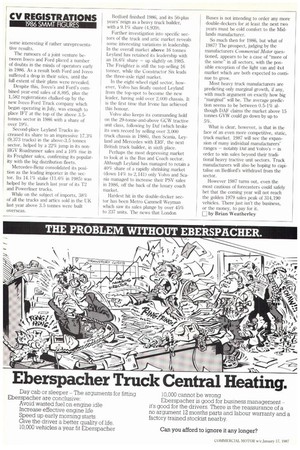

IMPORTS UP NO BIG DEALS

Page 30

Page 32

If you've noticed an error in this article please click here to report it so we can fix it.

We take a hard look at last year's commercial vehicle registrations.

With a few notable exceptions, the motor industry will be happy to see the back of 1986. Only the most reckless of optimists could describe last year's 1.56% increase in commercial vehicle sales — that includes car-derived vans, panel vans, trucks, buses and 4 x 4s — as anything other than "slight".

Back at the tail end of 1985, particularly at the Scottish Show, some manufacturers were making bullish noises about improvements in the market. How wrong they turned out to be. Only the importers managed to break records, raising their share to 39.6% — up from 36.6%.

According to the latest registration figures from the Society of Motor Manufacturers and Traders, sales of trucks and at-tics above 3.5-tonnes GVW were 54,138 — just 10 down on 1985.

Down too were panel vans (from 122,804 to 121,613) along with bus and coach sales, which continue to suffer the effects of deregulation.

Only the car-derived van sector showed any real sparkle in 1986, with sales climbing by 5.6% to 99,261. Registrations of light 4x4s also rose, by 3.6% to 14,057.

Despite its abysmal financial performance (Commercial Motor, January 10), and the damaging effect of the abortive GM takeover talks, Leyland Trucks managed to boost its sales above 3.5 tonnes GVW by 5%, achieving its highest market share for eight years.

Since 1981 Leyland Trucks' sales have gone up by an impressive 60%; the total UK market has grown by 24% in the same period.

LT's improving sales, however, could not stop an overall drop in the total number of commercial vehicles sold by the Rover Group (including Freight Rover, Land Rover, Leyland Trucks and Leyland Bus) which fell from 55,499 to 53,187.

LIGHT COMMERCIALS

• At the lightest end of the market — car-derived vans and micros up to 1.8 tonnes GVW — foreign manufacturers increased their share to over 30%. Despite the bolstering effect of extra Kombi models, market leader Ford (28,181 vans sold), came under even stronger fire from its second-place rival Bedford in 1986.

GM's UK van-building subsidiary enjoyed a 4.6% jump in market share to 25.6% with sales of 25,366. The arrival of extra Astra van models, and in particular the launch of the Rascal micro van, has given Bedford dealers the light CV throughput they have been promised.

Ironically, the lack of depth in Suzuki's UK dealer network has prevented it from making similar inroads into the micro market with its Luton-built Super Carry.

Much of Bedford's success has been at the expense of Austin Rover, which dropped down to third place, selling 20,049 Metro and Maestro vans. A lot now rests on how well the new Maestro diesel van is accepted — particularly with large fleets — if AR is to recapture lost ground (see News Headlines.) The most impressive performance last year by any importer was undoubtedly from Renault with its boxy Extra van.

Launched less than a year ago, in April '86, the Extra has been averaging a 5% share of the CDV market every month thanks to its typically-Renault competitive pricing and above-average specification.

During 1986 Renault sold 4,527 Extras — enough to push Volkswagen out of fifth place. If Renault's projections for 1987 prove accurate the Extra could well finish this year even higher.

Even more spectacular, in percentage terms, if not in actual numbers, was the 238% increase in penetration by Citroen's Spanish-built C15 Visa van.

The French importer sold 2,478 Visas last year and now needs to strengthen its light CV dealer network if it wants to remain a serious challenger in this market sector.

The 1.8-3.5-tonne panel van sector was expected to continue growing in 1986. It didn't, at least not overall, although the drift towards maximum-weight heavy vans continues. Even if the top three manufacturers, Ford, Freight Rover and Bedford, could not improve their share, the importers found no such problems, raising their stake in the sector by 6.5% to 46.1%.

