SCOTCHING THE RUMOURS

Page 46

Page 48

If you've noticed an error in this article please click here to report it so we can fix it.

English and Welsh PSV operators are settling down to business following NBC privatisation and deregulation. Now its Scotland's turn, with SBG coming under the hammer. They're sharpening the corporate Claymores, north o' the border, but the post-privatisation scene may come as a surprise.

• The Scottish bus scene is set for its biggest upheaval in years when the bidding opens for the 11 companies that comprise the Scottish Bus Group. Scottish Secretary Malcolm Rifkind announced in November that seven of SBG's busoperating subsidiaries would be sold as they are; two more would be formed by merging Clydeside with Western, and Central with Kelvin. Then there are SBG's specialist companies — express service operator Scottish Citylink, and heavy engineering arm SBG Engineering.

Grampian Regional Transport has already been bought from the council by a management/employee team. This was the first buyout of its kind in Scotland, and it is likely to be followed by similar moves in Strathclyde and Tayside.

Lothian's Labour-controlled council has said that it is unwilling to sell the Edinburgh operation.

Rifkind has repeatedly expressed his hope that SBG company employees will be given an opportunity to bid for their companies, and is offering financial assistance to those drawing up bids.

Most SBG company managers did set up savings schemes to encourage staff to raise the necessary finance, but it became clear that in-house bids would have to be substantial to beat the many would-be purchasers waiting on the sidelines.

The high prices realised by National Bus Company subsidiaries have alerted many to the value of this type of investment, and there is also the realisation that much of Scotland is still good busoperating territory, in spite of the spread of car ownership and the dramatic growth in competition since deregulation.

MAIN PLAYERS

The main players on the Scottish scene are SBG, the four former municipal fleqs, and the independents — notably Perth based Stagecoach and a number of other well-established local operators.

With an annual turnover of 2160 million, individual SBG companies earn up to 220 million a year from a mixture of urban, inter-urban, local express and contract work. But SBG's best routes are under attack from the former municipal fleets and the independents.

In Edinburgh and Glasgow the local authority companies have expanded beyond the city boundaries into SBG heartland, and while SBG companies have responded with urban services, observers feel that these have not been sufficient to balance the loss of traffic and revenue in their traditional operating areas.

In Dundee, the situation is different. Tayside Buses still has a virtual monopoly of city services, leaving SBG subsidiary Strathtay Scottish with inter-urban and local town services — although these are increasingly under threat from small, locally-based independents, who benefit from lower overheads and wage costs.

The Grampian management/employee buyout has added a new dimension to the Aberdeen scene. Previously Grampian and SBG's Northern Scottish had co-existed, with occasional forays into each others' territories.

Now Grampian managing director Moir Lockhead has expressed a wish to buy into SBG, and the timing of the Grampian sale clearly gives the new company a significant advantage.

A third player has emerged in the area: Alexanders North East, formed by Northern management who left last year to set up a rival company, initially to operate express services north from Aberdeen to Peterhead and Fraserburgh.

The choice of the name was a shrewd one, for "Alexanders" still evokes memories of the former Alexander company, precursor of today's Northern company, which has retaliated by labelling its buses "The original Alexander Company".

The new Alexanders company must be another contender for 220-bus Northern Scottish. Also in the running is Stagecoach, which has grown from two secondhand coaches in 1980 to become one of the main bus groups in Britain.

Stagecoach snapped up three National Bus Company subsidiaries (Cumberland, Hampshire Bus and United Counties) which are now in the same stable as Stagecoach Express Services and the urban Magicbus services in Glasgow.

Stagecoach's unconventional chairman Brian Souter has clearly indicated his desire to buy "all of SBG", although if the . example of NBC is followed, restrictions will be placed on the number of companies that can be owned by any one organisation. With its HQ in Perth, Stagecoach is well placed to guarantee Scottish control of any SBG companies it buys.

