hat Does the Oiler Save?

Page 66

Page 69

If you've noticed an error in this article please click here to report it so we can fix it.

THERE has lately been a recrudescence of the question: "What is the annual mileage below which it..

would not pay to run an oil-engined vehicle of the 30-mph. class ?" or, conversely: ." What is the mileage per annum_ which when exceeded makes ' it profitable to use • the oil-engined 30-m.p.h. vehicle ?"

There is justification for that question being repeated from time to time, as it is affected by rising prices of materials and fuel. The answer is to be found by discovering how far the vehicle must travel before the saving in the expenditure of fuel is equal to the extra cost of the oilengined vehicle expressed in terms related to the depreciation per annum.

The last time 1 dealt with this question was in the issues dated April 26 and May 3, 1946. At that time prices for oil fuel and petrol were is. 10d. and 2s. Id. per gallon respectively: the difference in the purchase price of the oilengined 6-tonner and the petrol-engined vehicle of the same size was £250. To-day, petrol from the pump costs 3s. 7d., 3s. 71d,, or 3s. 7-id. per gallon according to the district in Which it is bought; the bulk 'prices correspondingly are 3s. 30., 3s. 31d. and' 3s. 3.1d. Oil fuel in bulk costs 38. 1/d. per gallon.

• If the ,differenee between the price of the oil-engined vehicle and the petrol-eneined machine remained at £250, then protagonists of the oiler would have a stronger case than those who advocate petrol-engined machines. Actually, there has been almost a corresponding rise in the price of the vehicles. An approximate average figure to-day for the difference between the two is £380.

There are two ways of dealing with the question. One, the simple and direct method, and the other, more complicated but more accurate, which takes every item of operating cost of the vehicles concerned into account. I shall begin with the simple method.

According to the figures in the current issue of "The Commercial Motor" Tables of Operating Costs, a petrol-. engined 6-tonner averages 11 m.p.g., compared with 19 m.p.g. to be normally expected from an oil-engined vehicle of the same capacity.

If, therefore ,,i the price of oil fuel and of petrol were the same, there would be a great saving by using the oiler, because it runs 19 m.p.g., compared with the petrol-engined vehicle's 11 m.p.g. The case for the oiler is the more favourable because oil fuel is cheaper, A reasonable statement is that the cost of fuel with an oil-engined vehicle is half that of the cost of fuel with a petrol vehicle.

Difference in Cost

The average purchase price of .a petrol-engined 6-ton dropsided lorry, painted, varnished and ready for the road, is £1,100. A similar figure for an oil-engined machine is £1,480. The difference is £380, which is actually 91,200d.

The cost per mile for petrol on the one machine, assuming the owner pays pump price which is 3s. 7d., is the cost of one gallon divided by 11, the mileage covered while that gallon is consumed. That is 3.91d. per mile. In the case of the oil-engined vehicle, taking the price of oil fuel to be 3s. 1/d. and the mileage per gallon 19, the cost per mile for .fuel is 1.97d.

It is not fair, however, to employ pump prices in a comparison of this kind. I have always based my own calculations on -what I term the average price for fuel. Not all users are able to buy petrol in hulk; they -cannot afford the expensive storage facilities which the-law rightly demands, and in making a calculation of this kind I usually split the difference between the pump price and the bulk price, which means, in this ease, that 1 assume the price for petrol to be 3s. 5d. per gallon,

There is no corresponding difference to be taken into account in connection with oil fuel except that bulk buyers of large quantities obtain rebates and, therefore, I assume that the average price paid for oil fuel is a little less than the advertised bulk price; instead of taking 3s. led. per gallon I take 3s. Id. Applying these figures and taking again 11 m.p.g. for petrol and 19 m.p.g. for oil fuel I get for the petrol-engined vehicle 3 73d. per mile, and for the oil-engined vehicle 1.95d. per mile, a saving of 1.78d. per mile resulting from the use of the oiler.

In the first example, that is assuming the pump price is paid for both fuels, then dividing 1.94d., the saving per mile, into 91,200d., the extra cost of the oiler, I get 47,000 miles as the distance fo be run before the extra cost of the oiler is wiped out by the savings in expenditure on fuel. I would imagine that that figure would be sufficient in the case of most operators to decide the prbblem in favour of the oiler. With some operators that would mean that the extra cost would be amortized in a year. In the second case, the saving in expenditure on fuel per mile is 1 78d., and if I divide that into 91,200d. I get 51,200 miles as the distance which needs to be travelled before the extra cost is eliminated. Even at that there will be few operators who would not wipe it off inside two years. The foregoing does not, however, give the answer to the question, as there is one more matter to take into account, namely, the number of years over which the operator decides to depreciate his vehicles. To-day, that period tends to be decided for him, not on ordinary economic grounds, but because new vehicles are not easy to get: there must be few who would crieize my, assumption that six years is a representative figure. On the basis of six years for depreciation, the annual debit on account of the extra cost of the oiler is 1/6 of £380, which is £63 6s. 8d., or 15,200d. That is the extra cost of the oiler per annum. Assuming first of all pump or retail prices, then, the saving, as I have shown, is I.94d. per mile, and if I divide that into 15,200 I must get as my answer the number of miles which dint be run in order to wipe out that extra cost. The answer is 7,830 miles.