The new Transit does not seem to be having it all its own way. Ford has, however, kept the top slot in 1986 with a slightly-reduced 34.1% share based on sales of 39,508. Second place, Freight Rover, has managed to tread water, successfully keeping second place thanks to extra minibus orders prompted by deregulation.

The lack of any replacement for the long-serving CF is beginning to show up in Bedford's medium/heavy van sales which fell to 11,634 last year.

After its impressive rise in the market in 1985, Renault UK simply could not get enough Trafic and Master vans into the UK.

Nissan's market researchers' faith in a compact van market, has been more than justified however. The extra 2,000 or so Vanettes, supplied without the problems of quotas by Nissan's Spanish Motor-Iberica plant, boosted the company's sales to over 8,000 — enough to overtake VW and give them fifth place.

TRUCKS ABOVE 3.5 TONNES

• The lumping together by the SMMT of all CV sales above 3.5-tonnes GVW into a trucks-and-artics sector produces some interesting if rather unrepresentative results.

The rumours of a joint venture between Iveco and Ford placed a number of doubts in the minds of operators early in 1986. As a result both Ford and Iveco suffered a drop in their sales, until the full extent of their plans were revealed.

Despite this, Iveco's and Ford's combined year-end sales of 8,895, plus the 1,582 registrations chalked-up by the new Iveco Ford Truck company which began operating in July, was enough to place IFT at the top of the above 3.5tonnes sector in 1986 with a share of over 19%.

Second-place Leyland Trucks increased its share to an impressive 17.3% (9,373 trucks) in the above-3.5 tonnes sector, helped by a 22% jump in its nonHGV Roadrunner sales and a 10% rise in its Freighter sales, confirming its popularity with the big distribution fleets.

Mercedes-Benz consolidated its position as the leading importer in the sector. Its 14.1% stake (11.6% in 1985) was helped by the launch last year of its 12 and Powerliner trucks.

While on the subject of imports, 38% of all the trucks and artics sold in the UK last year above 3.5 tonnes were built overseas. Bedford finished 1986, and its 50-plus years' reign as a heavy truck builder, with a 9.1% share (4,939).

Further investigation into specific sectors of the truck and artic market reveals some interesting variations in leadership. In the overall market above 16 tonnes Leyland has retained its leadership with an 18.6% share — up slightly on 1985. The Freighter is still the top-selling 16 thriller, while the Constructor Six leads the three-axle rigid market.

In the eight-wheel rigid sector, however, Volvo has finally ousted Leyland from the top-spot to become the new leader, having sold over 2,000 chassis. It is the first time that Irvine has achieved this honour.

Volvo also keeps its commanding hold on the 29-tonne-and-above GCW tractive unit class, following by Daf (which broke its own record by selling over 3,000 truck chassis in 1986), then Scania, Leyland and Mercedes with ERF, the next British truck builder, in sixth place.

Perhaps the most depressing market to look at is the Bus and Coach sector. Although Leyland has managed to retain a 40% share of a rapidly shrinking market (down 14% to 2,141) only Volvo and Scania managed to increase their PSV sales in 1986, off the back of the luxury coach market.

Hardest hit in the double-decker sector has been Metro Cammell Weyman which saw its sales plunge by over 45% to 237 units. The news that London Buses is not intending to order any more double-deckers for at least the next two years must be cold comfort to the Midlands manufacturer.

So much then for 1986, but what of 1987? The prospect, judging by the manufacturers Commercial Motor questioned, appears to be a case of "more of the same" in all sectors, with the possible exception of the light van and 4x4 market which are both expected to continue to grow.

Most heavy truck manufacturers are predicting only marginal growth, if any, with much argument on exactly how big "marginal" will be. The average prediction seems to be between 0.5-1% although DM.' claims the market above 15 tonnes GVW could go down by up to 5%.

What is clear, however, is that in the face of an even more competitive, static, truck market. 1987 will see the expansion of many individual manufacturers' ranges — notably Dat and Volvo's — in order to win sales beyond their traditional heavy tractive unit sectors. Truck manufacturers will also be hoping to capitalise on Bedford's withdrawl from the sector.

However 1987 turns out, even the most cautious of forecasters could safely bet that the coming year will not reach the golden 1979 sales peak of 314,190 vehicles. There just isn't the business, or the money, to pay for it.

by Brian Weatherley