Getting your fuel on 'tick'

Page 38

Page 39

If you've noticed an error in this article please click here to report it so we can fix it.

FUEL CREDIT CARDS are not new to the lorry driver — these were in use as "agency cards" long before "plastic money". Garages would accept any agency card, which became interchangeable under the banner "All Cards Accepted". On the rear of the agency card was printed: "Not to be used for fuel supplied to private vehicles."

Now that company cars are so numerous, and petrol so expensive, firms have seen advantages in reducing administration costs and in keeping some control over fuel expenses, by giving the driver a "credit card" to obtain fuel. In the 1982/83 tax year, the company car fuel credit card was acknowledged by HM Inspector of Taxes, who decided to tax the private use element of fuel obtained by a company credit card as a benefit.

Over the past year, a number of new credit cards have appeared; this system, it is claimed, "saves costs". But does it?

A big saving is claimed to be "reducing the fiddling of expenses"; it makes all company vehicle drivers appear as crooks. Although it is possible to obtain goods other than fuel and to have the receipt marked "petrol or derv", or to obtain a receipt for 10 gallons when only five gallons were issued, does the credit card really stop these malpractices? My view is NO!

I doubt whether the "fiddling of receipts" is as widespread as is made to appear. Company drivers need to obtain fuel on "credit" for many different reasons, one being to avoid the carrying of large sums of money.

Company credit cards fall into four types: Bank Credit Cards, eg Visa, Access; Fuel Company Cards, eg Agency Cards and the recently announced Esso Charge Card; Forecourt Credit Cards, eg Heron, Kennings, Alan Pond, and Swan National Fleet Fuel Card; Fleet Management Cards, eg All Star (PHH), Overdrive (Interleasing), Dialcard (Dial Contracts), and the latest addition, the MAA Fuel Card. Within this category falls another type of facility where "vouchers" replace the credit card, eg Petrocheque, and Autofax.

The Visa Card is used by many companies and the problems of surcharges appear to have gone. The annual cost of a Visa Card is £12 and no charges for each transaction or, £3 plus 20p for each transaction — accounts are sent monthly and must be settled within 28 days to avoid interest charges.

The Essocharge Card is the first available under the name of a fuel company — up to 3,000 outlets are planned and the card, unlike Visa, is restricted to the purchase of fuel and oil. Invoices are sent each 14 clays and payment required within 14 days. The card costs £8.40 a year, which is charged out at 70p on each monthly invoice. Unlike the agency card, all fuel obtained with this card, including derv, is invoiced at "pump prices".

The Swan National Fleet Fuel Card is of special interest — Swan operates a national rental fleet across the UK, and at 52 of its sites has fuel for sale. The Fleet Fuel Card is available to all fleets at no cost, and invoices are sent each 14 days, payment being required within 14 days.

The invoice lists fuel issued to each driver, and in times of fuel shortage, card holders are given priority. A bonus is available to those companies using Swan rental cars — a rebate of up to 4p per gallon is given depending upon the total car-hire spend in a year. Dery is available at some Swan sites and this facility is a good opportunity to take advantage of having a credit facility plus a rebate of pump prices on all fuels including derv, with no additional costs.

Fleet management cards is the growth area and I see more companies offering similar facilities and trying to tempt fleet managers to use their cards to reduce costs.

All Star was one of the first with this type of card, and when taken over by PHH, expanded rapidly to provide over 4,000 outlets in the UK. An All Star card costs £7.50 annually and is restricted to obtaining fuel and oil. No other charges are made and invoices are sent weekly to be paid within 14 days.

Dialcard provides not only a fuel facility — routine servicing, repairs, tyres and batteries can also be "paid for" using this card. Dialcard stresses that it is not a credit card — the card holder acts as "agent" for Dial which is required to pay the garage. The monthly invoice lists every transaction, and detailed management reports covering each vehicle and depot accompany the invoice. A monthly charge of £2.20 per vehicle is made for the card — additional cards for a vehicle are not charged. A "usage" charge is made, which with an annual vehicle expenditure of £800, amounts to approximately 55p.

Overdrive has three card specifications — the standard card is similar to the All Star call and costs £8.50 a year. The FMS card (full management system), provides a monthly analysis of all fuel used by each vehicle, showing the monthly and aggregate miles per gallon. A variance report is also included in the package.

The cost of the FMS card is £19.20 a year. The third type of card is a "single fleet card" from which the fleet manager can emboss supplied vouchers to give to those drivers who are no issued with a card. Invoices are sent each 14 days to be paid within 14 days.

TVIAA Fuel Card (Motor Agent: Association). Operated by Charge Card Services, this has recently been announced with the aim of linking up its 9,000 member sites to form the larges single outlet for all types of fleet fuel. To date, over 3,000 sites an listed and the annual cost of a

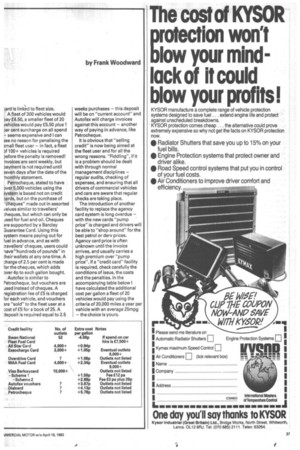

.:ard is linked to fleet size. A fleet of 300 vehicles would pay £4.50, a smaller fleet of 20 rehicles would pay £5.50 plus 1 3er cent surcharge on all spend — seems expensive and I can ;ee no reason for penalising the ;mall fleet user — in fact, a fleet Pf 100+ vehicles is required pefore the penalty is removed! nvoices are sent weekly, but payment is not required until ;even days after the date of the TIonthly statement. Petrocheque, stated to have aver 5,000 vehicles using the 'ystem is based not on credit ....ards, but on the purchase of 'cheques" made out in assorted ,falues similar to travellers' '...heques, but which can only be Jsed for fuel and oil. Cheques 3re supported by a Barclay Guarantee Card. Using this 5ystem means paying out for fuel in advance, and as with travellers' cheques, users could lave "hundreds of pounds" in their wallets at any one time. A harge of 2.5 per cent is made for the cheques, which adds Dyer 4p to each gallon bought. Autofax is similar to

Pet rochequ e, but vouchers are ised instead of cheques. A registration fee of £5 is charged for each vehicle, and vouchers are "sold" to the fleet user at a :ost of E5 for a book of 25. A leposit is required equal to 2.5 weeks purchases — this deposit will bean "current account" and Autofax will charge invoices against this account — another way of paying in advance, like Petrocheque.

It is Obvious that "selling credit" is now being aimed at the fleet user and for all the wrong reasons. "Fiddling", if it is a problem should be dealt with through normal management disciplines — _. regular audits, checking of expenses, and ensuring that all drivers of commercial vehicles and cars are aware that regular checks are taking place.

The introduction of another facility to replace the agency card system is long overdue — with the new cards "pump price" is charged and drivers will be able to "shop around" for the best petrol or dery prices. Agency card price is often unknown until the invoice arrives, and usually carries a high premium over "pump price". If a "credit card" facility is required, check carefully the conditions of issue, the costs and the penalties. In the accompanying table below I have calculated the additional cost per gallon a fleet of 20 vehicles would pay using the criteria of 20,000 miles a year per vehicle with an average 25mpg — the choice is yours.