflet 700/11/88: Should I cancel my registration?

— a revised July 1987 edition. LI Amendment 1 to Notice 727 VAT: Retail Schemes —

revises the guidance on changing from one retail scheme to another and includes an explanation of retrospective scheme changes. There is also a section on the effects of the annual accounting scheme on retail businesses.

LI VAT Leaflet 700/40/88: Persistent Misdeclaration Penalty — explains the new civil penalty introduced by this year's Finance Act.

LJ VAT Leaflet 702/1/88: Importing goods on which VAT has already been paid in the European Community — details the current arrangements for allowing a reduction in VAT for these goods.

Copies of these new publications are available from local VAT offices.