If I take the second set of figures for cost of petrol and oil fuel which showed a saving of 1.78d. per mile, then the extra cost of the oiler will be eliminated in 8,000 miles, so that it might be taken as reasonable that the answer to the question is around 8,000 miles. • However, it is not the answer that satisfies everybody. Many of my readers like to have the answer in greater detail and I will give that, doing as I have been intending for some time, indicating the form which subsequent issues of "The Commercial Motor" Tables of Operating Costs are likely to assume. I will set out the data for these two figures in the way in which I expect to set out those for the 1952 edition of the Tables.

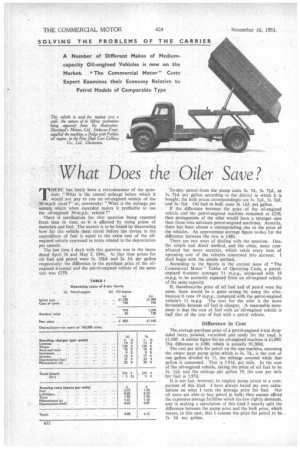

First, at the top of the table, I put the initial cost, in the case of the petrol-engined 6-tonner, £1,100. Next the cost of tyres, which for a set of 35 by 7i is £190. Readers should know that this is for a set of six tyres and not seven. The cost of the spare tyre is not included in this calculation because it is not wearing. That leaves 1910. Next I take a standard figure for the residual value, approximately 10 per cent. of the value of the vehicle less tyres. In this case 10 per cent, will be £91; it is convenient to take the round figure of £90. Taking that residual value from the £910, leaves me the net value of am.

Next we have to decide the allowance to be made for depreciation both on a time and mileage basis. For reasons already stated in this article, I am taking six years as the Lime basis and 160,000 miles as the mileage basis. Having got so far 1 can proceed with the rest of the table on very nearly, but not quite, the lines so familiar to the readers of "The Commercial Motor."

I give first the standing charges per week. The licence for a vehicle weighing a little short of 3 tons is £35 per annum or 14s. per week. For wages I-take the current amount for the driver of a 6-tonner, namely £6 per week, and I add 10s. (4 to that to provide for insurance premiums and holidays with pay, that gives me the amount, 130s. 6d., set out in Table I.

For garage rent 1 have 10s. per week and for insurance (assuming a C-licence vehicle) 9s. per week. Interest on the capital outlay of £1,100 at 3 per cent. is 13s. 6d. per week, and next comes depreciation (half). Here a little calculation is necessary. The net value of the vehicle is set out in the table as £820; half of that is £410, which has to be debited over six years. Six divided into £410 gives me /68 6s. Rd., which is equivalent to 27s. 4d. per week. Maintenance (d) is the cost of routine operations, clean ing and polishing, greasing and oiling and periodic varnishing and repainting. For washing and polishing, greasing and oiling I have assumed 12s. 6d. per week. I have assumed an annual varnish costing £12 10s., and a repainting every other year at £25. That is £37 10s. per two years, that is to say for 100 working weeks, which is equivalent to 7s. 6d. per week. Add the 12s 6d. for washing and polishing, etc., I get the round figure of £1 per week as maintenance (d). The total is seen tobe 224s. 4d. per week or 5s. lid, per hr. for a 44-hr. week.

Next come the running costs. The fuel cost has already been given as 3.73d. per mile. The other items in the running costs need no explanation beyond perhaps the statement that for tyres I have taken a life of 24,000 miles. Depreciation (half) is £410 from above, divided by 160,000 miles, which gives me 0.60d. The total of running cost is 8.08d. per mile.

Side by side with these figures for the petrol-engined vehicle are those for the oiler. I have assessed them in the same way and I imagine there is no need for me to give any further explanation of the items. The interesting point to observe is that the standing charges per week for the oiler are 10s. more than those for the petrol-engined machine, but the running cost for the.oiler is 1.66d. per mile less.

Using those two figures, the 10s. per week and the 1.66d. per mile saying on the running cost, it is now a simple matter to arrive at the critical mileage. All that needs to be done. ie to divide 1.66d. into 10s. The answer is 72 rniles, which means that if the vehicle. runs more than 72 miles per week it will be prOfitable to purchase the oil-erigined machine instead of petrol. '

In Table II I have set out the total costs of both types of vehicle for various weekly mileages, and in a third column I have appended the savings per week because of using an oiler.-S.T.R.