it pays to understand

Page 54

If you've noticed an error in this article please click here to report it so we can fix it.

your tax by R. H. Grimsley BCorn, FIAC

10. Tax treatment of private cars

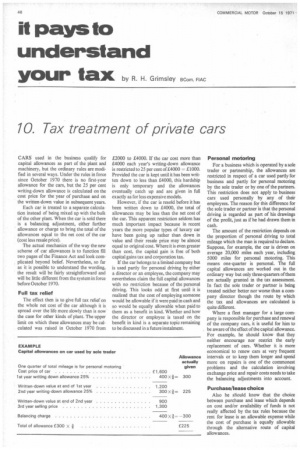

CARS used in the business qualify for capital allowances as part of the plant and machinery, but the ordinary rules are modified in several ways. Under the rules in force since October 1970 there is no first-year allowance for the cars, but the 25 per cent writing-down allowance is calculated on the cost price for the year of purchase and on the written-down value in subsequent years.

Each ear is treated to a separate calculation instead of being mixed up with the bulk of the other plant. When the car is sold there is a balancing adjustment, either further allowance or charge to bring the total of the allowances equal to the net cost of the car (cost less resale price).

The actual mechanics of the way the new scheme of car allowances is to function fill two pages of the Finance Act and look complicated beyond belief. Nevertheless, so far as it is possible to understand the wording, the result will be fairly straightforward and will be little different from the system in force before October 1970.

Full tax relief The effect then is to give full tax relief on the whole net cost of the car although it is spread over the life more slowly than is now the case for other kinds of plant. The upper limit on which these allowances may be calculated was raised in October 1970 from £2000 to £4000. If the car cost more than £4000 each year's writing-down allowance is restricted to 25 per cent of £4000 = £1000. Provided the car is kept until it has been written down to less than £4000, this hardship is only temporary and the allowances eventually catch up and are given in full exactly as for less expensive models.

However, if the car is resold before it has been written down to £4000, the total of allowances may be less than the net cost of the car. This apparent restriction seldom has much important impact because in recent years the more popular types of luxury car have been going up rather than down in value and their resale price may be almost equal to original cost. Where it is even greater than cost, the capital gain is free of both capital gains tax and corporation tax.

If the car belongs to a limited company but is used partly for personal driving by either a director or an employee, the company may nevertheless claim the full capital allowances with no restriction because of the personal driving. This looks odd at first until it is realized that the cost of employing someone would be allowable if it were paid in cash and so would be equally allowable when paid to them as a benefit in kind. Whether and how the director or employee is taxed on the benefit in kind is a separate topic remaining to be discussed in a future instalment. Personal motoring For a business which is operated by a sole trader or partnership, the allowances are restricted in respect of a car used partly for business and partly for personal motoring by the sole trader or by one of the partners. This restriction does not apply to business cars used personally by any of their employees. The reason for this difference for the sole trader or partner is that the personal driving is regarded as part of his drawings of the profit, just as if he had drawn them in cash.

The amount of the restriction depends on the proportion of personal driving to total mileage which the man is required to declare. Suppose, for example, the car is driven on average 20,000 miles each year, including 5000 miles for personal motoring. This means one-quarter is personal. The full capital allowances are worked out in the ordinary way but only three-quarters of them are actually granted in the tax assessment. In fact the sole trader or partner is being treated neither better nor worse than a company director though the route by which the tax and allowances are calculated is quite different.

Where a fleet manager for a large company is responsible for purchase and renewal of the company cars, it is useful for him to be aware of the effect of the capital allowance. For example, he should know that they neither encourage nor restrict the early replacement of cars. Whether it is more economical to renew cars at very frequent intervals or to keep them longer and spend more on repairs is one of the commonest problems and the calculation involving exchange price and repair costs needs to take the balancing adjustments into account.

Purchase/lease choice Also he should know that the choice between purchase and lease which depends on cost and/or availability of funds is not really affected by the tax rules because the rent for lease is an allowable expense while the cost of purchase is equally allowable through the alternative route of capital allowances.