01 1 INIONS

Page 52

Page 53

If you've noticed an error in this article please click here to report it so we can fix it.

and QUERIES

The Editor invites correspondence on all subjects connected with the use of commercial motors. Leiters should be written on only one side of the paper. The right of abbreviation is reserved and no responsibility for vkits expressed is accepted.

HOW EXCEPTIONAL RATES AFFECT THE RAILWAYS.

[4783] As a regular reader of your valuable journal, I feel that I must draw attention to the rather sweeping statement, by your contributor " Transex " in your issue of April 3, which is, in effect, a travesty of the facts.

He states that although the railways may be regarded in law as common carriers, in practice they are, through the medium of exceptional rates and agreed charges, in a position to pick and choose their traffic by the mere manipulation of rates. The position is that railway companies are bound to accept everything offered to them for conveyance, provided it can be carried by rail, and no manipulation of rates can in any way alter this statutory obligation.

On the other hand, road hauliers are able to discriminate as to the traffic -which they will accept, and it is only becanse of this and the fact that there is no control over their rates, that they can give the service and quote the rates which they do to-day.

The road-haulage industry claims equality of treatment with the railway companies. Very well, let them have precisely the same treatment, including publication of rates, the liability of common carriers, etc., etc., and 1 am .convinced that they could not quote the same service, nor the same rates, as are available at the present time.

It would be exceedingly interesting, in any event, if " Transex " could explain how agreed charges affect the railway companies' liability as common carriers, in view of the fact that under an agreed charge, subject to very minor exclusions, the whole of the traffic is handed to rail at one rate.

I will refrain from passing any comments on his statement that the railway-freight rebate fund constitutes a subsidy to the railway companies, as this is obviously not the case, and, in any event, more than four-fifths of the traffic to which the rebates are allowed is not traffic

normally conveyed by road transport. A.I.T.A. Glasgow, S.2: IS THE BONNETED VEHICLE OBSOLESCENT?

L47871 I was very interested to read the letter of Pro Bono Publico (No. 4780), and heartily endorse his remarks regarding the lack of provision df maximum platform area for a given overall length, on vehicles turned out by many manufacturers to-day.

B38

I recently inspected some commercial vehicles of the lighter type (30-40-cwt. capacity) and was particularly impressed by the fact that in each the engine and cab occupied approximately half the total length of the vehicle. In my opinion, the bonnet is doomed and will slowly but surely be eliminated, as new designs are produced.

The overtype vehicle, with the .driver mounted over the vertical-type engine, was, at one time, much to the fore, and it certainly does allow larger platform ,area.

• In this case the engine is no more inaccessible than when placed under a bonnet, in view of the fact that the side panels can be removed and the driver's floorboards lifted. The cab supports, however, have to be stronger, and therefore heavier, and the driver lives a more strenuous life, by having to climb up and down from his elevated seat, especially when on short-journey work. This objection is, however, overcome if a flat or horizontal engine be used, with the driver mounted above, or, alternatively, if an engine of this type be slung beneath the chassis, on the lines I have previously suggested in an article on this subject published in The Commercial Motor dated November 1, 1935. When mounted in this manner, the engine is far more accessible than when under a bonnet and allows for the largest available load area for a given overall length of vehicle.

Whilst British commercial-vehicle manufacturers have often given the lead in design, it would now seem that the German outlook is in advance of our own, in view of their adoption of the horizontal engine to most makes of chassis, for when one considers that at the recent Berlin Show, vehicles with this type of engine were exhibited by Henschel, Bussing-N.A.G., Magirus, and others, it clearly shows that they must see many advantages in this type of power unit.

There is a big field open in this country for the exploitation of the horizontal eng!ne, as adapted to commercial vehicles. This type of power unit does undoubtedly get over many of the difficulties that beset us in designs incorporating the vertical type and allows for increased loading space, butter accessibility and reduced total weight of chassis. L. A. Pocaz. London, S.W.1.

DETAILS Or. .A TRAVELLING RESTAURANT REQUIRED.

[4788] The writer is interested in a project for a motor service of hot suppers, etc., and would be grateful to have advice as to the most suitable vehicle for the purpose and, if possible, further particulars as to the best type of cooker, if by chance you have experience

of such a proposition. MOBILE CATEEtER. Cardiff.

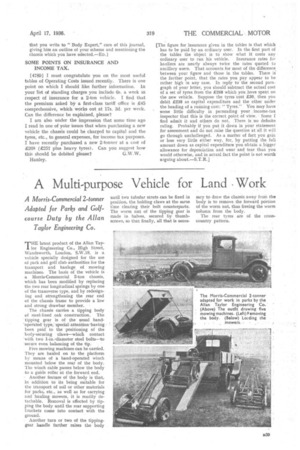

[A 30-cwt. chassis is suggested as the basis for mounting a travelling restaurant. The body would measure about 9 it. behind the driver's cab, or 11 ft. with the forwardcontrol type of chassis. The usual arrangement is to divide the near side of the body horizontally, so that the upper part may form a canopy and the lower part a serving counter. There is a stove across the van behind the driving-seat partition. Close to this is the sink, also the draining board if required. There are lockers and shelves under the counter and on the off side behind the servers. Entrance is by back door and the headroom is increased by means of a lantern or clerestory roof. With regard to the stove, we are sending you particulars of the "Cabin." stove, which is supplied by the London Warming Co„ Ltd., which will be pleased to advise you as to other details of cooking equipment. The "Cabin " stove is 221 ins. by 15 ins. by 14 ins. deep. If you require a drawing of a suitable body, we would suggest

that you write to " Body Expert," care of this journal, giving him an outline of your scheme and mentioning the chassis which you have selected.—ED.] SOME POINTS ON INSURANCE AND INCOME TAX.

[4789] I must congratulate you on the most useful tables of Operating Costs issued recently. There is one point on which I should like further information. In your list of standing charges you include Os. a week in respect of insurance for a 2-ton vehicle. I find that the premium asked by a first-class tariff office is £45 comprehensive, which works out at 17s. 3d, per week. Can the difference be explained, please?

I am also under the impression that some time ago I read in one of your issues that when purchasing a new vehicle the chassis could be charged to capital and the tyres, etc., to general expenses, for income tax purposes. I have recently purchased a new 2.-tormer at a cost of £268 (£257 plus heavy tyres). Can you suggest how this should be debited please? G.W.W. Hanley. [The figure for insurance given in the tables is that which has to be paid by an ordinary user. In the first part of the tables the object is -to show what it costs any .

ordinary user to run his vehicle. Insurance rates for hauliers are nearly always twice the rates quoted to ancillary users. That accounts for most of the difference, between your figure and those in the tables. There is the further point, that the rates you .pay appear to be rather high in any case. In reply tothe second paragraph of your letter, you should subtract the actual cost of a set of tyres from the £268 which you have spent on the new vehicle. Suppose the tyres cost £30, then you debit £238 as capital expenditure and the .other under the heading of a running cost: " Tyres?' You may have some little difficulty in persuading your income-tax inspector that this is the correct point of view. Some I find admit it and others do not, .There is no definite ruling. Probably if you put it down in your statement for assessment and do not raise the question at all it will go through unchallenged. As a matter of fact you gain or lose very little either way, for, by putting the full amount down as capital expenditure you obtain a.bigger allowance for depreciation and wear and tear than you would otherwise, and in actual fact the point is not worth arguing about.—S.T.R.]