CARRYING A EAVY LOAD

Page 44

Page 45

If you've noticed an error in this article please click here to report it so we can fix it.

Britain's the first hauliers are forced to operate under a crippling tax burden — and for time the Freight Transport Association is telling the Chancellor so, in a detailed budget submission.

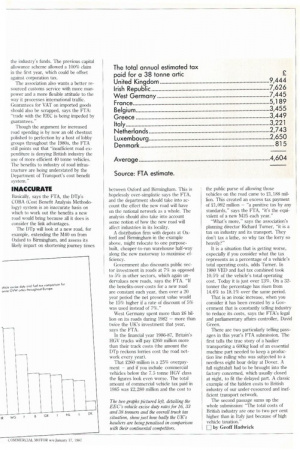

• Britain's hauliers pay the highest vehicle excise duties in Europe, the second-highest diesel taxes (after Ireland) and by far the greatest overall truck tax in the entire EEC. Yet they get less in return than almost any of their continental competitors.

Our present capital allowance system is punishing lorry owners hard because trucks devalue faster than the sort of static industrial plant the regulations are designed for. Our customs service is one of the most notoriously inefficient in Western Europe and our national road network continues to groan under the burden of Government disinterest.

Despite the high sums the UK transport industry pays the Exchequer every year, the country still spends comparitively little on renewing and extending its major road network.

So says the Freight Transport Association's 1987-88 Budget submission to Chancellor Nigel Lawson. For the first time the association has prepared an extensive series of comparisons between the British transport industry's tax burden and that of the rest of the Community.

SUBSIDISING

According to the FTA, "commercial vehicles are subsidising other sectors of the economy by more than £1 billion per annum through taxation.

"In recent years, vehicle taxation (combined annual vehicle excise duties and fuel duties) has increased to one-fifth of the operating costs of a typical 32.5 tonne GVW articulated lorry. This trend must be reversed."

Britain is now the "unenviable leader" of the EEC commercial vehicle tax league, says the FTA, and in its submission which landed on Lawson's desk earlier this week it points out that "the average British 38 tonner is paying more than twice the EEC average in vehicle taxation per annum. British industry is being put at a competitive disadvantage and international trade is currently biased in favour of other EEC states. Vehicle taxation must be reduced to allow competition on equal terms."

The ETA wants the new capital allowances rules changed. The association is calling for a 50% allowance against corporation tax in the first year and a 30% reducing balance allowance for subsequent years so that the allowance curve more accurately mirrors the depreciation curve of a modern truck. Lor nes lose half of their value in the first year of ownership, yet the present allowance scheme only caters for an annual 25% reducing balance. The ETA's new, full-time economist Russ Phillips — who has prepared this year's detailed submission — reckons that the current 25% scheme is costing transport companies 21,500 in extra tax for every 38 tonner they run. He says that if the Government adopts the association's suggested 50% first-year allowance, hauliers could save 21,500 for every 38 tonne truck life. This would be a major boost to the industry's funds. The previous capital allowance scheme allowed a 100% claim in the first year, which could be offset against corporation tax.

The association also wants a better resourced customs service with more manpower and a more flexible attitude to the way it processes international traffic. Guarantees for VAT on imported goods should also be scrapped, says the FTA: "trade with the EEC is being impeded by guarantees."

Though the argument for increased road spending is by now an old chestnut polished to perfection by a host of lobby groups throughout the 1980s, the FTA still points out that "insufficient road expenditure is denying British industry the use of more efficient 40 tonne vehicles. The benefits to industry of road infrastructure are being understated by the Department of Transport's cost benefit system."

INACCURATE

Basically, says the FTA, the Dip's COBA (Cost Benefit Analysis Methodology) system is an inaccurate basis on which to work out the benefits a new road would bring because all it does is consider the link advantages.

The DTp will look at a new road, for example, extending the M40 on from Oxford to Birmingham, and assess its likely impact on shortening journey times between Oxford and Birmingham. This is hopelessly over-simplistic says the VIA, and the department should take into account the effect the new road will have on the national network as a whole. The analysis should also take into account some notion of how the new road will affect industries in its locality.

A distribution firm with depots at Oxford and Birmingham in the example above, might relocate to one purposebuilt, cheaper-to-run warehouse half-way along the new motorway to maximise efficiency.

Government also discounts public sector investment in roads at 7% as opposed to 5% in other sectors, which again undervalues new roads, says the FTA. "If the benefits-over-costs for a new road are constant each year, then over a 20 year period the net present value would be 15% higher if a rate of discount of 5% was used instead of 7%."

West Germany spent more than 26 billion on its roads during 1982 — more than twice the UK's investment that year, says the FTA.

In the financial year 1986-87, Britain's HGV trucks will pay 2260 million more than their track costs (the amount the Dip reckons lorries cost the road network every year).

That 2260 million is a 25% overpayment — and if you include commercial vehicles below the 7.5 tonne HGV class the figures look even worse. The total amount of commercial vehicle tax paid in 1985 was 22,280 million and the cost to the public purse of allowing those vehicles on the road came to 21,188 million. This created an excess tax payment of 21,092 million — "a punitive tax by any standards," says the ETA, "it's the equivalent of a new M25 each year."

"What's more," says the association's planning director Richard Turner, "it is a tax on industry and its transport. They don't tax a lathe, so why tax the lorry so heavily?"

It is a situation that is getting worse, especially if you consider what the tax represents as a percentage of a vehicle's total operating costs, adds Turner. In 1980 VED and fuel tax combined took 10.5% of the vehicle's total operating cost. Today it is just over 13%. On a 32tonner the percentage has risen from 14.6% to 18.1% over the same period.

That is an ironic increase, when you consider it has been created by a Government that is constantly telling industry to reduce its costs, says the FTA's legal and parliamentary affairs controller, David Green.

There are two particularly telling passages in this year's FTA submission. The first tells the true story of a haulier transporting a 600kg load of an essential machine part needed to keep a production line rolling who was subjected to a needless eight hour delay at Dover. A full nightshift had to be brought into the factory concerned, which usually closed at night, to fit the delayed part. A classic example of the hidden costs to British industry of our under-resourced and inefficient transport network.

The second passage sums up the whole submission: "The total costs of British industry are one to two per cent higher than in Italy just because of high vehicle taxation."

fl by Geoff IIadwick