SCOTTISH HANDS

Keeping SBG in Scottish hands was a point forcefully argued by SBG in its unsuccessful attempt to persuade Government of the benefits of a unified employee buyout. Rifkind has indicated his support for employee ownership, but it is likely that the Treasury will be looking for a good price from the SBG sale; £60 million was an early estimate, and a higher final figure seems possible.

Rifkind did bow to pressure to combine SBG companies in the Glasgow area to allow more effective competition with 800bus Strathclyde Buses. This was the reverse of the NBC situation, where larger companies had to be subdivided before the sale. SBG had already gone through this exercise in 1988 in preparation for deregulation, when four new territorial companies were created.

Two of them, Clydeside and Kelvin, were formed to allow more effective competition. In the case of Kelvin this re suited in cutbacks and fleet reduction. Now Clydeside is being re-merged with Western, and the Kelvin and Central operations are being combined. The two resulting companies will each have around 700 buses, though Central suffered from a long strike early this year.

Many of the established Scottish independent operators seem content to compete only for the contracts awarded on tenders by regional councils, and many have won these against SBG competition.

Outside the principal urban areas, the larger independent operators are mainly sticking to their well-established route networks, relying on brand loyalty to retain custom. The Ayrshire co-operative operators, AA Buses and Al Service, have pursued this policy successfully.

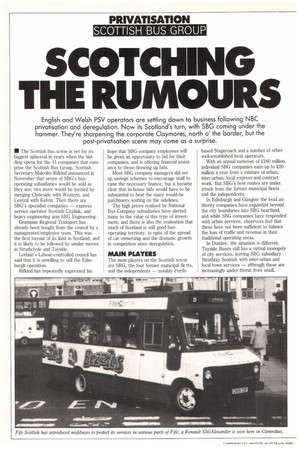

There are, inevitably, exceptions to this rule. In Greenock there is a virtual freefor-all, with a plethora of independent operators competing with the incumbent, Clydeside Scottish. And in Inverness a breakaway group of Highland drivers formed Inverness Traction.

Decisions have got to be taken about SBG's property portfolio. It is not clear if prime properties such as depots and bus stations will be offered with the operating companies, which would obviously boost the selling price.

The success of NBC privatisation guarantees a lively interest in the SBG sale. In addition to the likely bidders from Scotland, there is a growing queue of would-be English buyers, many of them groups that have grown from the sale of NBC. But SBG's two non-territorial companies, SBG Engineering and Scottish Citylink, will probably attract a different type of interest.

SBGE was formed in 1985 to control the central works of the operating companies. It now has five workshops, spread from Kilmarnock to Inverness and handles a proportion of the heavy engineering work for SBG's bus-operating subsidiaries, as well as outside work.

There is no guarantee, however, that privatised SBG companies will continue tc use SBGE, and it may be unweildly in its present form.

Scottish Citylink functions on similar lines to National Express, operating SBG's long-distance express services using coaches owned by SBG companies bu painted in Citylink colours. Citylink pays individual companies on a distance basis and retains fare revenue. Most of its cross-Border services, except those to London, are operated jointly with Nationa Express.

The first SBG company sales are expected in the autumn, and there is growing interest in the group and its performance. In an unexpected move, the Transport and General Workers Union at Clydeside Scottish has been negotiating a employee/management bid for the combined Clydeside/Western operation, whict would give staff a controlling interest — i contrast to the more familiar managemen. employee buyouts.

Western's management has produced a more conventional management/employee scheme, and this is likely to attract the support of the major institutions looking for evidence of established leadership and continuity.

When the SBG sale is completed, even to 11 separate owners, it seems likely that most will jealously protect their own territory, unwilling to incur the costs of intense competition, and will be content with a mix of competition and social services. The promotion of competition is clearly Government's aim in SBG privatisation.

When the time comes, Whitehall could be in for a few surprises.

0 by Gavin Booth