FORD STILL RULES LIGHT CV MARKET

Page 48

Page 49

If you've noticed an error in this article please click here to report it so we can fix it.

CM gives you the clearest analysis of the UK

light commercials market. Here's our run

down of last year's winners and losers.

Weicome to our latest half-yearly analysis of the UK light CV market. covering the whole of 2005. Just to recap on how our figures are presented.we only look at vans up to 3,500kg GVW and at pickups,spl it into five categories.Where a large van predominantly sells at 3,500kg, such as 'Ransil and Sprinter, all versions go into large vans'. while the likes of the Vito andTransporter are classed as 'medium vans'.

Hatchvans and CDVs Starting as usual with the smallest CVs,the Astravan retains its lead. albeit by a considerably reduced margin —down from 60% to 48%.

We didn't decide to include the Suzuki and Daihatsu microvans until the mid-2005 roundup, but with the figures adjusted to include them the sector is down from 21,738 vehicles to 18582.

The Suzuki Carry is still in second place, outselling the Ford Fiesta. However. the Japanese baby will soon be discontinued. Vauxhall's other small model. the Corsavan, has grown from 1,200 to 1.682 units:seemingly at the expense of the Peugeot 206. which it has overtaken.The Fiat Punto and Renault Clio hatchvans have both fallen out of favour to a similar degree.

A new entry is the tiny Citroa C2 Enterprise. Its discontinued five-door Xsara stablemate makes its farewell appearance. joining ilk. Rover 25 and MG Express. High-cube vans High-cube van sales rose from 77.276 to 78.197: the rankings are unchanged with the Ford Transit Connect in pole position. But Vauxhall has cut its lead from 6.599 to 2,210. The only other models to boost sales are the Peugeot Partner and the Volkswagen Caddy. The biggest loser is Renault's Kangoo,which dropped nearly 17%.

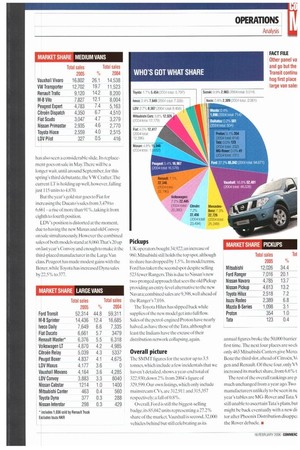

Medium vans

it's all change at the top with the Vauxhall Vivaro regaining top slot after losing it to the Volkswagen Transporter at the mid. 2005 point. Both increased their annual sales. by 2,264 and 1,179 units respectively Combined with its Renault and Nissan clones, both of which also won more sales, the Vivaro accounts for 44.9% of the sector.

But the news in the rest of the sector is not so good, with total sales falling from 64,452 to 60.918.The only other medium van to improve on 2004 was the Toyota Hiace, which added 44 units to take it to 2.559. LDV's Pilot will pass into history this year.

Large vans

I be full-sized panel van sector fell back by 5.2% during 2005.Although reclassifying all Transits as heavy vans mid-year confused the issue, the evergreen Ford's share fell from 48.2% to 44.8%.Ford will no doubt be expecting the improved newTransit to reverse this trend when it goes on sale in the third quarter.

Another manufacturer keenly awaiting its new model is Mercedes-Benz, whose Sprinter has also seen a considerable slide. Its replacement goes on sale in May.There will he a longer wait. until around September. for this spring's third debutante, the VW Crafter:me current LT is holding up well, however, falling just 115 units to 4,870.

But the year's gold star goes to Fiat for increasing the Ducato'ssales from 3.479 to 6,661 -a rise of more than 91%. taking it from eighth to fourth position.

LDV's position is distorted at the moment, due to having the new Maxus and old Convoy on sale simultaneously. However the combined sales of both models stand at 8,060.That's 20 up on last year's Convoy and enough to make it the third-placed manufacturer in the Large Van class, Peugeot has made modest gains with the Boxer,whileToyota has increased Dyna sales by22.5% to 377. Pickups UK operators bought 34.922:an increase of 96(.1. Mitsubishi still holds the top spot. although its share has dropped by 1.5%.1n model terms. Ford has taken the second spot despite selling 523 fewer Rangers-Ibis is due to Nissan's new two-pronged approach that sees the old Pickup providing an entry-level alternative to the new Navara:combined sales are 9,398, well ahead of the Ranger's 7,016.

The Toyota Hilux has slipped back while supplies of the new model get into full now. Sales of the petrol-engined Proton have nearly halved, as have those of theTata. although at least the Indians have the excuse of their distribution network collapsing. again.

Overall picture 'rhe S NWT figures for the sector up to 3.5 tonnes, which include a few incidentals that we haven't detailed, shows a year-end total of 322.930; down 2% front 2004's figure of 329599. Our own listings, which only include mainstream CVs, are 312,911 and 315,357 respectively; a fall of 0.8%.

Overall. Ford is still the biggest-selling badge, its 85,042 units representing a 27.2% share of the market. Vauxhall is second. 32,0(X) vehicles behind but still celebrating as its annual figures broke the 50,000 barrier first time. The next four places are sock only 463 Mitsubishi Canters give Meru Benz the third slot, ahead of Citroen,IA gen and Renault.° f these four, only V) increased its market share, from 6.6% t The rest of the overall rankings are p much unchanged front a year ago.Two manufacturers unlikely to be seen in nc year's tables are MG-Rover and Tata.): still unable to ascertainTata's plans, but might be back eventually with a new di: tor after Phoenix Distribution disappc: the Rover debacle. a